With Dogecoin (DOGE) currently holding the top spot as the leading meme cryptocurrency in market capitalization, the community remains focused on its price trajectory, with the ambitious goal of reaching the $1 mark.

The likelihood of DOGE achieving this milestone remains a subject of speculation, considering the token’s tendency to follow the broader crypto market regarding trading patterns. Moreover, the challenge of reaching $1 is compounded by the absence of significant fundamentals compared to assets such as Bitcoin (BTC).

Seeking insights into the potential timeline for Dogecoin hitting $1, Finbold turned to the artificial intelligence (AI) tool Google Bard.

When will DOGE hit $1?

Bard acknowledged that the possibility of DOGE reaching $1 remains high, pointing to potential catalysts such as increased adoption and utility. Should the cryptocurrency expand its utility beyond speculative trading and find practical applications, like broader merchant acceptance or integration into decentralized finance (DeFi) applications, it could experience a surge in demand and a corresponding increase in overall value.

In addition, the tool highlighted that a positive upswing in the broader cryptocurrency market could favor Dogecoin’s value, bringing it closer to the elusive $1 mark.

Brad also identified the role of meme coin’s community. The AI platform noted that the actively engaged DOGE community plays a pivotal role in shaping its price. Coordinated buying efforts and renewed interest sparked by influencers or celebrities can drive up Dogecoin’s value, inching it closer to the desired $1 threshold.

Significantly, if these favorable factors align, the AI tool emphasized that DOGE might achieve the coveted valuation by 2030.

On the flip side, Brad identified several challenges in pursuing the $1 mark. The tool pointed out unlimited supply, competition, and regulatory uncertainty as key barriers to the cryptocurrency’s price trajectory.

Dogecoin key fundamentals

In the meantime, DOGE’s price trajectory hopes to be influenced by recent fundamentals that saw the coin rally to historic levels in 2021. Notably, the support from Tesla (NASDAQ: TSLA) CEO Elon Musk remains crucial.

Musk remains bullish on Dogecoin, speculating that the meme coin will likely find use cases on the upcoming X (formerly Twitter) payment system.

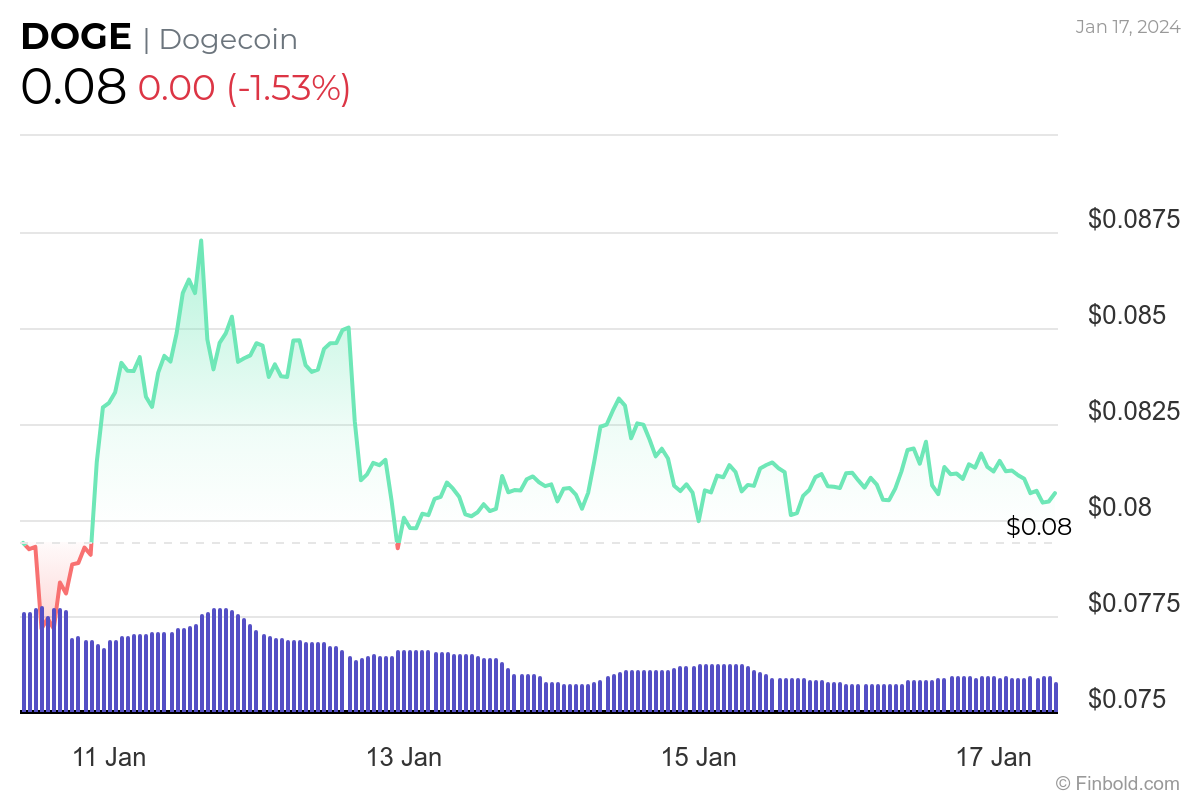

At the same time, the DOGE community remains on edge regarding the next price trajectory, with the coin witnessing significant whale transactions. Specifically, on January 16, a whale transferred 990 million DOGE from an unknown wallet to another unknown wallet.

In this scenario, speculations are rife that the transfer might signal an upcoming dump.

Notably, for DOGE to reach $1, it would require a price increase of $0.92 or 1150% from its current valuation of $0.08. In its journey towards the $1 mark, the coin needs to reclaim its previous all-time high of $0.73, witnessed in May 2021. This implies that DOGE is currently $0.65 or 812.5% away from its last record high.

In conclusion, attention remains focused on DOGE and whether the coin will avoid further short-term drops even as the market seeks to stabilize amid a bearish trend.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here