A research paper from Valhill Capital contends that the XRP fair value is much higher than its current market price, ranging from $9.81 to $513,000 based on six valuation models.

Currently trading for $0.5759, XRP is 82% down from its all-time high price of $3.31 in January 2018.

Despite its role in cross-border settlements and a potential to disrupt TradFi domination of the industry, XRP has continued to trade at low prices while other crypto assets record massive surges.

XRP Price Under Suppression?

For instance, amid the ongoing pre-bull market phase, assets such as Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) have largely outperformed XRP. Most market watchers argue that XRP’s unimpressive performance is due to age-long price suppression.

Before now, some pundits contended that the legal battle between Ripple and the SEC contributed to this price suppression. Now, with XRP having attained legal clarity in July 2023, others have pointed to Ripple’s consistent XRP escrow releases and sales.

Regardless of the reason behind it, the general consensus is that XRP is a victim of price suppression, resulting in the asset trading below its fair market value. As a result, to ascertain this fair market value, several models have sprung up.

A Quest to Determine XRP Fair Market Value

Valhill Capital, a private equity investment firm, published a research paper that consolidates six of these valuation models. The paper aimed to provide insights into differing opinions on the fair market value of XRP.

These valuations put XRP fair market value at a minimum of $9.81 and a maximum of $513,000. However, should the two outliers at $9.81 and $513,000 are removed, the fair market value of XRP ranges from $3,500 to $22,000. The models also had their drawbacks.

Each model employed a different basis for calculating XRP’s fair market value. The models include the Pipeline Flow, the Athey & Mitchnick Model, the 99-Year Golden Eagle Model, the Discounted Cash Flow, the Collateralization Model and the Quantum Liquidity Model.

XRP to $3,541: The Pipeline Model

The Pipeline Flow model envisions a scenario where a large portion of the global foreign exchange volume shifts to the XRP Ledger, due to its superior features and benefits. The model calculates that XRP’s price would be $3,541 in this case.

XRP Fair Market Valuation Pipeline Model

XRP to $4,813: Athey & Mitchnick Model

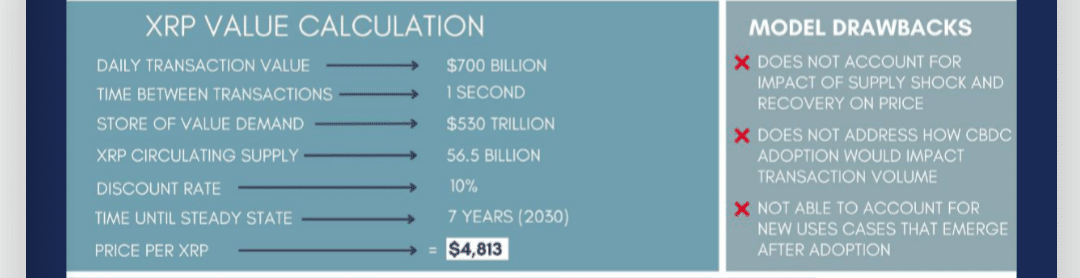

This model projects that XRP will capture 10% of the global market for cross-border payments and foreign exchange transactions by 2030.

The model also assumes that XRP will become a preferred store of value, with its demand hitting $530 trillion by 2030. This model predicts that XRP’s price would be $4,813 by then.

XRP Fair Market Valuation Athey and Mitchnick

XRP to $13,386: 99-Year Golden Eagle Model

The 99-Year Golden Eagle model focuses on XRP’s role as a medium of exchange, rather than a store of value or a speculative asset. Notably, it assumes that XRP will be used mainly for transactions, with no holding or hoarding behavior.

The model estimates that XRP’s price would increase to $13,386 in 99 years, based on the expected growth of the XRPL network and the global economy.

XRP Fair Market Valuation 99 Year Golden Eagle

XRP to $18,036: Discounted Cash Flow

This model values XRP as a cash-generating asset, based on the expected future cash flows from its use cases and applications. It also assumes XRP’s utility as a means of transaction, and not its store of value.

The model discounts the future cash flows to their present value, using an appropriate discount rate. It determines that XRP’s price would be $18,036, based on the current and projected cash flows from XRP.

XRP Fair Market Valuation Discounted Cash Flow

XRP to $122,580: Collateralization Model

The Collateralization model assumes the tokenization of global money, with the resulting tokens finding their way to the XRP Ledger.

This model, considered an extreme approach, talks about all the money in the world denominated in tokens on the XRPL. Based on this assumption, it puts XRP’s fair market value at $122,580.

XRP Fair Market Valuation Collateralization

XRP to $513,158: The Quantum Liquidity Model

This model values XRP as a liquidity asset boasting a high enough value to uphold financial stability for an extended period of time.

It considers XRP as a store of value rather than a means for transactions. The model evaluates that XRP’s price would be $513,158 at the satisfaction of these conditions.

XRP Fair Market Valuation Quantum Liquidity

Read the full article here