Bitcoin (BTC), worth over $7.2 billion, is still controlled by the United States government — but its losses are mounting.

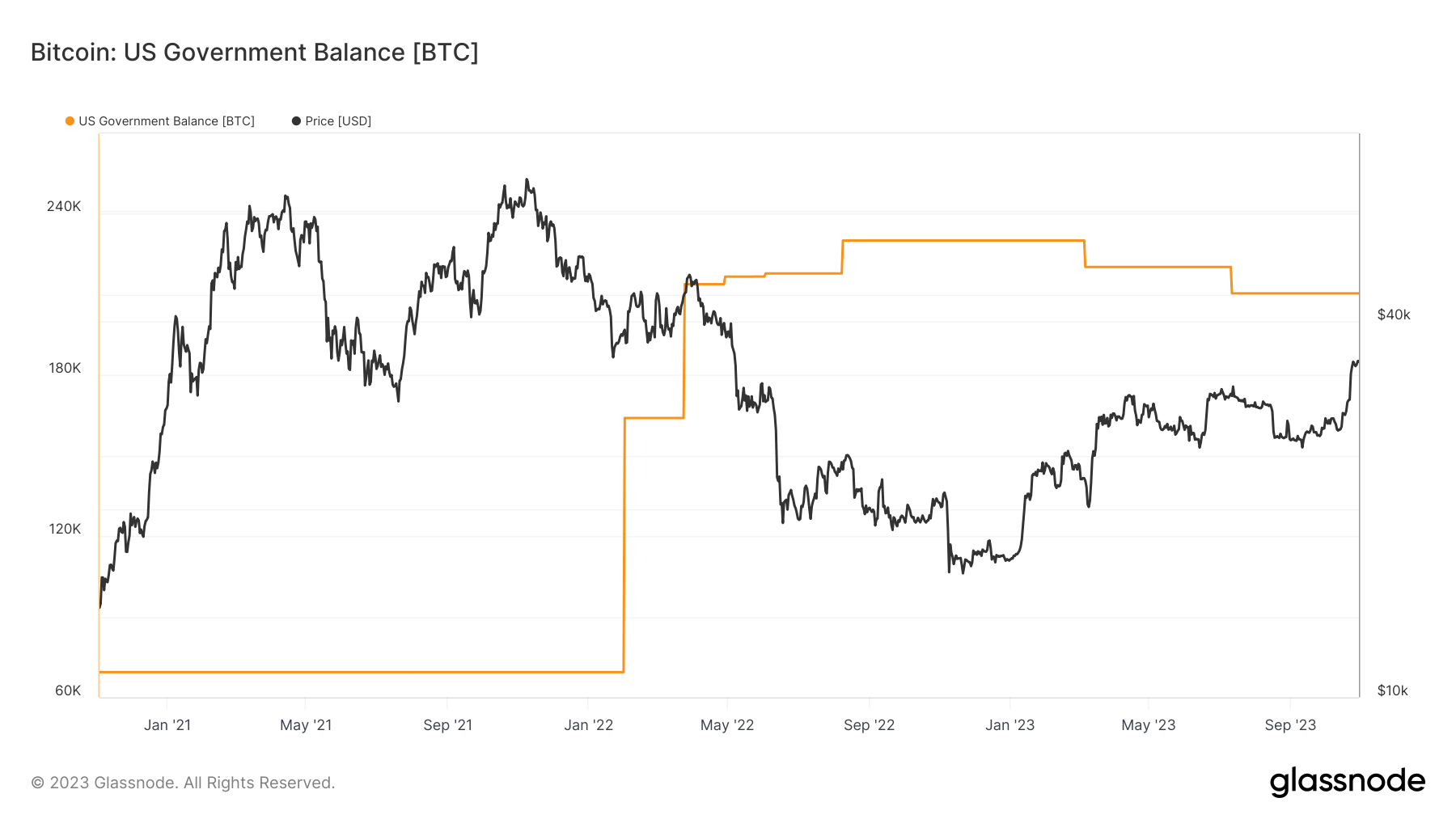

Data from on-chain analytics firm Glassnode shows that Washington’s seized Bitcoin total 210,429 BTC as of Oct. 31.

195,000 BTC sold, $6.3 billion down

The U.S. Department of Justice (DOJ) and Internal Revenue Service (IRS) are well known — perhaps accidentally — as being one of the world’s largest Bitcoin whales.

Through various legal proceedings, lawmakers have confiscated vast amounts of BTC over the years, and only a small percentage of its takings have been resold at auction.

Those who opted to buy the proceeds have profited considerably, and adding to the irony, the DOJ — more like a Bitcoin newbie than a whale — has been guilty of selling too soon.

According to statistics compiled by Jameson Lopp, co-founder of Bitcoin custody firm Casa, the government has so far missed out on a grand total of over $6 billion in potential gains from its 195,092 BTC sell-off.

No single entity other than Satoshi Nakamoto owns more BTC than the DOJ. The largest corporate BTC treasury, for example, owned by MicroStrategy, currently consists of 158,245 BTC ($5.43 billion), per data from monitoring resource BitcoinTreasuries.

Heavy Bitcoin bag

Glassnode shows the DOJ stash growing in step with announcements of confiscations.

Related: There are now nearly 40M Bitcoin addresses in profit — A new record

In early 2022, its inventory increased by nearly 100,000 BTC — at the time worth $3.6 billion — thanks to legal action against individuals accused of attempting to launder the proceeds of a 2016 hack of major crypto exchange Bitfinex.

Meanwhile, billionaire Tim Draper, one of the original BTC auction bidders, recently accused the U.S. government of suppressing crypto growth.

Having previously predicted a $250,000 BTC price tag for 2022, Draper subsequently claimed that policy failures were “killing the golden goose of Silicon Valley.”

“Regulations smother innovators,” part of an X post from May reads.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here