As the majority of assets in the cryptocurrency market continue to trade in the green, Ethereum (ETH) is no exception, and its slow but sure advance could lead the second-largest digital asset by market capitalization to the critical psychological level of $2,000 in a matter of weeks.

Specifically, as cryptocurrency analyst Crypto Tony pointed out, “the altcoin market looks to be heating up nicely,” its gains led by the largest altcoin of them all, and “$2,000 ETH is only a few weeks away, I would say personally,” as he explained in an X post published on November 2.

Indeed, Ethereum’s next stop could be $2,000, which is the area that it last time briefly reached back in mid-July and traded in for a bit longer earlier in April this year, and which is currently acting as resistance for this crypto asset.

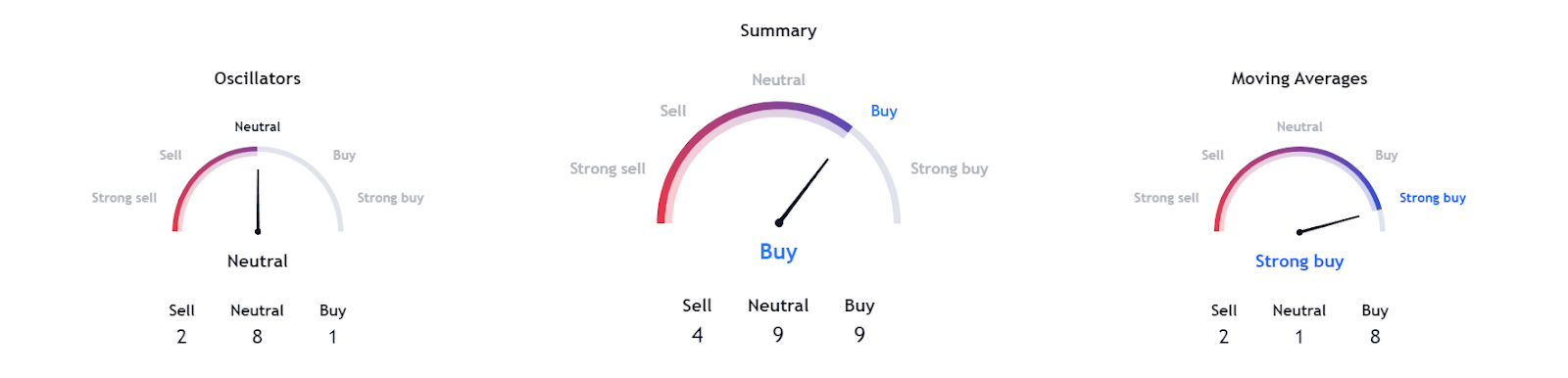

In addition to the analyst’s optimistic view of Ethereum, the 1-week technical analysis (TA) sentiment gauges over at the finance and crypto analytics platform TradingView are bullish too, suggesting a ‘buy’ at 9, which is the summary of oscillators in the ‘neutral’ at 8, and moving averages (MA) pointing at a ‘strong buy’ at 8.

Ethereum price analysis

As things stand, Ethereum is currently changing hands at the price of $1,827.09, recording a 1.53% gain in the last 24 hours, as well as advancing 0.42% across the previous seven days, and adding to the more significant increase of 10.37% over the past month, as the most recent charts demonstrate.

All things considered, Ethereum’s current price is not far from the $2,000 level, and its previous behavior demonstrates that this price zone is not unattainable for the digital asset, particularly as November 1 marks the peak of new addresses created on the network since October 7, and its supplies on crypto exchanges continue to drop.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here