Este artículo también está disponible en español.

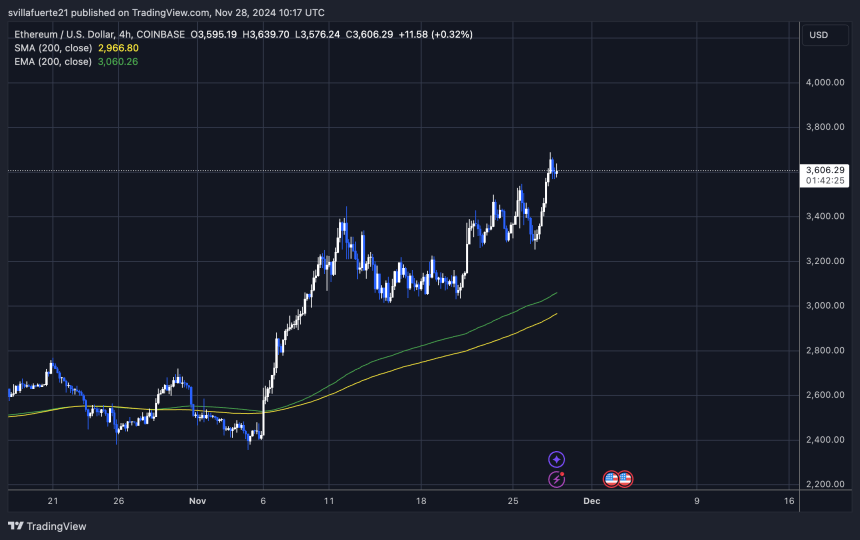

Ethereum has been making waves in the crypto market, reaching its highest levels since June after hitting a local high of $3,688 just hours ago. This impressive price action has sparked excitement among investors and analysts, with many anticipating further surges in the coming hours.

Ethereum is now eyeing a breakout above its yearly highs, which could set the stage for an even more aggressive rally.

Related Reading

Crypto analyst Carl Runefelt shared a technical analysis on X, highlighting the significance of Ethereum’s current resistance. According to Runefelt, ETH is at a critical juncture, facing a major resistance level that could determine its next move. Should Ethereum break above this barrier, it might quickly pump to $3,900, solidifying its bullish momentum.

As the broader market sentiment remains strong, Ethereum’s price action remains unpredictable, especially as it leads altcoins in this upward trend. Investors are now eager to see whether ETH can maintain its upward trajectory and establish new milestones in the days ahead.

Ethereum Reaching New Highs

Ethereum is making headlines as it reaches new highs, riding the wave of bullish momentum while Bitcoin consolidates below the $100,000 mark. This rally has positioned Ethereum as a key driver in the altcoin market, which continues to post massive gains and attract investor attention.

With the broader market sentiment improving, Ethereum’s performance is becoming a focal point for traders and analysts alike.

Related Reading

Crypto analyst Carl Runefelt recently shared a technical analysis on X, emphasizing Ethereum’s critical resistance level. According to Runefelt, Ethereum is currently at a make-or-break point. A successful breakout above this resistance could trigger a sharp rally, potentially sending ETH to $3,900. If this level is surpassed, Ethereum would likely target yearly highs above $4,000, solidifying its position as a leader in the ongoing market surge.

The coming days will be crucial for Ethereum as traders closely watch its ability to maintain upward momentum and overcome these key price levels. With the altcoin market gaining strength and optimism growing, Ethereum’s next move could set the tone for the broader crypto landscape. Whether it achieves a breakout or consolidates further, the attention on Ethereum highlights its role in shaping this bullish market cycle.

ETH Price At A Turning Point

Ethereum is currently trading at $3,600, a crucial level that will define its next price direction. As the market watches closely, Ethereum’s ability to hold above this price will determine whether it can continue its bullish momentum or face a pullback.

If ETH maintains strength above $3,600, it is likely to surge further, targeting the next significant milestone: yearly highs at $4,080. A breakout above this level would not only reaffirm the bullish trend but also position Ethereum for a potential continuation toward even higher levels.

However, Ethereum could face a short-term correction if it fails to hold above $3,600. The first major demand zone lies at $3,400, which would act as a critical support level. A failure to sustain even this level could lead to further declines, with the next potential support zones forming at lower price ranges.

Related Reading

Market sentiment remains cautiously optimistic, with many analysts highlighting the importance of Ethereum’s current price action. The coming days will be pivotal as investors and traders look for signs of strength or weakness at this critical juncture. Whether Ethereum consolidates further or surges toward new highs, its performance will likely have a significant impact on the broader altcoin market.

Featured image from Dall-E, chart from TradingView

Read the full article here