Bitcoin (BTC) is grappling with key resistance below the $45,000 mark despite a recent surge linked to speculation about approving a spot exchange-traded fund (ETF) in the United States.

This comes as the prevailing market sentiment suggests that Bitcoin is poised for a potential rally, aiming to reach a new all-time high.

In line with this, an analysis by crypto trading expert Tradingshot, posted on TradingView on December 29, highlights that Bitcoin’s parabolic rally may be imminent if it successfully breaches the significant resistance at $48,500.

Tradingshot observed that Bitcoin has witnessed substantial mid-cycle growth over the past two months, edging closer to the pivotal $50,000 level. The expert emphasized that surpassing the $48,500 resistance could mark the commencement of the parabolic phase of the bull cycle.

“Bitcoin (BTCUSD) has seen a significant mid-cycle growth in the past 2 months, approaching the pivotal 50k level. Technically a break above the 48.5k resistance constitutes the beginning of the Parabolic Phase of the Bull Cycle,” he noted.

To visually depict this transition, the analysis utilized the Pitchfan tool to represent cycles, highlighting Bitcoin’s current market movement stage. According to the expert, historical patterns indicate that resistance breakouts in the Bitcoin market often coincide with the halving event—a fundamental occurrence signaling the start of a rally towards a new record high.

With the halving event just four months away, the expert suggested that every pullback to the 1D MA50 (the 50-day moving average) presents a buying opportunity for investors employing Dollar Cost Averaging (DCA) strategies.

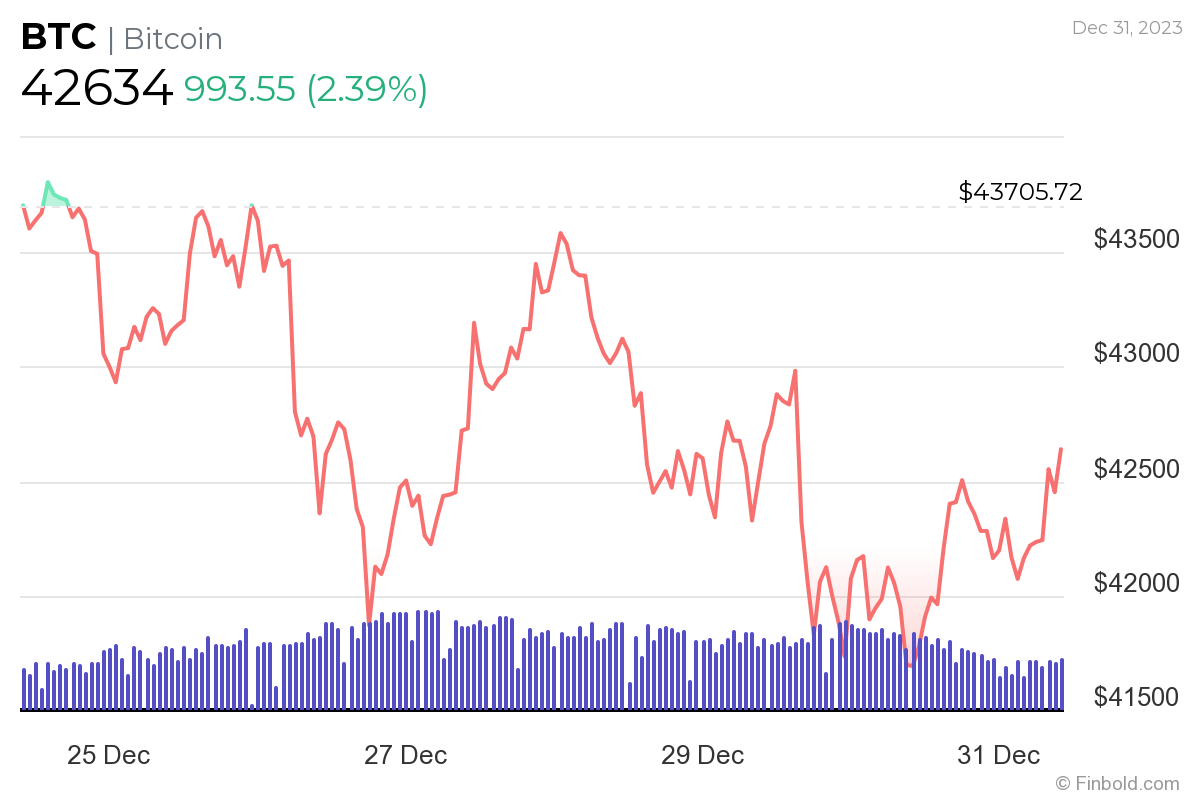

Bitcoin consolidating below $45,000

Overall, despite Bitcoin showing signs of short-term consolidation, the cryptocurrency is in a better position than 18 months ago, supported by speculation around ETF approval. Notably, not all market participants believe the approval will trigger a significant price movement for Bitcoin.

As reported by Finbold, CrediBULL Crypto, a cryptocurrency commentator, suggested that both the anticipation and the actual approval of the ETF would result in purchasing enthusiasm, terming it a “buy the rumor, buy the news event.”

In the meantime, market sentiments continue to indicate possible long-term holding behavior for Bitcoin. According to CryptoQuant data as of December 29, Bitcoin exchange reserves hit a multi-week low, possibly indicating anticipation for future gains.

As per the data, throughout December, the typical quantity of Bitcoin on prominent centralized exchanges has hovered around 2.04 million coins. Nevertheless, within 24 hours, an outflow of over 33,000 Bitcoins led to a multi-week low in exchange reserves, now at slightly over 2 million bitcoins.

Bitcoin price analysis

Currently, Bitcoin is trading at $42,634, showing daily gains exceeding 2%. However, on the weekly chart, Bitcoin has experienced a decrease of approximately 2%.

In other analyses, Bitcoin’s technical assessment sourced from TradingView maintains a bullish outlook. A summary of the one-day indicators indicates a ‘buy’ signal at 11 while moving averages favor a ‘buy’ at 9. Oscillators are currently neutral, registering at 8.

Overall, while the $48,000 level has been identified as a crucial point in Bitcoin’s price trajectory, surpassing $45,000 remains a key resistance to monitor in the short term.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here