The crypto markets are currently in a range-bound state, with Bitcoin’s price facing challenges in overcoming bearish pressures and maintaining above key support levels. Additionally, Bitcoin’s market dominance is rising, showing that it continues to attract significant trader interest. Consequently, other altcoins, particularly Ethereum, are trading within a descending pattern, with concerns of further lows. However, the current dip might be profitable for traders as MVRV ratio records a weekly low, building up momentum for a rebound.

Ethereum Triggers Profitable Buying Opportunity

Over the last few hours, the crypto market has been surging as the price broke above the $63K mark. As a result, ETH price also gained traction and is nearing $3,000. According to Coinglass data, the market witnessed around $8.6 million worth of liquidations and ETH price saw a short-liquidation amounting nearly $1.5 million.

Looking beyond the significant Ethereum news headlines circulating in the media, on-chain data indicates a positive shift in investors’ sentiment. This change has likely contributed to the current bullish trend in ETH prices.

IntoTheBlock’s Open Interest ratio, which measures the value of capital invested in ETH derivatives contracts against the spot market capitalization, has surged. An increasing open interest ratio signals bullish sentiment.

Currently, the open interest ratio stands at 4.21%, marking a significant rise. Historical data shows that ETH price often struggles to stay above $3,000 when the open interest ratio falls below 0.2%. The last notable decline to this threshold occurred on April 14. However, the current surge in the ratio might signal robust trading interest

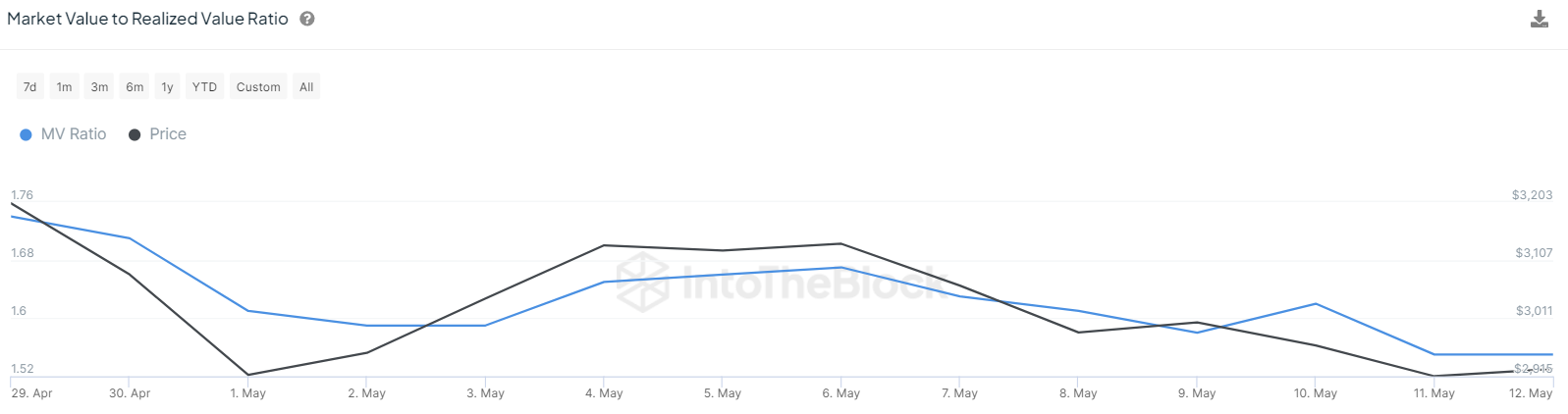

Additionally, the MVRV ratio for price has been declining. Data from IntoTheBlock shows that Ethereum’s MVRV is currently at 1.55. This ratio dropped from the peak value of 1.74, suggesting that the realized value is nearing its value. This might bring a profitable opportunity for holders to accumulate more as the overheated sentiment cools down.

Market capitalization represents the total dollar value of the circulating supply, calculated using the average daily price across major exchanges. In contrast, the realized value, often considered a more accurate measure of actual value, estimates the total amount paid for all existing coins by summing the market value of coins each time they are involved in an on-chain transaction.

Very high MVRV values suggest that Ethereum market price may be overvalued compared to its fair or realized value, while extremely low values indicate the opposite.

What’s Next For ETH Price?

ETH price has been striving to surpass the immediate resistance at $3,000, but the bears are firmly defending this level. ETH price dropped below $2,900 following increasing selling pressure; however, buyers successfully defended the price. As of writing, ETH price trades at $2,966, surging over 1.3% in the last 24 hours.

A minor positive for the bulls is their success in keeping the price close to $3K, which increases the likelihood of a breakout above this level. If achieved, the ETH/USDT pair could test the next resistance at $3,210.

Key support on the downside is the Fib levels. A break and close below $2,800 could indicate a consolidation phase between $2,800 and $2,500 for a few days.

Both moving averages are trending downwards; however, the RSI level is surging above the midline on the 4-hour chart, signaling that the bulls have an advantage. Buyers will aim to push the price above $3,200 to strengthen their position. A successful move above the level might skyrocket the price toward $3,600.

However, the bears will attempt to pull the price below the 20-EMA. If successful, it would indicate strong resistance from the bears, potentially driving the pair down to the 50-SMA.

Read the full article here