After Bitcoin (BTC) crossed the massive psychological level at $38,000 and continued to advance, optimism has returned to the cryptocurrency market, which is now waiting to see if the flagship decentralized finance (DeFi) asset would surpass another major threshold.

Indeed, chances are increasing that this could actually happen, as pseudonymous cryptocurrency analyst Crypto Tony noted that Bitcoin was “MOONING TO TARGET” and “going for that $39,000 – $40,000 mark” he predicted earlier, as he said in his analysis shared on December 1.

That said, as the crypto trading expert observed, some “buggery” or dips are possible between now and when the maiden digital asset climbs to the predicted price level in the following weeks, but he nonetheless stated that “I do remain long currently,” according to his assessment.

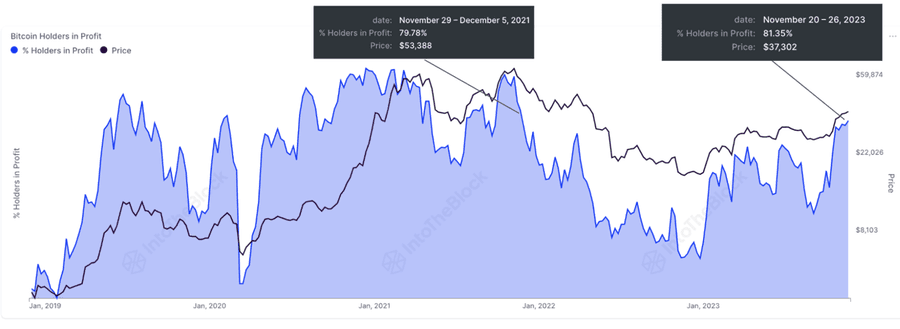

Highest profitability in 2 years

Meanwhile, another bullish sign for the maiden crypto asset is its profitability, which on November 26 reached levels from December 2021, when its price stood at above $50,000, according to the information shared by the blockchain and crypto market intelligence platform IntoTheBlock.

More recently, this percentage has climbed even further, as currently 85% of Bitcoin addresses are in profit, as opposed to 11% in loss and 4% right at the money, according to the latest information retrieved by Finbold from the IntoTheBlock platform on December 1.

Bitcoin price analysis

As things stand, Bitcoin is presently changing hands at the price of $38,425, which represents an increase of 1.54% in the last 24 hours, as well as a 1.87% gain across the previous seven days, adding up to the 10.45% advance accumulated on its monthly chart, as per data on December 1.

All things considered, Bitcoin does seem to be moving in the direction of the $40,000 price level and could even grind towards $45,000, as noted by crypto expert Michaël van de Poppe, who also suggested that now was the time to “buy the dip” before the asset reaches those highs.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here