Some cryptocurrency analysts, experts, and researchers believe we are already in a bull market since 2023. Others believe cryptocurrencies have just started rising from consolidation, while some think there is a long way ahead before getting optimistic.

Dr. Martin Hiesboeck, Head of Research at Uphold, belongs to the second group. Particularly, Dr. Hiesboeck declared this cycle’s bull market starting on January 24 through a post on X (formerly Twitter).

“Today begins the biggest bull market in crypto history. Just a thought.”

– Dr. Martin Hiesboeck, Head of Research at Uphold

In retrospect, bear and bull markets are identified by zooming out the charts, spotting tops and bottoms in long time frames. However, the shorter the time frame, the harder to properly identify these cycles’ marks through startings and endings.

Bull market? Crypto total market cap analysis

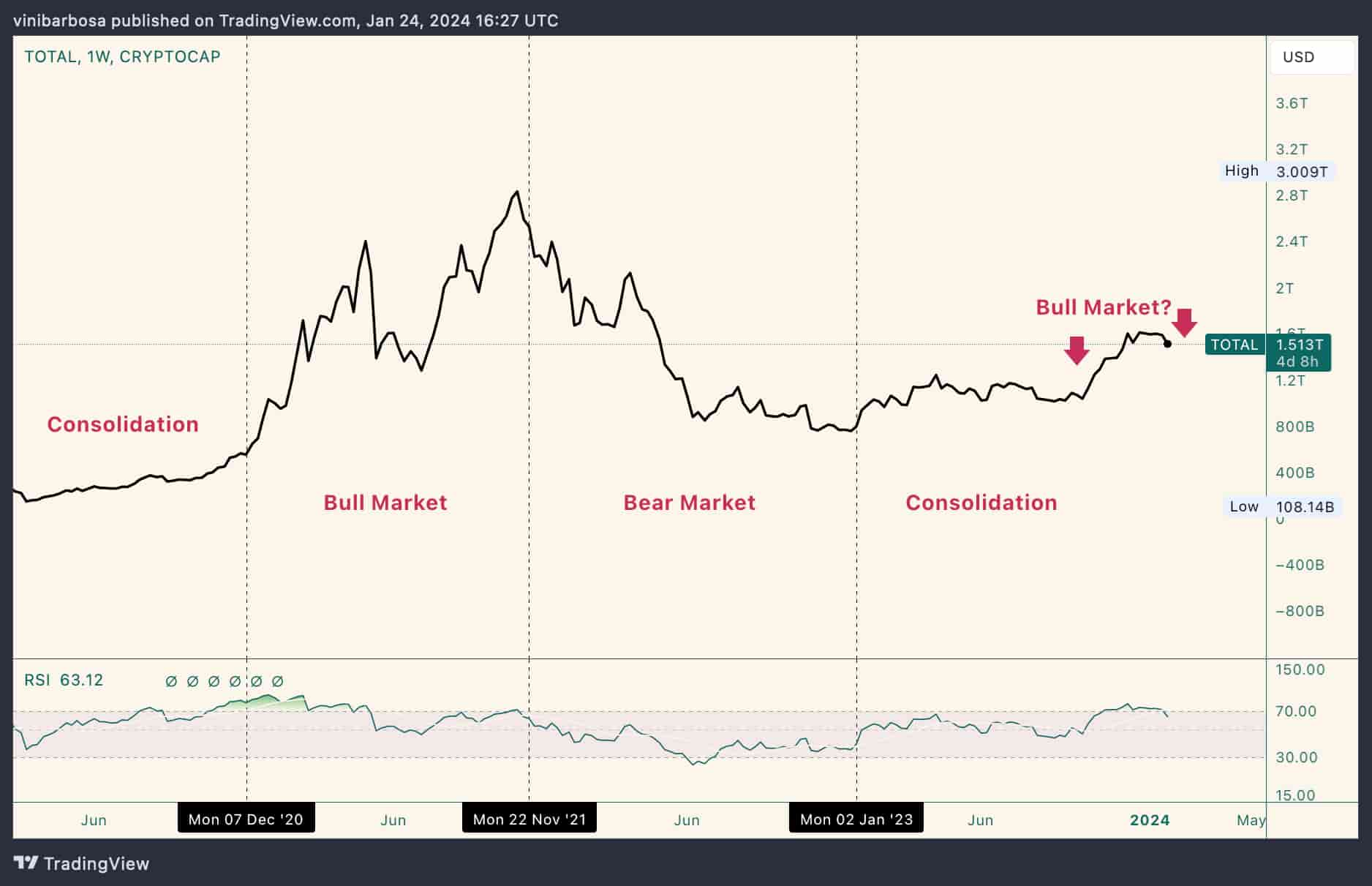

Notably, we can identify each market’s cycle phase by looking at the Crypto Total Market Cap Index chart. The last bull market started somewhere in late 2020, reaching its peak in November 2021, preceding the multi-year recent bear market.

Further, a consolidation phase could have started in January 2023. Experts might disagree on this setup and on each phase’s proper definition. Nevertheless, the capitalization surge in late 2023 is notable and resembles the pattern of the past cycle.

Currently, the total capitalization of the cryptocurrency market is at $1.51 trillion. This is half of 2021’s $3.00 trillion total market cap. Meanwhile, being two times this cycle’s lows at around $750 billion in January 2023.

Essentially, cryptocurrencies are halfway from the top and the bottom since the last bull market. Therefore, it is possible that we are still in consolidation.

The starting point of the next bull market will depend on further price action from this moment by press time. On that, Uphold’s head of research seems to believe in an uptrend moving forward. Moreover, Dr. Martin Hiesboeck calls for the biggest rally in all crypto history.

Despite the positive forecast, investors must remain cautious and understand that risk-asset markets are highly volatile and unpredictable. Everything could happen in the short term, requiring proper risk management and due diligence while speculating.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here