XRP might be struggling to sail the current market turbulence, but whales have moved to open bullish long positions amid the liquidation of over $453,000 in shorts.

XRP’s journey has not been pretty in recent times, with a host of bearish developments compounding existing investor angst. Some of these developments include a rare SEC win in the Ripple case, and the hack affecting Ripple co-founder and chairman Chris Larsen.

The crypto asset has been flirting with the $0.51 price threshold following the latest market decline that saw it drop from a $0.5270 high earlier this month. Amid a loss of volatility, XRP has struggled to reclaim and retain the $0.51 level, with a slump below it compounding bearish pressure.

XRP Sees $453K in Short Liquidations

Market participants hurriedly created short positions, as they expscted further declines in the aftermath of the crash below $0.51. However, XRP eventually reclaimed the price point yesterday, retesting the higher spectrum of the threshold in a push to $0.5184.

This subtle price recovery led to massive liquidations impacting existing short positions, which had skyrocketed in the wake of the previous price drop. Notably, data from crypto market data provider Coinalyze indicates that XRP traders have recorded over $517,600 in liquidations over the past 24 hours.

XRP Liquidations | Coinalyze

Interestingly, of this figure, short positions account for $453,900, representing a massive 87.69% of the total liquidations across the market. Most of these liquidations have occurred on Binance. Notably, long liquidations only amount to a paltry $63,100 in the past 24 hours.

This represents the highest dollar worth of short liquidations in the XRP market since Feb. 1, when market participants suffered short liquidations to the tune of $816,676. XRP also quickly recovered above the $0.51 threshold that day amid a battle at $0.50.

More Whales Open Long Positions

Following the latest surge of short liquidations, whale sentiment has shifted, with long positions taking absolute predominance. Notably, market interest has also risen, as futures and perpetual open interest (OI) jumps 2.31% to the current value of $458 million.

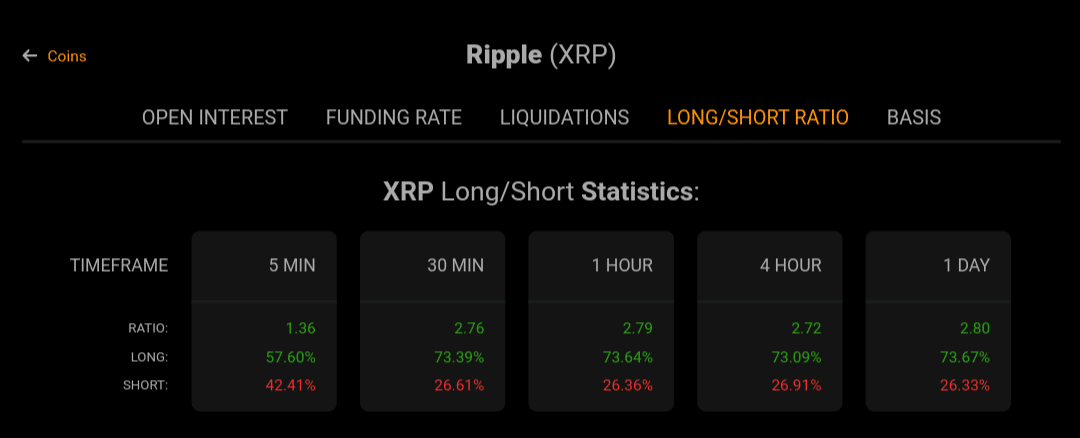

Significantly, the long/short ratio, which assess the ratio of long positions to short positions, has seen a spike. Over the past 24 hours, long positions have made up 73.67% of total leveraged positions across all exchanges. This puts the long/short ratio at 2.80.

XRP Long Short Stats | Coinalyze

A similar ratio cuts across multiple timeframes, with 73.09% in four hours, 73.64% over the last hour, and 73.39% in the past 30 minutes. This metric indicates that market participants are starting to rebuild their confidence in XRP’s future trajectory.

Meanwhile, XRP currently trades for $0.5130, up 2.23% over the past 24 hours, and 2.19% in the last seven days. Binance has witnessed a surge in volume amid the renewed interest, with the order book consisting of an impressive 59.3% buy orders.

Read the full article here