Virtuals Protocol token bounced back on Tuesday, Jan. 14, a day after forming a doji candlestick pattern as its ecosystem tokens rebounded.

Virtuals Protocol (VIRTUAL) rose to $2.93, up 32% from its lowest level this year as investors bought the dip.

Most tokens in the Virtuals Protocol ecosystem were among the best performers. G.A.M.E token rose by 17.5%, bringing its market cap to over $172.9 million. Luna jumped 30%, while aixbt soared 63%, pushing its valuation to $546 million. Other top-performing tokens in the ecosystem included Sekoia, Acolyte, TAOCat, and WAI Combinator.

The rebound coincided with a broader rally in the cryptocurrency market, particularly in the AI agent sector. Other AI agent tokens, such as ai16z, Humans.ai, BasedAI, and Orbit were among the top gainers in the industry.

It remains unclear whether these gains will hold, as the rebound could be part of a dead cat bounce — a temporary recovery in an asset experiencing a prolonged downtrend before it resumes its decline.

A key risk for Virtuals Protocol is that the most profitable investors have sold most of their tokens. As shown below, the profit leader, LVT Capital has exited all his positions in the past few weeks, making millions of dollars.

VIRTUAL price analysis

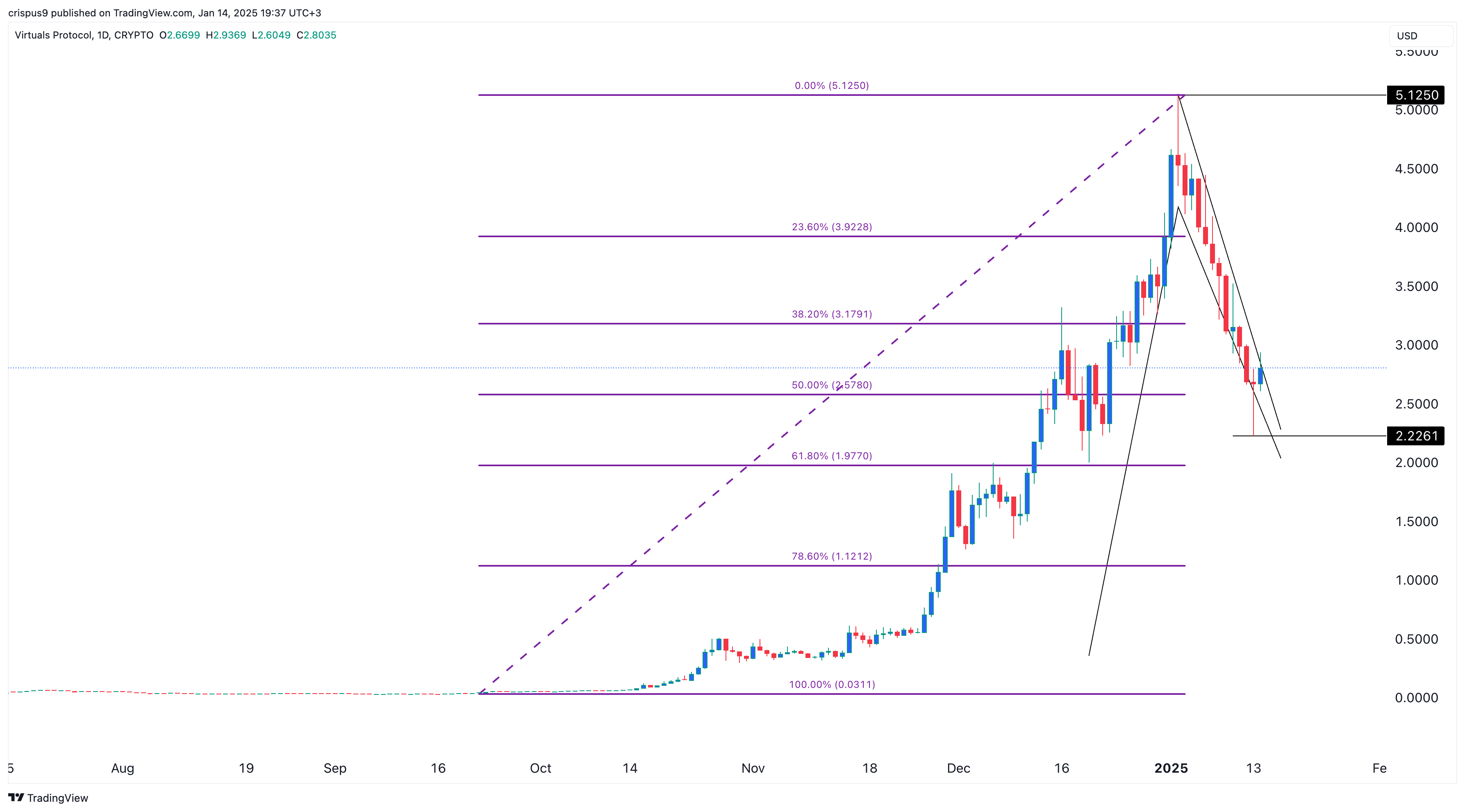

The daily chart shows that Virtuals Protocol has been in a strong bearish downtrend over the past few weeks, falling from a record high of $5.1250 to $2.8.

The token is currently trading slightly below the 50% Fibonacci retracement level. On the positive side, it has formed a long-legged doji candlestick pattern, which features a long lower shadow and a small body. This pattern is often considered a bullish reversal signal.

Additionally, VIRTUAL has formed a falling wedge pattern, another bullish indicator. Based on these technical signals, the token may stage a strong rebound in the coming days, with investors targeting the next resistance level at $4 — representing a potential 40% upside from the current price.

However, a drop below the lower part of the doji at $2.2260 would invalidate the bullish outlook. In such a scenario, the next key support level to watch would be $1.50.

Read the full article here