Solana price has recently undergone a remarkable upswing, showcasing a significant rise in the last day alone. This marks a continuation of its impressive performance throughout 2023, where it witnessed a staggering 660% increase. Despite this, the past week has seen Solana’s value fluctuate, descending from the $100 level to the $80 range.

Solana price prediction

Currently, the Solana Price is trading at an impressive $92.05, indicating a more than 2% increase in just 24 hours. This suggests a growing bullish momentum in the market. The cryptocurrency now boasts a market capitalization of $40 billion, securing its position as the fifth-largest digital currency by market cap. However, it’s worth noting that there has been an 8% decrease in its 24-hour trading volume, now standing at $1.6 million.

Solana Price Prediction: Navigating Market Volatility

In the last week, Solana’s price movement has been confined within a narrow $80 to $95 bracket, largely dominated by a bearish trend. The altcoin touched its weekly low at $79 on January 23, under considerable selling pressure. Despite these recent fluctuations, Solana has achieved an impressive growth of over 280% over the past year. Crypto market experts remain positive about its potential for continued upward movement in the near future.

Cryptocurrency expert Nebraskangooner has kept a keen eye on the price trends of SOL, Solana’s native token. His insights reveal a potential upswing in the price of Solana market value in the near future. He points out that the current positive trend could lead to a larger rally. Nebraskangooner emphasizes that if Solana manages to hold its support levels, it could experience significant financial gains, an optimistic scenario for the cryptocurrency.

$SOL

Daily reclaimed looking like a spring now.

Assume upside potential as long as support is maintained https://t.co/rLsyhogop1 pic.twitter.com/5WllnHOihg

— Nebraskangooner (@Nebraskangooner) January 27, 2024

If Solana continues on its current trajectory, its performance in the market could hinge on several critical elements. If the bearish trends maintain their grip, Solana might be approaching a support level near $50, potentially falling to $20.

On the other hand, a revival of bullish forces could thrust Solana towards challenging higher resistance levels, possibly around $125. The subsequent weeks and months are crucial in determining whether Solana will recover from its recent downturns or remain at the mercy of ongoing market fluctuations.

Technical Indicators: A Bullish Outlook for Solana

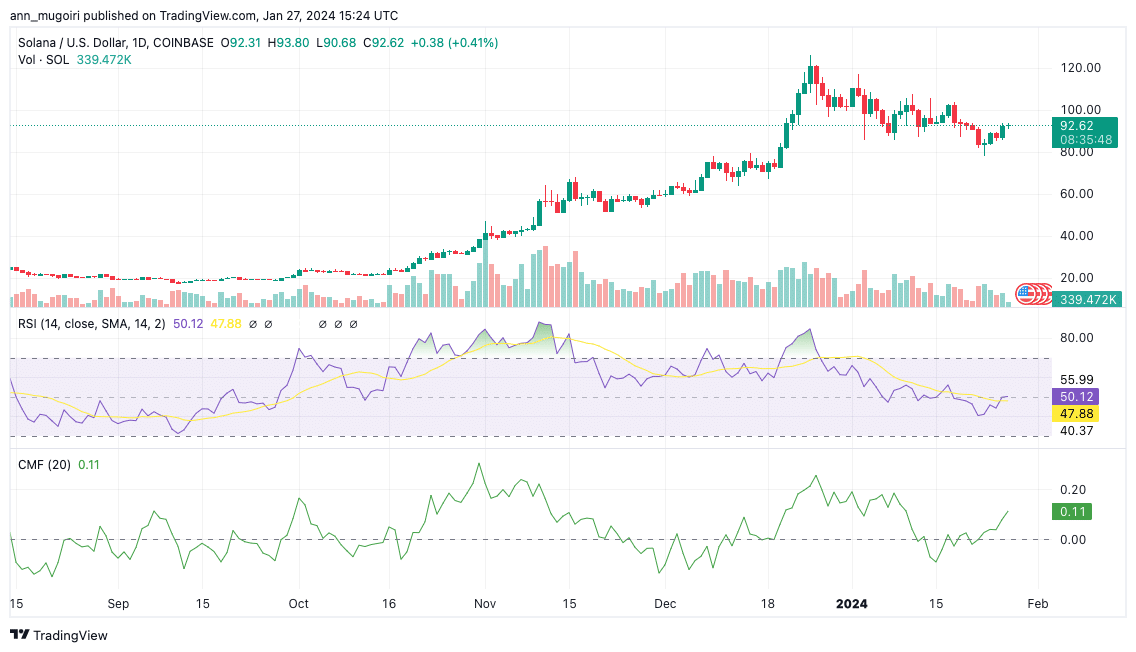

The technical indicators for Solana currently present a promising outlook. The daily Relative Strength Index (RSI), hovering around the 50 level, signals a potential shift toward bullish territory in the short term. This metric, a crucial tool for gauging market momentum, suggests an evenly balanced sentiment among traders, with a slight inclination towards a positive trend.

Solana price chart: Tradingview

Further reinforcing this optimistic view is the Chaikin Money Flow (CMF), which is currently trending at 0.11. This positive trend in the CMF, which assesses an asset’s buying and selling pressure, hints at a bullish run for Solana. Additionally, the current positioning of the 20 Exponential Moving Average (EMA) above its 50-EMA counterpart underscores the possibility of further gains for Solana.

Related Articles

- 7 Reasons To Buy Solana (SOL) This Year

- MYRO Volatility Rises As It Enters Top 3 Memecoins On Solana

- Solana Price Prediction As Bull Trap Puts $SOL At Risk Of 20% Drop

Read the full article here