When it comes to finance, predictions and warnings from renowned figures can send ripples through markets, causing both excitement and apprehension among investors.

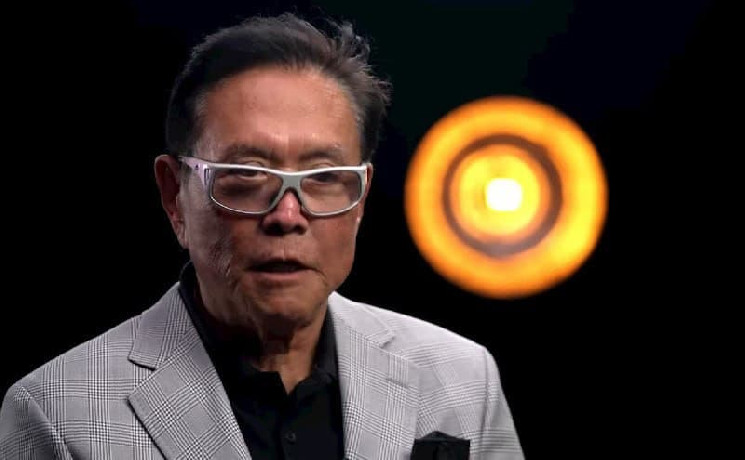

Recently, Robert Kiyosaki, famed author of “Rich Dad Poor Dad,” took to X, formerly Twitter to issue a stark caution: the S&P 500 is poised for a monumental crash, potentially plummeting by a staggering 70%.

This proclamation, coupled with his recommendation to invest in hard assets like gold, silver, and Bitcoin (BTC).

Kiyosaki’s latest warning

Kiyosaki’s assertion raises a pertinent question: why haven’t financial planners advocated for hard asset investments earlier? His answer, succinctly put, revolves around money—commissions, to be exact.

The author contends that financial planners have been hesitant to steer clients towards hard assets due to the allure of traditional investments and the substantial commissions they generate. However, he emphasizes that historical data supports the superiority of hard assets, particularly gold, which has outperformed the S&P for decades.

The notion of a looming market crash is not novel in Kiyosaki’s narrative. He points to his book, “Rich Dad’s Prophecy,” where he reportedly forecasted the impending cataclysmic event years ago. His tweet serves as both a reminder and a call to action for investors to reassess their strategies and choose their financial advisors wisely.

Finally a few Financial Planners are recommending investing in Gold, Silver, Bitcoin.

Q: Why have financial planners not recommended investing in hard assets earlier?

A: $. Money Baby !!! Commissions!!! Gold has beaten the S&P for decades. The S&P is about to crash by 70%.…

— Robert Kiyosaki (@theRealKiyosaki) February 12, 2024

In light of Kiyosaki’s warning, investors are urged to exercise caution and diligence in navigating the turbulent financial landscape. While the prospect of a market downturn may be unsettling, it also presents opportunities for astute investors to safeguard their wealth and capitalize on undervalued assets.

Embracing diversification and incorporating hard assets into investment portfolios could serve as a prudent strategy in mitigating potential losses amidst market volatility.

Kiyosaki’s proclamation serves as a wake-up call for investors to reevaluate their investment approach. Over the weekend he questioned the sustainability of the American Empire amidst record-high debt and extravagant spending habits.

Drawing parallels to the decline of the Roman Empire, he warned against repeating historical mistakes and urged investors to prioritize assets like gold, silver, and Bitcoin. With a stark reminder that history often repeats itself.

Read the full article here