Pepe coin price joined other meme coins in a rebound as the Santa Claus rally happened on Christmas Eve.

Pepe (PEPE), the third-biggest meme coin, surged in a high-volume environment as investors bought the recent dip. This rally happened as Bitcoin (BTC) jumped to $98,500, and the crypto fear and greed index approached the greed zone.

Most cryptocurrencies rallied, with the market cap of all coins tracked by CoinGecko hitting a high of $3.60 trillion.

Pepe had a 24-hour volume of $2.2 billion, while the futures open interest rose for the third consecutive day, reaching a high of $151 million. It has jumped to the highest level since December 30.

The coin also jumped as signs showed that Pepe was the cheapest it has been since Nov. 5 in terms of the Market Value to Realized Value indicator. The MVRV-Z score indicator is widely seen as one of the most accurate indicators in predicting tops and bottoms.

This indicator is calculated by considering an asset’s market price and the realized value. This MVRV value has dropped to 1.28, a sign that it has become highly oversold. The last time that Pepe had this MVRV value was in November, and the coin staged a strong rally to an all-time high of $0.00002830.

The other contrarian case for Pepe is that there are signs that speculators capitulated and exited their trades. Data shows that the number of active, new, and zero balance addresses dropped by over 20% in the last seven days.

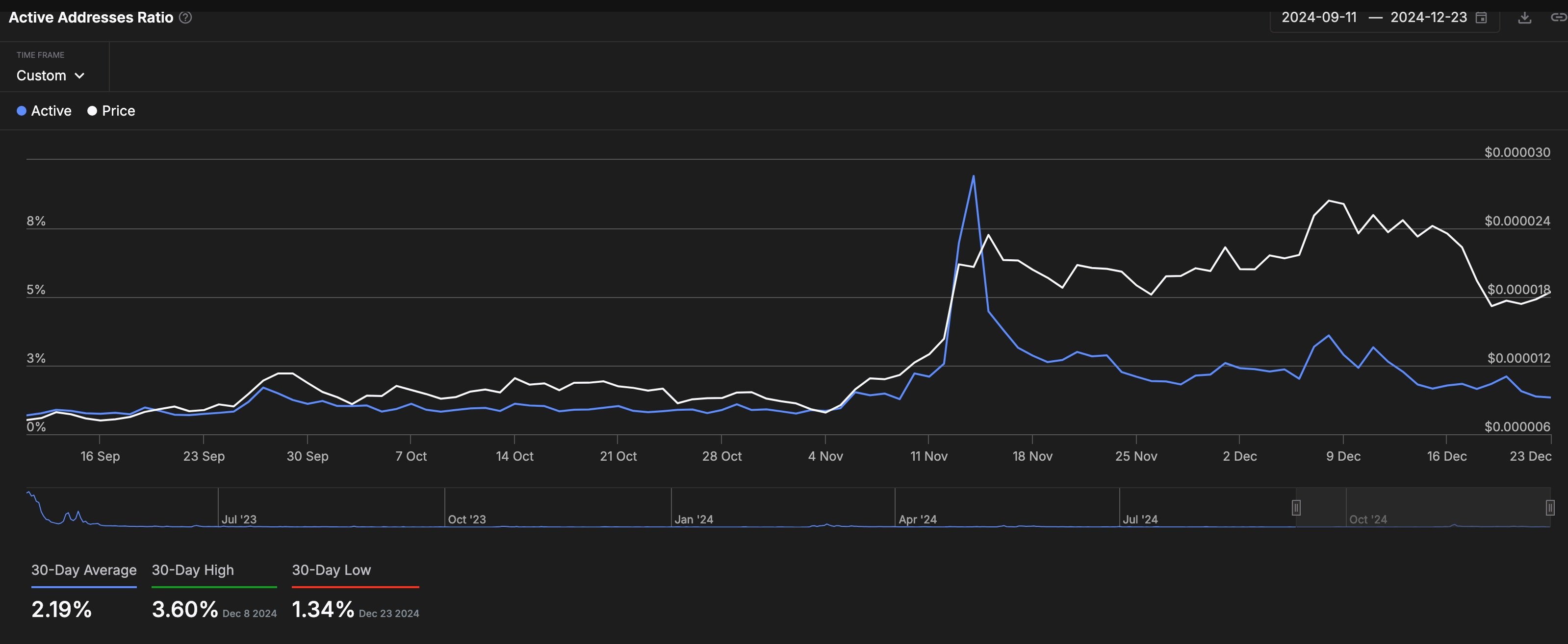

As shown below, the active addresses ratio has dropped to 1.34%, its lowest level in over a month. Most Pepe price breakouts happen when the ratio is falling.

Pepe coin price analysis

The daily chart shows that the Pepe coin price peaked at $0.00002830 earlier this month and then suffered a harsh reversal.

It dropped below the important support level at $0.00001713, the upper side of the cup and handle pattern that formed between May and November. A break and retest pattern is usually a sign of a continuation. Pepe remained above the 100-day moving average and is attempting to flip the 50-day MA.

So, is the Pepe price crash over? Not yet, since this rebound may be a dead cat bounce. It may also be part of the formation of a bearish flag chart pattern, a popular downward continuation sign.

Therefore, there is a risk that the coin will resume the downward trend once the Santa Claus rally ends. A complete bullish breakout will be confirmed when the coin rises above the psychological point at $0.000025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Read the full article here