Crypto veteran Dan Morehead says Bitcoin (BTC) is in a bull market and is laying out a timeline for how long it could last.

In a new open letter to investors, Morehead, who oversees $4.2 billion worth of assets at Pantera Capital, says that Bitcoin’s market cycles are nearly “alien” in their similarity.

Morehead says Bitcoin’s supply and distribution model is based on predictable and transparent principles set forth by its pseudonymous creator, Satoshi Nakamoto.

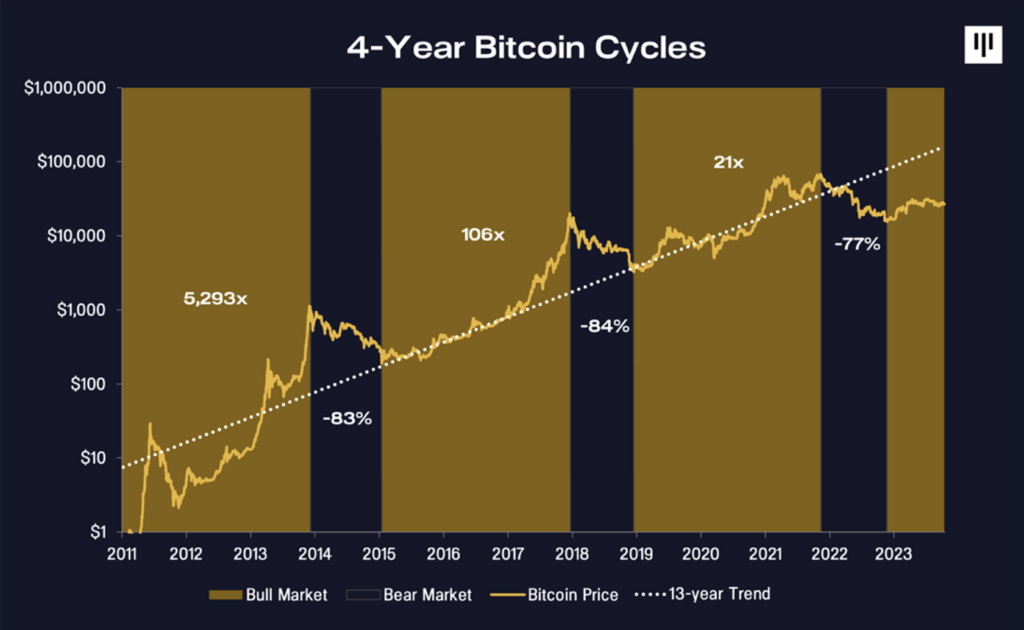

He says the rules of Bitcoin’s halving, when miners’ rewards are slashed in half roughly every four years, have created pronounced cyclicality which has created a pattern that suggests that the current bull market will last until about November 1, 2025, just under two years from now.

“The table below shows these cycles. The rhythm is amazingly steady. The rallies are within 23 days of the 1,076-day average bull market (2.95 years). Same tightness on the downside – bear markets end within 24 days of the 382-day average (1.05 years).

**IF** past performance was a predictor of the future, the rally would last until November 1, 2025.”

“The symmetry of these 4-year blocks is simply amazing.”

In a previous letter to investors earlier this year, Morehead said that the stock and bond markets were overvalued and that crypto and blockchain assets were set to outperform traditional financial asset classes.

“We talk to asset allocators all the time. If you’re thinking of putting money to work in bonds, I think that’s pretty dangerous. Real estate is coming off all-time highs. Equities are overvalued. That does leave a couple of asset classes, like real commodities and blockchain assets.

Blockchain is a trillion-dollar asset class. Most institutions have essentially zero exposure right now. I believe they should dial it up to a couple percent.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Generated Image: Midjourney

Read the full article here