Sentiment has been majorly bullish for Ethereum (ETH), particularly with the updates in the last two years. The cryptocurrency market expects a bull market by 2025, and investors are trying to predict its price for the next 24 months.

However, predicting volatile cryptocurrencies’ prices poses a challenge, and analysts will often miss their targets. Long-term projections increase the risk of inaccuracy, so investors should regularly revise their estimates.

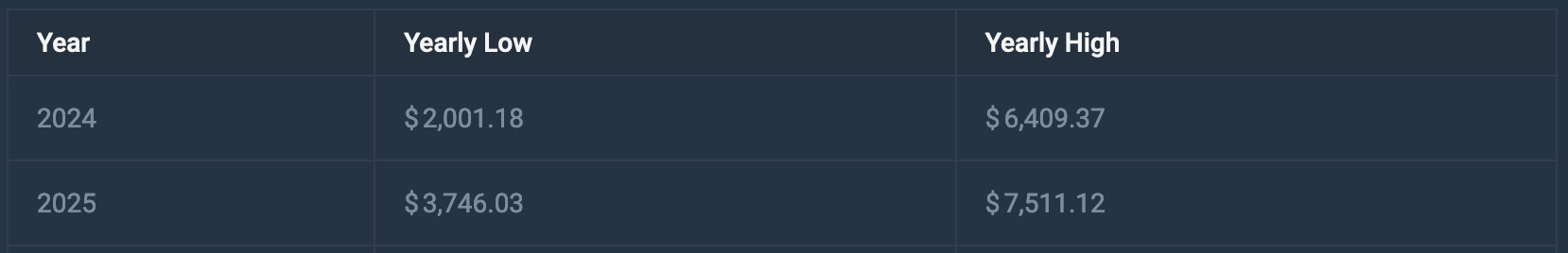

Despite the challenges, Finbold turned to artificial intelligence (AI) tools and expert cryptocurrency traders to present a conservative Ethereum price prediction for late 2025. Meanwhile, ETH is trading at $2,050 per token by press time.

ChatGPT bearish, neutral, and bullish ETH price predictions

Therefore, ChatGPT-4 was prompted to give three conservative Ethereum price predictions for Q4 2025. One with a bearish bias, a neutral prediction, and a bullish forecast for last.

“Bearish Prediction: Assuming potential regulatory pressure and competition from other blockchain platforms, Ethereum’s price could face downward pressure. A conservative bearish forecast for Q4 2025 might be $1,500.

Neutral Prediction: Factoring in modest market growth and technological advancements within the Ethereum ecosystem, a neutral outlook could place Ethereum at $2,500 by Q4 2025.

Bullish Prediction: With the anticipation of a cryptocurrency bull run spurred by Bitcoin’s halving in 2024, and given Ethereum’s historical correlation with Bitcoin’s price action, a bullish but conservative estimate for Ethereum might be $3,500 in Q4 2025.”

— ChatGPT-4

The bearish prediction of $1,500 would mean 27% losses from current prices, while the bullish prediction would reward investors with 70% gains in two years. Curiously, ChatGPT also forecasts Ethereum to increase by 20%, even with the neutral prediction of $2,500.

Experts forecast Ethereum price for 2024

Notably, the AI predictions are aligned with Michaël van de Poppe’s forecast for 2024. The expert cryptocurrency trader targets $1,800-$1,900 in a retrace and $3,100-$3,600 after an 18-month trend breakout.

All things considered, Ethereum’s performance will depend on the demand for its native token. Positive developments in the Web3 ecosystem, adoption, regulatory pressure, tokenomics, and macro economics will highly influence the leading layer-1 blockchain price in the following years. Investors must remain cautious and do their due diligence while building trading positions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here