Este artículo también está disponible en español.

The Bitcoin price looks set to enjoy a bullish reversal in January next year, having maintained a tepid price action to close out this year. This bullish outlook for the flagship crypto came as crypto analyst Tony Severino revealed a potential Doji formation, which suggested that BTC could enjoy this uptrend in the new year.

Related Reading

Doji Formation Could Lead To New Year Bitcoin Price Rally

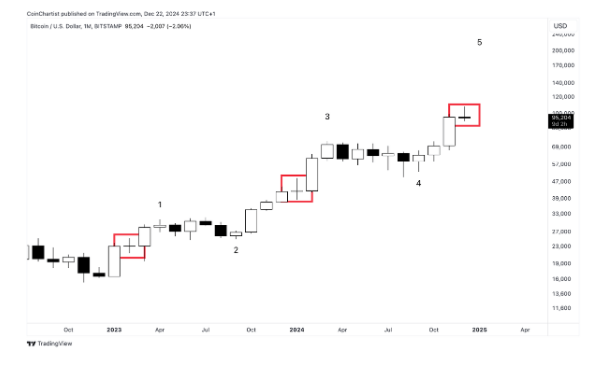

In an X post, Severino suggested that a Doji formation could lead to a Bitcoin price rally in the first two months of the new year. The analyst mentioned that he suspects BTC will end December with the Doji and then January shows a strong continuation for the flagship crypto. His accompanying chart showed that this strong continuation could extend into February.

The crypto analyst explained that a Doji represents a pause in the market due to indecision from buyers and sellers. He added that the following candlestick shows market participants the decision the market has made through strong continuation or a reversal. In this case, Severino expects that the following candlestick will show a strong continuation for the Bitcoin price.

Severino noted that a similar Doji at similar subwaves each resulted in two more months of upside before a local top was in for the Bitcoin price. Therefore, the crypto could enjoy two months of upside between January and February 2025 if history repeats itself. From a fundamental perspective, Donald Trump’s inauguration is one factor that could spark this strong continuation.

The BTC price rallied above $100,000 after Trump’s victory in the November US presidential elections. As such, the flagship crypto could continue this rally as Trump becomes the first pro-crypto US president. Moreover, the US president-elect may create a Strategic Bitcoin Reserve when he takes office, which would provide more bullish momentum for BTC.

BTC Needs To Hold Above $92,730

In an X post, crypto analyst Ali Martinez remarked that the Bitcoin price needs to avoid dipping below $92,730, as if that level breaks, it will be in free-fall territory. The analyst’s accompanying chart showed that Bitcoin could drop to the $70,000 range if it breaks this $92,730 price level.

Related Reading

However, in another X post, Martinez suggested that such a Bitcoin price drop might not necessarily be bad. This came as he stated that a 20% to 30% price correction is the most bullish thing that could happen to Bitcoin. Meanwhile, Martinez stated that the invalidation levels for his bearish Bitcoin outlook are a sustained close above $97,300 and a daily close above $100,000.

At the time of writing, the Bitcoin price is trading at around $94,400, down almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Reuters, chart from TradingView

Read the full article here