SUI price prediction: Sui, the Layer-1 smart contract platform, has recently become a focal point in the decentralized finance (DeFi) sector. Its native token, SUI, has witnessed a striking 280% growth in just three months.

This remarkable increase in SUI’s value began in 2024, indicating a strong bullish trend in the market. Market analysts are optimistic about this altcoin’s future, foreseeing continued bullish momentum.

Sui Price Prediction: Dissecting Potential Surge

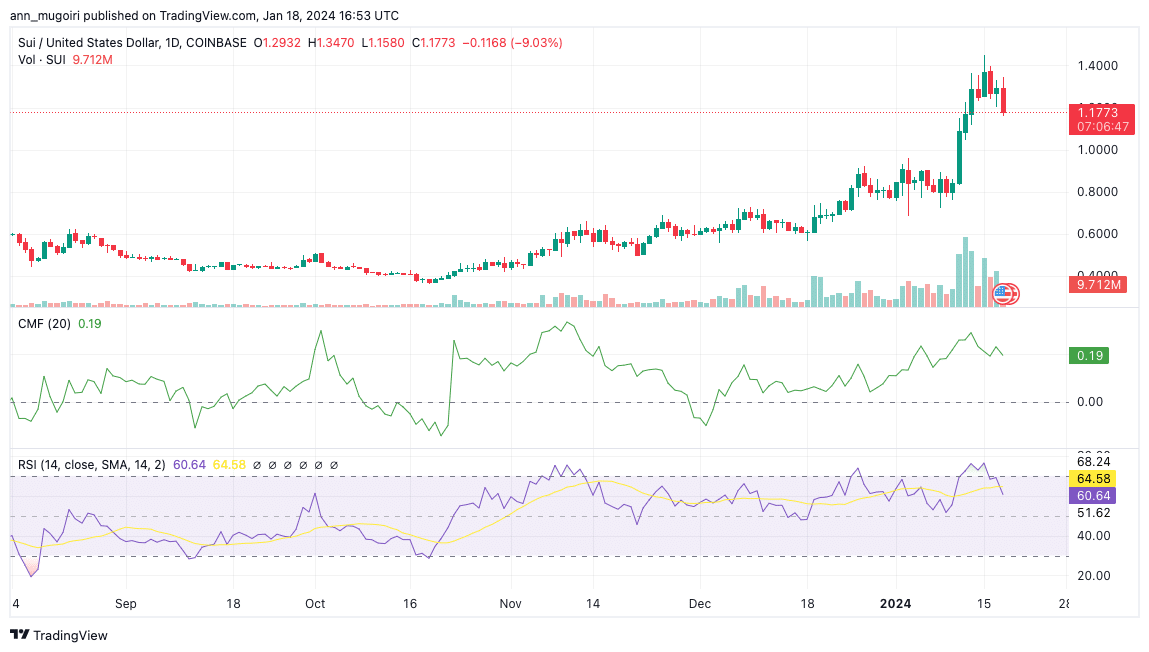

Sui price has recently undergone a slight decrease of 0.56% in its valuation. Despite this modest setback, market indicators suggest an upcoming bullish phase. Currently priced at $1.24, Sui boasts a market capitalization nearing $1.3 billion. This positions it as the 53rd largest cryptocurrency based on data from CoinMarketCap. Additionally, its 24-hour trading volume has diminished significantly, dropping over 6% to $412 million.

Sui Price Prediction chart by Tradingview

According to renowned crypto analyst Crypto Tonny, Sui’s market outlook is receiving a positive boost. His projections on the platform (X) suggest an imminent upsurge, potentially surpassing the $1.26 mark.

Tonny’s analysis goes beyond short-term fluctuations, indicating the start of a sustained Bull Market that could extend for several months. This optimistic forecast reflects a growing confidence in the token’s long-term market performance.

$SUI / $USD – Update

Another day on the top gainers list .. Hold that $1.26 steady for continuation pic.twitter.com/hRQ1s4wVVP

— Crypto Tony (@CryptoTony__) January 18, 2024

SUI price has been experiencing a phase of constrained price fluctuations recently, staying within the $0.85 to $1.2 range. This pattern indicates an increasing bullish trend over the past week. If these trends persist, SUI could escalate to approximately $1.30. However, a shift towards a bearish market could lead to a notable increase in value, potentially breaking through the $0.8 support and possibly reaching as low as $0.7 in a brief timeframe.

Technical Indicators Signal Upward Momentum for SUI

The daily technical indicators for SUI suggest a potential upward trend in the near term despite its current minor decline. Most of the moving averages and oscillators currently point to a neutral stance, reflecting a state of indecision in the market. The Relative Strength Index (RSI) is hovering at a neutral 60, but there are expectations of a shift towards the overbought zone due to anticipated bullish momentum. Additionally, the Average Directional Index (ADX) presents a positive stance, further supporting prospects of a bullish trend.

Sui price chart | Tradingview

Other indicators like the 20 Exponential Moving Average and the 50-EMA show positive alignment, bolstering the likelihood of an optimistic future. The Moving Average Convergence Divergence (MACD) indicator reinforces this sentiment, with its line positioned above the signal line on the daily chart. Moreover, the Chaikin Money Flow (CMF) indicator is also in positive territory, at $0.19, which aligns with the overall bullish trend.

Related Articles

- Sui Price Prediction: How Rapid TVL Rise Could Supercharge SUI To $5

- Crypto Prices Today: Bitcoin and Pepe Crash Amid Market Rout, SUI Jumps 14%

- Sui Price Skyrockets As TVL Triumphs Over Bitcoin

Read the full article here