The euphoria surrounding the approval of spot Bitcoin ETFs has evaporated significantly, leaving the crypto market in a subdued state. One could almost say the news marked the peak, at least for now. Based on the overall technical structure, a significant correction could be brewing before Bitcoin and top altcoins muster the strength to challenge 2024 record highs again.

For traders seeking resilient altcoins to weather this potential downturn, Ethereum Name Service (ENS), BONK, and Optimism (OP) merit consideration. These tokens have demonstrated relative stability even under bearish market pressures.

Expert traders like Doctor Profit have already started speaking about a potential correction in Bitcoin price. According to a post on X, the analyst foresees a 30-40% decline from its recent $48,000 peak.

Soon panic selling will start

The 30-40% correction started at 48k

After that golden bull will start ⏳

— Doctor Profit 🇨🇭 (@DrProfitCrypto) January 12, 2024

With the ETF out of the way, investors would be looking at the next major event — the miner reward halving. Rekt Capital reckons via X that Bitcoin tends to post a pre-halving retrace followed by a pre-halving rally.

The pre-halving rally should ideally take place 60 days before the actual event while the pre-halving retrace would be expected in the next 30 days or so.

#BTC

Historically, Bitcoin tends to perform its Pre-Halving rally ~60 days before the Halving (light blue)

Which means…

If $BTC is going to perform a deeper retrace during its Pre-Halving period (orange), it should occur over the next 30 days or so#BitcoinETF #Bitcoin pic.twitter.com/9mDseEB0uO

— Rekt Capital (@rektcapital) January 12, 2024

That said, the easiest and recommended way to minimize risk is to diversify the crypto portfolio which brings us to the top altcoins like ENS, BONK, and OP. Identifying key entry positions could bolster the return on investment both in the short-term and long-term.

Recommended: Crypto Price Prediction For January 12 as First Spot BTC ETF Begins Trading: ETH, BCH, SUI

Ethereum Name Service (ENS)

Investors piquing interest in the Ethereum Names Service (ENS) token are confident that the rally will continue in Q1. The first solid support at $8 paved the way for bulls to regain control—a move that continues to bear fruits while rewarding patience among holders.

ENS has in the last 24 hours seen its value increase in double-digit figures of 11%. This cumulatively pumped the gains by 80% and 188% in seven and 30 days, respectively based on market data by CoinGecko.

ENS price chart | Tradingview

Trading at $25 on Friday, the Ethereum Name Service token is back to levels last seen in October 2022. The next most critical resistance holds at $28 (the purple band). With a successful break above it, ENS could tap on FOMO to close the gap to the all-time high at $84.

However, investors should be aware of the highly overbought conditions, especially on the weekly chart. In case of a correction, investors should keep in mind the potential support at $20 (grey band) and if the decline continues, at $16.

Bonk (BONK)

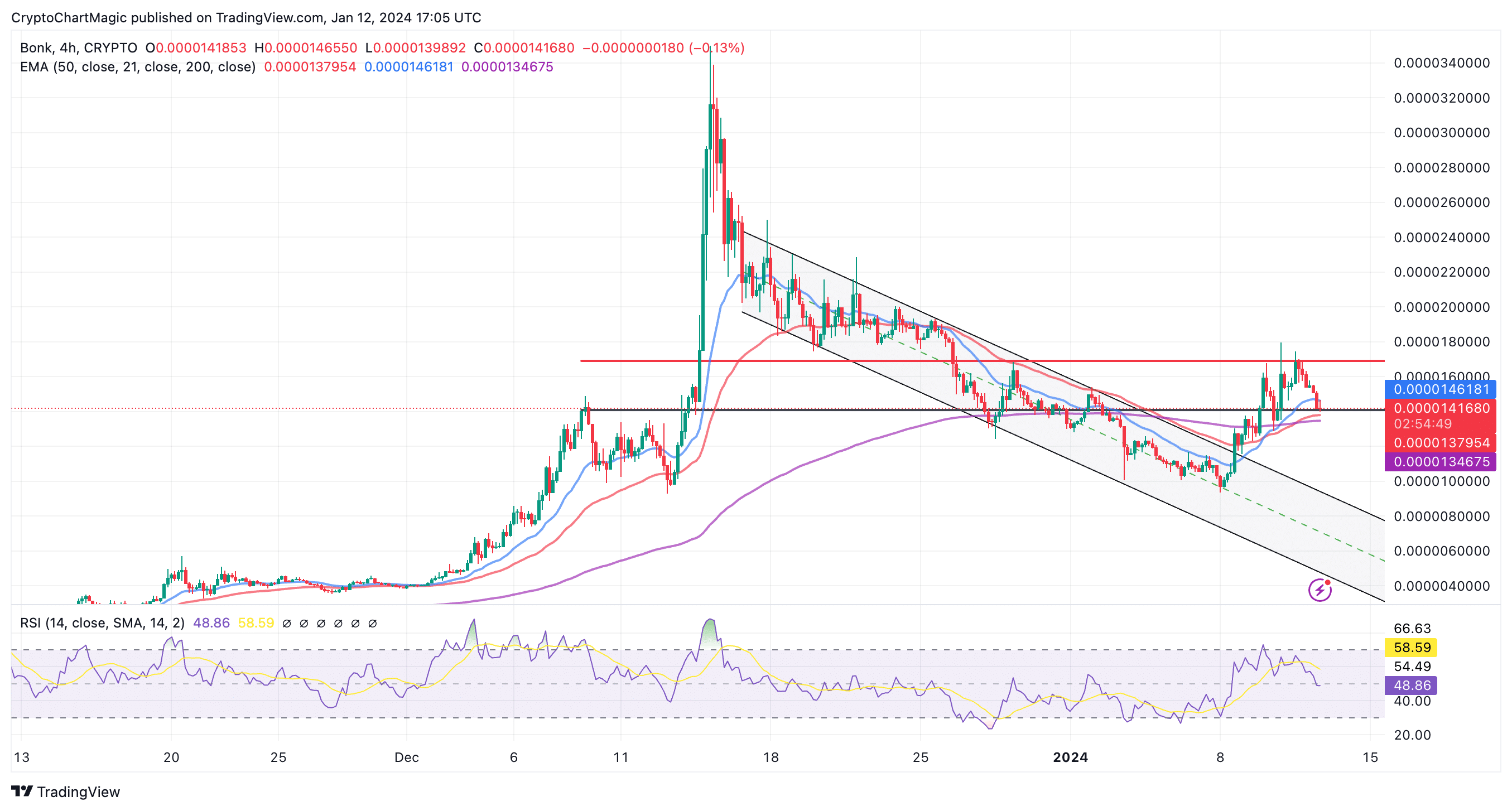

After emerging as one of the best-performing altcoins in Q4, reaching new all-time highs of $0.000053, Bonk retraced respecting the boundaries of a descending channel.

The gravitational pull on the meme coin built on the Solana blockchain seemed unstoppable until bulls found footing in the support area around $0.00001. This support coupled with the ETF drums, propelled BONK into a recovery trajectory.

While a break above $0.00002 would have called on more investors to take up the token, market doldrums seem to have taken center stage, resulting in a decline to the current market value of $0.000014.

Bonk price chart | Tradingview

Profit-oriented traders may want to close their current open positions to not give back the gains to the market and aim to enter again following the acceptance of lower solid support.

The black horizontal ray is the first bet for a support area which if respected could blast Bonk toward $0.00002. Slightly below it is a confluence of the 50 Exponential Moving Average (EMA) (red) and the 200 EMA (purple). If both of these levels are lost, losses could intensify to $0.00001 and if push comes to shove reach the local support at $0.000005.

Optimism (OP)

Optimism is gearing up for another major breakout, but first, a stubborn resistance at $4 must be defeated. With most indicators including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) backing the uptrend, it would only be a matter of time before OP continues in its price discovery mode.

OP price chart | Tradingview

Traders should also consider the consecutive four-hour candle closes below the immediate resistance at $4. Another close below this key level could change the tide and lead to a freefall to the range low of $3.5.

Potential entry positions include the area above the range high at $4, the 20 EMA, the 50 EMA, and the range low. While we cannot immediately rule out further losses to $3, such a move would allow Bonk to collect liquidity before making way for a larger breakout into price discovery above $0.000035.

Related Articles

- Bitcoin Cash Price Eyes $335 As Party Fever Grips Loyal BCH Holders

- Solana Price Prediction: Bullish Pattern Signals $SOL Breakout Rally to $165

- Terra Classic Price Prediction As Bull Run Erupts, Can LUNC Crack $0.00016?

Read the full article here