As Solana, XRP, and Cardano grab all the limelight in the altcoin market rally, Ethereum (ETH) has been making silent moves in the meanwhile. The ETH price has shot another 2% in the last 24 hours moving to $1839 with a market cap of $221 billion.

Ethereum Network Growth Jumps

As per on-chain data from Santiment, Ethereum’s recent surge above the $1,800 mark is supported by a significant increase in the creation of new addresses, marking the highest daily number since October 7th.

If this long-term trend of network expansion persists and the available supply on exchanges continues to decrease, Ethereum’s price ($ETH) could have a strong case for surpassing the $2,000 threshold once more.

Courtesy: Santiment

A Look Into ETH Derivatives Market

Recently, Vitalike Buterin moving ETH to Coinbase sparked the discussion around the ETH price rally. Also, the Ethereum derivatives data shows growing bullish sentiment despite the recent selling pressure.

Ethereum (ETH) has experienced a 14.7% decline in its price, dropping from its peak at $2,120 on April 16, 2023. However, two key derivatives metrics indicate a significant increase in investor bullishness, reaching levels not seen in over a year.

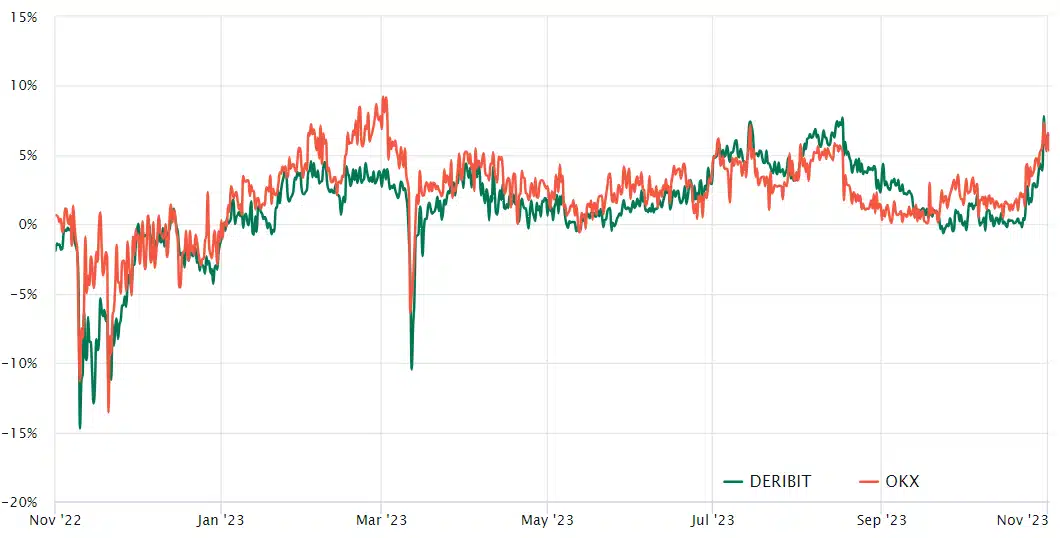

Firstly, the Ether futures premium, which measures the variation between two-month futures contracts and the spot price, has surged to its highest point in over a year. In a robust market, the annualized premium, also known as the basis rate, generally falls within the range of 5% to 10%.

This data signifies a growing demand for leveraged long positions in ETH futures, as the futures contract premium skyrocketed from 1% on October 23 to 7.4% on October 30, surpassing the neutral-to-bullish threshold of 5%. This remarkable surge in the metric follows a 15.7% price rally for ETH over a two-week period.

Furthermore, analysis of the options market provides additional insights. The 25% delta skew in Ether options serves as an indicator of when arbitrage desks and market makers might overcharge for upside or downside protection. An Ether price drop typically causes the skew metric to rise above 7%, while periods of optimism tend to exhibit a negative 7% skew.

Of particular note, the Ether options 25% delta skew reached a negative 16% level on October 27, marking the lowest point in over 12 months. During this period, protective put (sell) options were trading at a discount, reflecting excessive optimism among traders. Additionally, the current 8% discount for put options represents a notable shift from the previously persistent 7% or higher positive skew that extended until October 18.

Read the full article here