With the slow start for the stock market in 2024 and some investors being quick to forget the strong performance from the year before, it is not a coincidence that some analysts are warning of a bearish future.

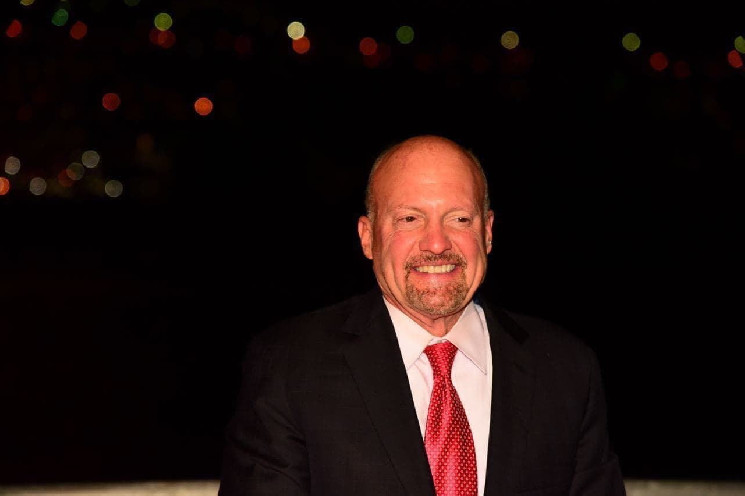

Jim Cramer recognized for his dynamic personality and outspoken perspectives on stocks and cryptocurrencies, weighed in on the latest developments.

On January 16, Cramer expressed that the market is poised for a pullback, citing the rapid ascent of numerous stocks, particularly those of tech companies promoting artificial intelligence (AI) initiatives, without a substantial foundation to support such swift gains.

“While I’m not a bear, we have way too many stocks that have gone parabolic, meaning they’re straight up and going straight up on nothing. They just keep rising as one analyst after another raises their price targets and really nothing more.”

Cramer mentioned that numerous participants in the sector might be merely paying lip service with their persistent assertions of future success driven by artificial intelligence.

“No matter what, you just can’t have the same stocks go up and up and up on the same old news, and as I see it, that’s what’s happening — momentum and multiple expansion,” he said. “Any stock that’s gone parabolic is a candidate to decline here.”

Social media users are bullish on the stock market

After the pessimistic comments by Cramer, social media users, specifically those on X, are sharing bullish thoughts on the stock market, in a trend that has grappled with the community called the ‘Inverse Cramer,’ which is connected to The Inverse Cramer Tracker ETF (SJIM).

“Jim Cramer has been wrong more than any other person that I never listen to,’ said one user.

Another one added, “new ATH coming?”

Just two months ago, the former hedge fund manager agreed with the bullish prediction for the S&P 500 index set by Bank of America at 5,000 by the end of 2024.

In the past, the ‘Inverse Cramer’ trend has been shown to work in many instances regarding Bitcoin on multiple occasions, multiple stocks, and other broad market predictions.

Investors are there to judge whether this trend is truly onto something or if it is just a sheer coincidence.

However, Cramer has recently missed the point on some of his predictions, with some traders that employed the ‘inverse Cramer’ tactic already reaping the benefits.

Read the full article here