Although Bitcoin (BTC) has started to slow down its gains from the past weeks that have seen it not just cross the critical $35,000 mark but almost reach $38,000, technical indicators suggest it might make a more significant move upward in the near future.

Specifically, the “higher timeframe picture on Bitcoin shows that we’ve hit a crucial resistance zone,” according to the analysis carried out by the cryptocurrency trading expert Michaël van de Poppe shared in an X post published on November 17.

Indeed, Bitcoin did briefly touch the pivotal resistance at the area around $38,000 (between $37,900 and $38,500), at the same time moving far away from the pivotal support between $31,114 and $31,790, as the cryptocurrency analyst’s chart suggests.

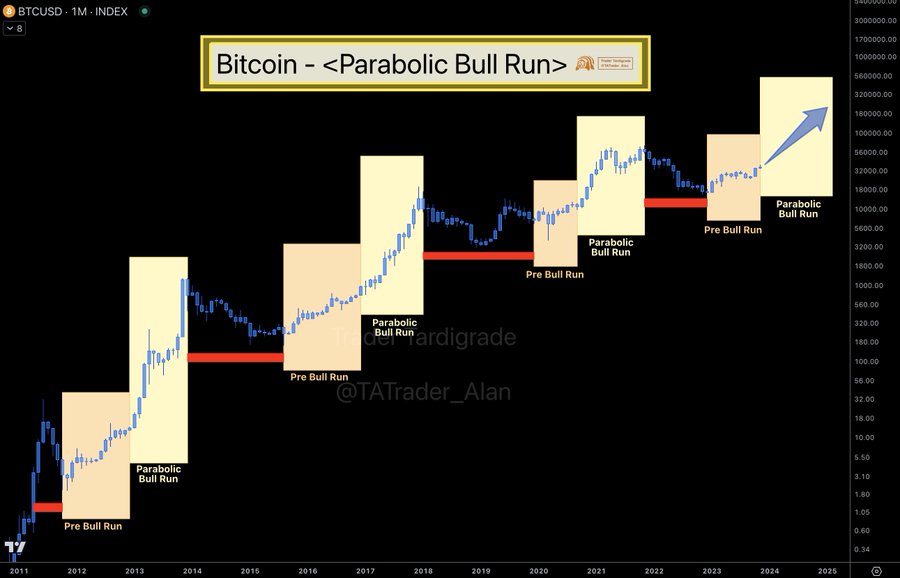

At the same time, pseudonymous crypto market analyst Trader Tardigrade has pointed out that Bitcoin would enter a “parabolic bull run soon,” sharing a chart pattern analysis dating back to 2012, which demonstrates similar price movement cycles occurring after each pre-bull run, one of which happened recently.

In fact, judging by the analysis that covers parabolic bull runs from 2013-2014, 2017-2018, and 2021-2022, the next one could start as early as December and continue for the following months and toward 2025, ultimately entering into the $200,000 territory.

Bitcoin price analysis

Meanwhile, the flagship decentralized finance (DeFi) asset was at press time trading at $36,323, recording a decline of 0.85% in the last 24 hours and dropping 2.15% across the previous seven days while still clinging to the 28.31% gain accumulated on its monthly chart, as per most recent data.

All things considered, despite the temporary slowdown, the maiden crypto asset has the capacity to push its price further, particularly considering that tons of new smaller wallets with less than one BTC have flooded the network, leading to a yearly high of 67.62% rate in newly created active addresses this week.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here