By Shayan

Bitcoin’s recent consolidation phase has expanded, with the price exhibiting a slight uptrend accompanied by exceptionally low volatility.

Despite this, it remains within a narrow price range, emphasizing the necessity of a breakout to determine the cryptocurrency’s next direction.

The Daily Chart

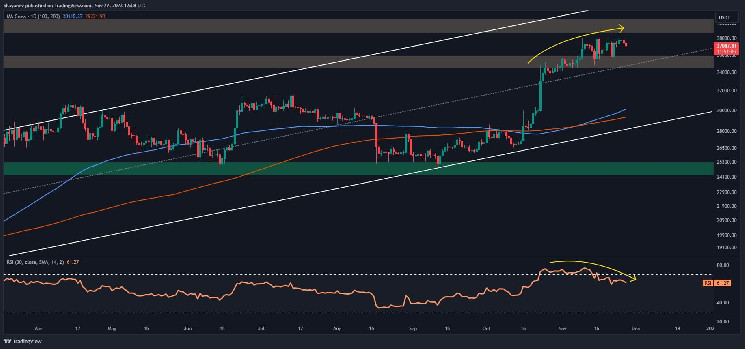

A detailed examination of the daily chart reveals a prolonged consolidation near the critical resistance region of $38K, where the price lacks a discernible direction. Throughout this consolidation, an expanded bearish divergence has materialized between the price and the RSI indicator, signaling a potential shift in market sentiment toward a bearish outlook.

However, BTC currently finds itself within a crucial price range, consisting of the pivotal $38K resistance zone and a significant support range, including the static support level of $35K and the middle boundary of the ascending channel. Consequently, Bitcoin’s forthcoming trajectory remains uncertain until a breakout from this decisive range transpires.

Shifting the focus to the 4-hour chart, the market’s consolidation phase has extended to the critical resistance level of $38K. Within it, a rising wedge pattern has emerged. This is usually considered to be a sign of reversal. Nevertheless, the price breaking below the lower trendline of the wedge will be a clear sign of a potential downturn in the market.

The presence of the rising wedge pattern, combined with an expanded bearish divergence between the price and the RSI indicator, indicates a need for a short-term retracement. If sellers gain control and BTC breaches the lower boundary of the wedge, a temporary correction stage becomes imminent, with the price experiencing continuous declines. Key support levels in this scenario include the $35K static support, as well as the range between the 0.5 ($32,260) and 0.618 ($30,909) Fibonacci levels.

By Shayan

For a considerable period, analysts have placed significant emphasis on examining and comprehending the behavior of whales within the cryptocurrency market. Among the metrics utilized for this purpose, the Exchange Whale Ratio stands out as a valuable tool, providing a comprehensive overview of these influential market participants’ activities.

This metric measures the ratio between the top 10 significant inflows and the total inflow volume on cryptocurrency exchanges. Elevated values in this ratio signal substantial funds from major players, commonly referred to as “whales,” being transferred into exchanges.

Upon closer inspection, it becomes evident that the accumulation stage and the initiation of an ascending trend were succeeded by a decline in whale activity. Conversely, a surge in this indicator often indicates the commencement of a downward trend.

As of the present moment, this index is experiencing significant growth but has not yet reached elevated levels. If this observed pattern persists, there is a likelihood of a notable downturn in the market. However, it remains crucial to diligently monitor this ratio, as alterations in its patterns could potentially lead to changes in the price of Bitcoin.

Read the full article here