Polygon (MATIC) price has declined by 17% in the last 30 days. While the token has had a series of recoveries, its price action in recent weeks has been nothing short of underwhelming.

One question investors will want to know is if the token will eventually trade against the current run of play. This on-chain analysis dives into the possibility.

Polygon Sees Mass Departure In Investors

According to Santiment, Polygon’s prospects remain bleak. One reason for this is the Open Interest (OI), which is the value of all outstanding contracts in the market. At press time, the OI per exchange was $38.85 million.

As seen below, the last time the metric reached this level was in June 2022 – specifically during the bear market. For the unaccustomed, a rise in OI indicates that traders are increasing exposure to a cryptocurrency by allocating more liquidity to contracts related to the token.

In most cases, this increase in net positioning drives a jump in price. However, a decrease in Open Interest suggests that traders are taking money out while potentially impacting price negatively.

Read more: What Is Polygon (MATIC)?

Polygon Open Interest. Source: Santiment

From a trading perspective, the fall in this value indicates an increase in aggressive sellers. If it remains unchanged, this could drag the price of the Polygon native token further down.

At press time, MATIC changed hands at $0.42, representing an 85.51% decrease from its all-time high. Considering the current market condition, this decline is supposed to be a “buy the dip” opportunity.

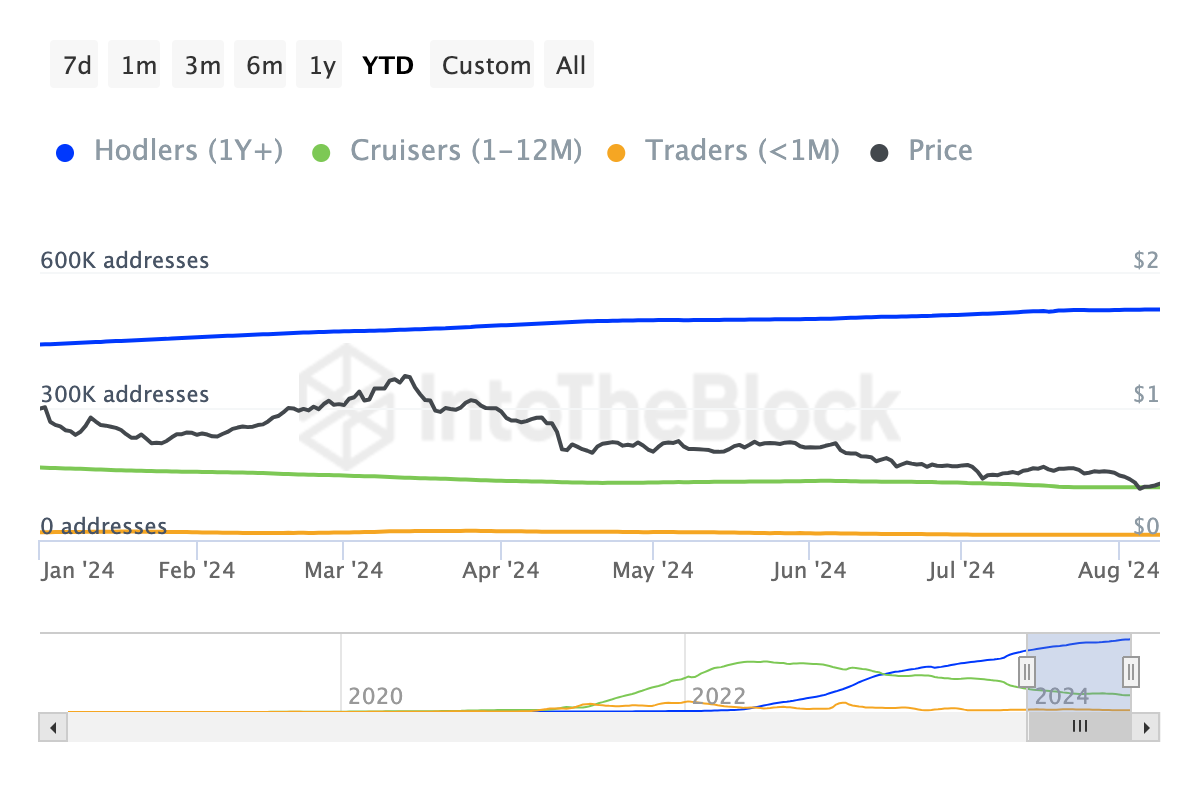

However, the broader market does not seem to view it that way, according to data from IntoTheBlock. As of this writing, the blockchain analytics platform shows that the number of Cruisers and Traders has declined.

Cruisers are those who have held a cryptocurrency between the last 30 days to 12 months. Traders, on the other hand, are those who held within the last 30 days.

Polygon Addresses By Time Held. Source: IntoTheBlock

If the number of these participants increases, it signifies market confidence in a token’s potential. But since it decreased, it means that a large part of the market is skeptical about MATIC’s short to mid-term potential.

MATIC Price Prediction: Brace for Another Decline

The daily MATIC/USD chart reveals that bulls were able to recover some of the recent losses. However, the token faces an uphill battle as it lingers below the $0.46 crucial support. Furthermore, the Chaikin Money Flow (CMF), used to differentiate between periods of accumulation and distribution, is down to -0.12.

When the CMF rating increases, accumulation outpaces distribution, thereby improving the chances of a price increase. Since the indicator’s reading dropped, it suggests that selling pressures outweigh the buy side.

However, the Relative Strength Index (RSI) registered a bounce from what it was a few days back. The RSI measures momentum and spot overbought and oversold regions. If the reading is 70.00 or below, the crypto involved is overbought.

Conversely, a reading at 30.00 or below means the crypto is oversold. From the image below, Polygon became oversold when the market crashed earlier in the week. But despite the slight increase it had, the RSI remains below the neutral line, suggesting that momentum remains bearish.

Read more: 15 Best Polygon (MATIC) Wallets in 2024

Polygon Daily Analysis. Source: TradingView

Should this stay the same, MATIC may find it challenging to bounce off the recent lows, possibly leading the crypto price below $0.40.

However, this prediction may be invalidated if investor sentiment changes from bearish to bullish. If this happens, MATIC price may retest $0.44 and likely reach $0.50.

Read the full article here