Este artículo también está disponible en español.

Bitcoin’s recent price fluctuations have left investors in a state of uncertainty, as the cryptocurrency has seen a dramatic decline from its peak of nearly $107,000 to around $94,550. This volatility raises essential questions about the ability of Bitcoin to maintain its rally and whether it can regain its footing in the coming weeks.

Related Reading

Critical Support Levels Under Threat

CryptoQuant analyst Shayan has had something important to say about current conditions in Bitcoins. According to him, the price is trying to stabilize right above the value of $92,000 level, which he further says is a key support.

He notes that Bitcoin is stabilizing near the $92,000 mark, which he identifies as a crucial support zone. If Bitcoin breaks below this level, it could trigger a wave of long liquidations and push prices down toward the 100-day moving average of $81,000. Also, this line has been performing as a real dynamic support by attracting buying inflows and can also cushion prices during further descent.

Shayan underlines the role of market sentiment and technical indicators. At present, Bitcoin is fluctuating at significant support levels which are created in the $90K level and Fibonacci retracement levels at $87K and $82K. If the above-mentioned levels do not hold, there could be further selling pressure with corrections.

Bitcoin Bullish Outlook Despite Bearish Fears

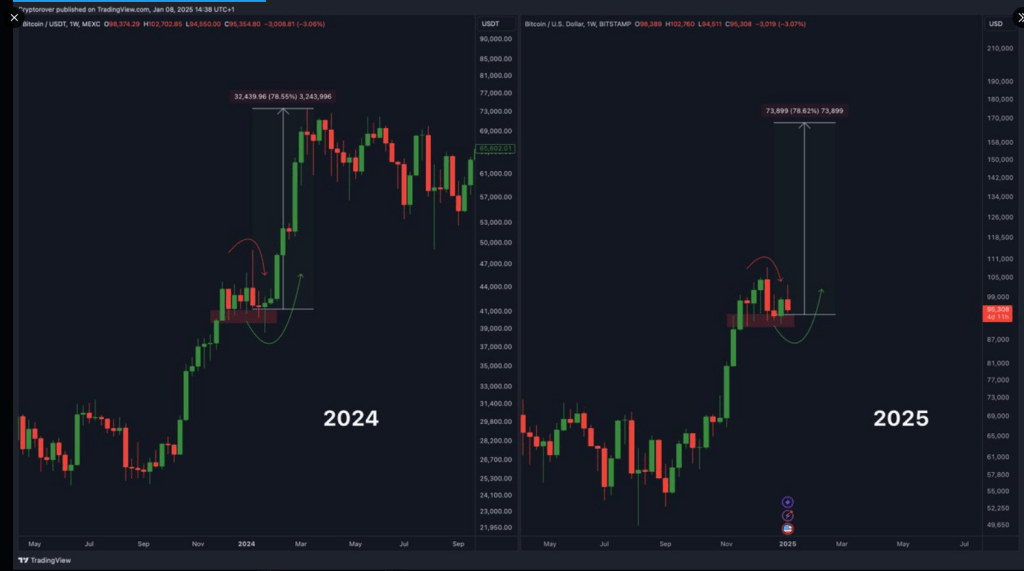

Amidst this uncertainty, renowned cryptocurrency analyst Crypto Rover has expressed a bullish outlook for Bitcoin. He recently compared today’s price action with historical patterns, suggesting that January could see positive trends for Bitcoin.

#Bitcoin history is exactly repeating.

January will turn green.

You’ll regret not buying more here. pic.twitter.com/DCssLNMGh6

— Crypto Rover (@rovercrc) January 8, 2025

In a tweet, he stated, “Bitcoin history is exactly repeating. January will turn green. You’ll regret not buying more here.” His analysis indicates that if Bitcoin can break through the critical resistance level of $100,000, it could potentially barrel past $107,000.

Big Capital Inflows

Rover’s positivity is strengthened by the huge capital inflows in Bitcoin ETFs, which attracted more than $900 million of inflows from institutions like BlackRock and Fidelity. Increasing institutional interest also signals confidence in the long-term prospect of Bitcoin. However, he also cautions that failure to close above the $100,000 mark will lead to a pullback to $92,000 or even lower.

The broader cryptocurrency market is feeling the strain too. This decline comes in tandem with Bitcoin’s failure to stay afloat, and other cryptocurrencies such as Ether and Solana have fallen by more than 7%.

Related Reading

Even the traditional stocks of the crypto sector, such as MicroStrategy and Coinbase, have been down sharply. Funding rates falling within the derivatives market adds yet another layer of bearish sentiment around Bitcoin. According to Shayan, the decreasing funding rates had reflected dipping demand for derivatives, which also played a pivotal role in maintaining price trends.

Featured image from Pixabay, chart from TradingView

Read the full article here