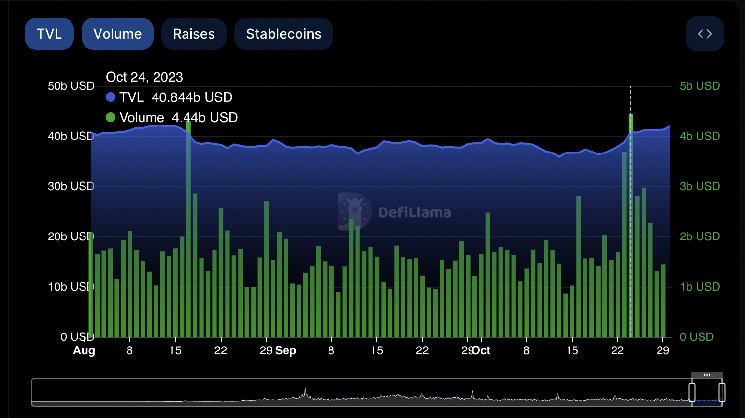

The total value of all assets locked on decentralized finance (DeFi) protocols has surged to a three-month high of $42 billion after being at its lowest point since February 2021 just two weeks ago, according to DefiLlama data.

The resurgence of the DeFi market is based on two factors: rising asset prices and fresh inflows from participants that aim to generate a yield through staking and lending.

Over the past two weeks, ether (ETH), the asset that underpins the majority of the DeFi market, has rallied from $1,590 to $1,810, while the likes of lido (LDO) and aave (AAVE) have posted 25% and 34% moves to the upside respectively.

Alongside a hike in asset prices, transactional volume across DeFi protocols rose to its highest point since March, with $4.4 billion recorded on Oct. 24, according to DefiLlama.

Solana’s most extensive lending protocol, Marinade, experienced a 120% jump in total value locked (TVL) this month following the release of its native staking product, which offers yields of 8.15% APY to complement its 7.7% rate on liquid staking. Marinade’s rival protocol, Jito, has risen by 190% to $168 million in TVL in the same period.

On Ethereum, meanwhile, the amount of capital on Enzyme Finance, Spark and Stader have all risen by between 37% and 55%, outpacing the rise in asset prices to illustrate fresh inflows.

Recently released layer one blockchains Sui and Aptos have also experienced positive growth this month, TVL on Sui has jumped from $34 million to $75 million. Aptos has been spurred by increased activity on lending platform Thala, with its overall TVL also hitting the $75 million mark this month.

Despite a fruitful month, risks remain across the DeFi sector, as even the slightest slide in the price of ETH would trigger notable on-chain liquidations. Currently, there is a $76.2 million position on Aave that will be liquidated if ETH crosses $1,777, with over $100 million set to be liquidated if the price falls by 20%.

Read the full article here