An astute early adopter of Ethereum, identified by the address 0x2ce, has recently executed substantial transactions, garnering considerable intrigue within the cryptocurrency sphere. According to a Spot On Chain X post, this influential holder transferred 4,153 ETH, valued at $12.2 million, to Coinbase at a rate of $2,931 per ETH.

3 hours ago, Early $ETH holder 0x2ce deposited 4,153 $ETH ($12.2M) to #Coinbase at $2,931.

The whale withdrew 12,423 $ETH from #Poloneix at ~$11.03 ($137K) in 2016,

And has deposited 9,436 $ETH to #Coinbase and #Luno at ~$2,245 ($21.2M) since 2021.

Current holding: 2,566 $ETH… pic.twitter.com/ky5g0uy2n5

— Spot On Chain (@spotonchain) May 13, 2024

Moreover, in 2016, this whale disengaged 12,423 ETH from Poloniex at an approximate value of $11.03 per ETH, culminating in roughly $137,000. This early procurement of Ethereum has yielded extraordinary returns over the subsequent years.

Since 2021, the investor has transferred a cumulative 9,436 ETH to both Coinbase and Luno at an average rate of $2,245 per ETH, amounting to $21.2 million. Presently, the whale’s holdings are quantified at 2,566 ETH, with an estimated worth of $7.48 million.

Based on the report, the projected aggregate profit from these dealings is approximately $28.5 million, which denotes a 204% appreciation from the initial investments.

ETH Price Action

As of press time, the ETH token is trading at $2,980.71, reflecting a 2.27% increment from the prior day. Furthermore, its daily market capitalization has ascended by 1.90%, attaining a valuation of $357,626,638,421. This augmentation in market cap mirrors the escalating interest and investment in Ethereum.

ETH/USD 24-Hour Chart (Source: CoinStats)

Additionally, ETH’s trading volume has experienced a remarkable upsurge of 67.91%, reaching $10,196,235,638. This amplification in trading volume signals an intensified level of investor enthusiasm and engagement. The escalating trading volume, in tandem with the hike in token price, suggests a bullish disposition among investors.

ETH Token: Bullish or Bearish?

The ETH token is presently displaying a symmetrical triangle on the 4-hour chart, with prices oscillating between $3,353.12 and $2,817.29. This formation signifies that the price movement of the ETH token is consolidating within a narrowing range, priming for a potential breakout in either direction.

ETH/USD 4-Hour Chart (Source: Tradingview)

Should the bullish momentum persist, the ETH token might initiate an upward rally, challenging the lower resistance at $3,061.77. The goal would be to reach the key resistance level around the 50% Fibonacci retracement level. Success in this move could propel ETH prices to higher levels, potentially targeting the 61.8% Fibonacci retracement level, aligning with the bulls’ target.

Conversely, if the ETH token experiences bearish pressure, the price is expected to find support at $2868.24 before attempting another upward movement. A breach of this support level could lead to further declines, with prices potentially falling to the $2817.29 support level, which was last touched on May 1.

ETH/USD 4-Hour Chart (Source: Tradingview)

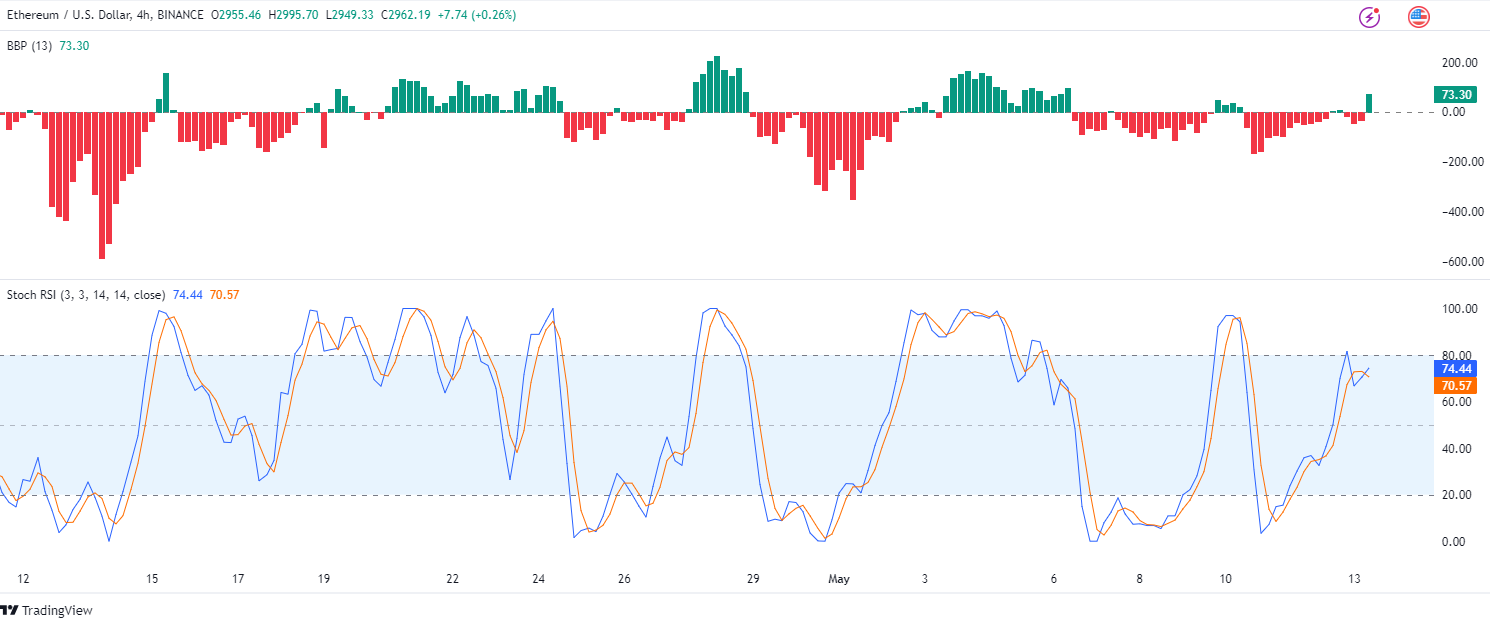

From a technical perspective, the Bull Bear Power indicator is showing a green bar above the zero line, positioned at 73.30. This scenario hints at an intensification of bullish momentum for the ETH token in the near term, suggesting the possibility of further price ascensions if the momentum sustains.

Moreover, the stochastic RSI is trading near the overbought region, signifying a potential short-term reversal for the ETH token. However, the upward trajectory of the K line (blue) above the signal line suggests there is still room for growth before a possible correction transpires.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here