A Bitcoin user paid 83.7 Bitcoin (BTC), worth $3.1 million, in transaction fees for transferring 139.42 BTC. The transaction fee of $3.1 million is the eight-highest in Bitcoin’s 14-year history.

The BTC wallet address bc1qn3d…wekrnl tried transferring 139.42 BTC to bc1qyf…km36t4 on Nov. 23, only to pay more than half the actual value in the transaction fee. The destination address received only 55.77 BTC. The mining pool Antpool captured the absurdly high mining fee on block 818087.

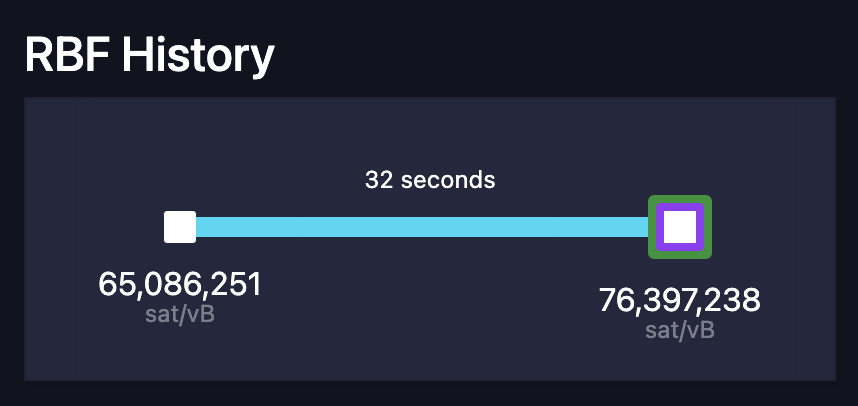

Users on social media suggested that the sender may have selected the high transaction fee, but the replace-by-fee (RBF) node policy and the sender’s unawareness also appear to have played a part. RBF allows an unconfirmed transaction in the mempool to be replaced with a different transaction that pays a higher transaction fee to get it cleared earlier. The mempool is where all BTC transactions are queued before approval and addition to the Bitcoin blockchain.

A mempool developer who goes by mononaut on X (formerly Twitter) said the user behind the transfer probably didn’t know RBF orders cannot be canceled. The user might have repeatedly replaced the fees in hopes of canceling it. The RBF history indicates that the last replacement increased the fee by another 20%, adding 12.54824636 BTC in fees.

This is not the first time a Bitcoin user accidentally sent an absurdly high transaction fee for a single Bitcoin transaction. In September, Bitcoin exchange platform Paxos accidentally sent a $500,000 transaction fee for a $2,000 BTC transfer. In that incident, the F2Pool miner who verified the transaction returned the $500,000 accidental transaction fee to Paxos.

However, this is the largest Bitcoin transaction fee ever paid in dollar terms, knocking the September Paxos transfer of $500,000 off its unfortunate podium. The largest fee in Bitcoin terms was paid in 2016 when someone accidentally sent 291 BTC in transaction fees.

Related: Binance’s DOJ settlement offers a glimmer of hope for the crypto industry

Mononaut told Cointelegraph that although the current instance of an accidental transaction fee has similarities to the Paxos case, the possibility that Antpool would return the funds would depend on their own payout policies, ”which might have implications for what obligations they have to share transaction fees with their miners.”

Antpool has yet to comment on the issue and has yet to respond to Cointelegraph’s requests for comments.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

Read the full article here