Toncoin’s price continued its strong sell-off on Monday as most tap-to-earn tokens on its network crashed and burn volume retreated.

Toncoin (TON) retreated to $4.90, down 41% from its highest point this year. It has also fallen nearly 30% since Aug. 24, when its founder Pavel Durov was arrested in France.

The sell-off coincided with mixed news about its ecosystem. On the positive side, stablecoin volume in the ecosystem has soared to over $1 billion for the first time.

Most of these coins are Tether (USDT), the industry’s largest stablecoin. An increase in stablecoins is a sign that the network is gaining traction among users, as they are the primary currencies used in the blockchain industry.

Toncoin’s price has, therefore, dropped due to several weak metrics in the ecosystem. For example, data from TonStat shows that the daily number of TON tokens burned has sharply declined in recent days, standing at 6,373, much lower than the year-to-date high of over 32,000.

Further data indicates that network fees have dropped to their lowest levels in months. After peaking at 77,000 TON in September, fees have since retreated to just 12,746 TON, suggesting decreased network activity.

Additional on-chain data reveals that the daily transaction count has continued to fall, hovering near its lowest point in the past six months. The number of active wallets has also dropped sharply.

Meanwhile, according to DeFi Llama, the total assets locked in the TON Blockchain have fallen to $375 million, making it the 20th largest chain in the industry. Just a few months ago, it was among the top ten chains.

The TON price has also slipped as investors watch the weak performance of some of its biggest ecosystem tokens like Hamster Kombat (HMSTR), Notcoin (NOT), and Catizen, which have all plunged from their highest points this year.

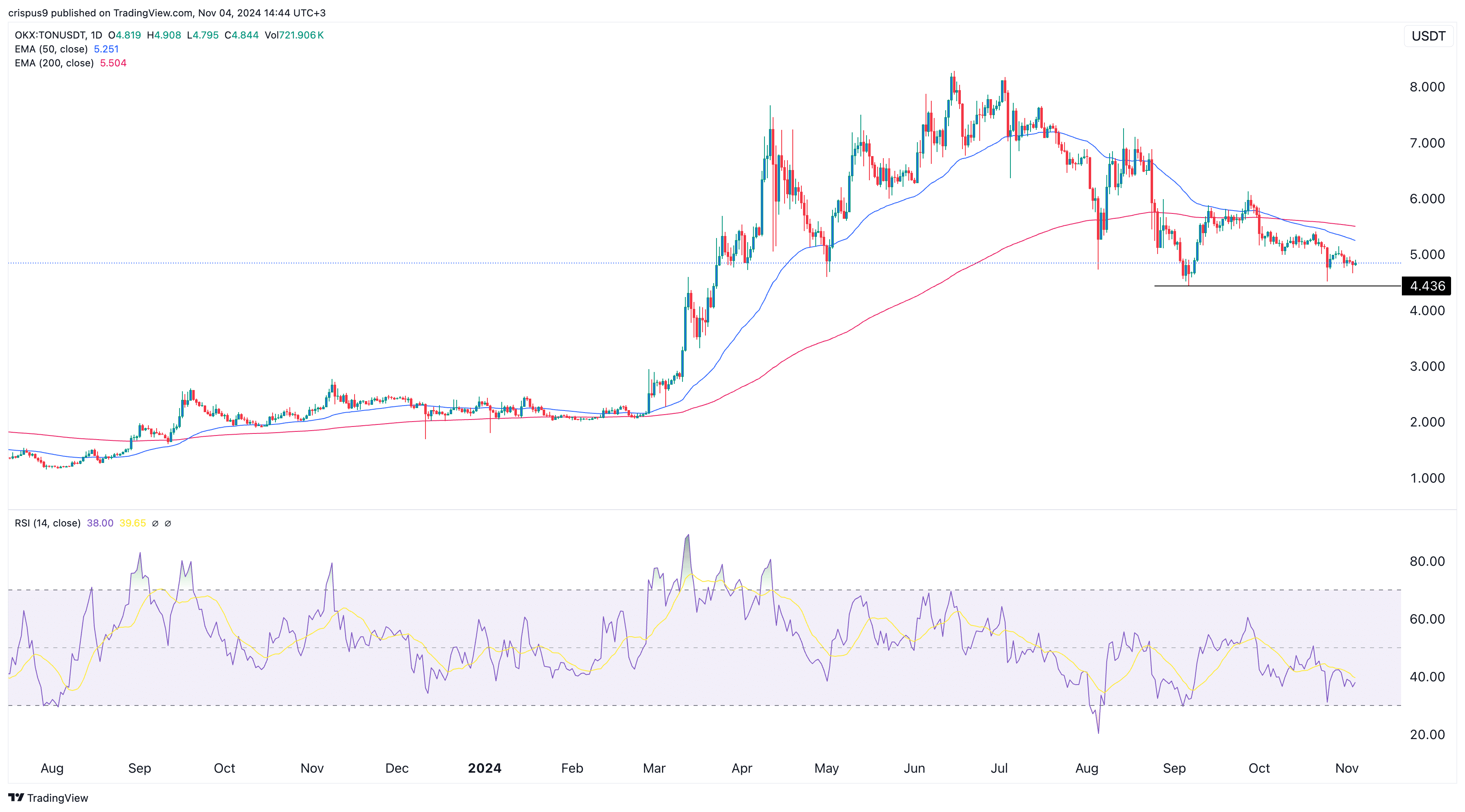

Toncoin has formed a death cross

On the daily chart, the Toncoin token has dropped significantly over the past few months, entering a deep bear market. Additionally, it formed a death cross as the 200-day and 50-day moving averages crossed.

All oscillators, including the Relative Strength Index and MACD indicators, are pointing downward. Therefore, the token will likely continue falling as traders target key support at $4. This view becomes valid if the token drops below the key support level at $4.43, its lowest point on Sept. 7.

Read the full article here