Este artículo también está disponible en español.

Solana (SOL) has been making waves in the cryptocurrency industry, reaching an all-time high of $265 on November 23, 2024. The surge of Bitcoin toward the $100,000 mark and the enthusiasm for meme currencies were the catalysts for this remarkable rally.

Related Reading

Solana-based tokens have experienced substantial gains in the past month, with some exceeding a twofold increase in value. In the crypto space, Solana’s presence is becoming increasingly evident, as shown by its $121 billion total market capitalization.

Solana’s Outstanding DEX Activity

Daily trading volume over $6 billion has made Solana’s decentralized exchanges (DEXs) highly in demand. This reflects a 45% market share. The low transaction fees of Solana helped the platform to stand out as a significant alternative to Ethereum, Binance Coin (BNB), and Polygon.

Investor optimism has been further bolstered by this level of activity, as analysts have identified the potential for ongoing expansion. Solana’s position in the DeFi sector has been further solidified by the network’s Total Value Locked (TVL) increasing to $9.35 billion, surpassing BNB Chain’s $6.21 billion.

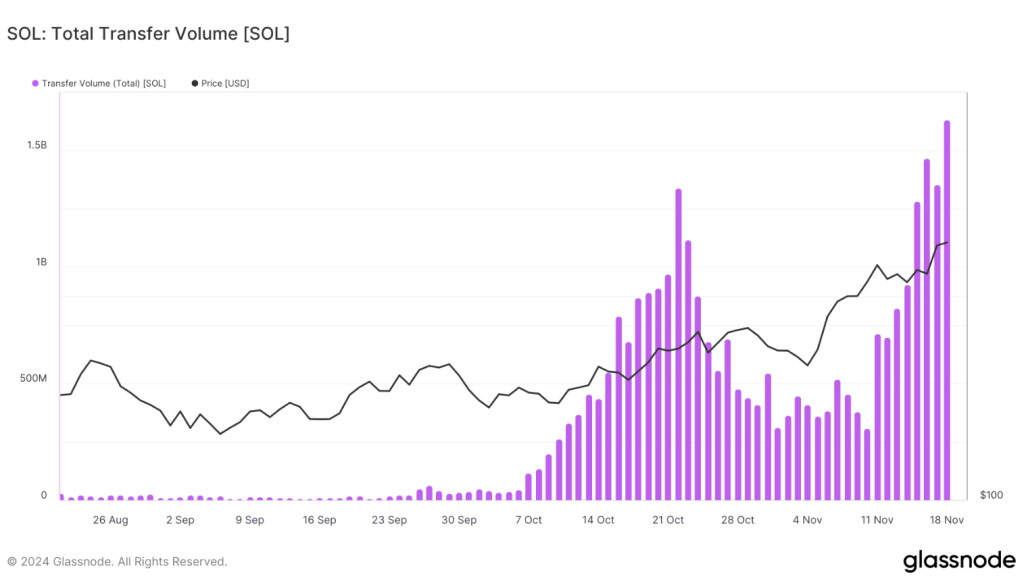

Additionally, Solana reached a historic $318 billion in transfer volume, setting a new record for the blockchain. Despite some signs of bot-driven activity inflating these figures, this high throughput demonstrates Solana’s capacity to handle massive transactions.

On November 16th, Solana’s transfer volume hit an all-time high of $318 billion, whilst the number of active addresses spiked to over 22 million.

However, mean and median transaction volumes dipped during the same period. This pattern of network activity inflation may be… pic.twitter.com/RJcE6Kjnkn

— glassnode (@glassnode) November 19, 2024

Market Risks And Resistance Levels

Solana’s recent performance has been noteworthy; however, analysts caution that the coin is approaching critical resistance lines. SOL is currently trading at $261, representing a 2.60% increase in the past 24 hours.

A breakout point has been identified by certain experts above $226, with key resistance levels at $271 and $309. Solana has the potential to advance into new territory if it can sustain momentum and overcome these resistance levels.

However, some are worried about the overbought conditions and have even speculated that consolidation could occur before SOL accomplishes its goal. The Relative Strength Index (RSI) is getting close to its upper limit, which may indicate a brief market correction is imminent.

Related Reading

A Positive Prognosis With Some Reservations

Many analysts anticipate that Solana’s price will continue to increase, with a forecasted 8.70% increase to $275 by December 25, 2024. The price is currently exhibiting a strong favorable momentum.

The Fear & Greed Index currently stands at 80, which indicates strong investor confidence and heightened avarice. Though the overall mood is upbeat, investors need to keep in mind the risks and volatility of the market.

It can be said that the growth tale of Solana is yet to be written fully, as seen by the recent trading volume and price action fluctuations. It will, however, need careful maneuvering as it continues its ascent.

Featured image from MoneyCheck, chart from TradingView

Read the full article here