- Arbitrum and Optimism experience decreases in LTV, while still maintaining significant dominance in the Layer 2 sector.

- Decrease in transaction volume in Arbitrum and Optimism signals current trend in the Layer 2 space.

Arbitrum and Optimism, two leading platforms in Layer 2 solutions, have experienced declines in their Total Locked-in Value (TVL), according to recent reports. Arbitrum recorded a 9% drop in its TVL, while Optimism showed a reduction of more than 12%. Despite these declines, Arbitrum maintains a dominance of more than 49% in LTV in the Layer 2 sector, and Optimism has about 25%.

Analysis of transaction volume in both networks indicates a decline. Arbitrum, which reached $1.8 billion in volume at the beginning of the year, has seen this number drop to approximately $542 million. Optimism, meanwhile, saw an initial increase in volume to $184 million, but this also declined to around $48 million.

Asfor the valuation of its tokens, ARB and OP, both have shown fluctuations. ARB experienced a 2.8% increase on January 24, but subsequently returned to a downtrend, trading around $1.6.

Source: Trading View by Ambcrypto

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) show bearish trends, although ARB remained above its short-term moving average.

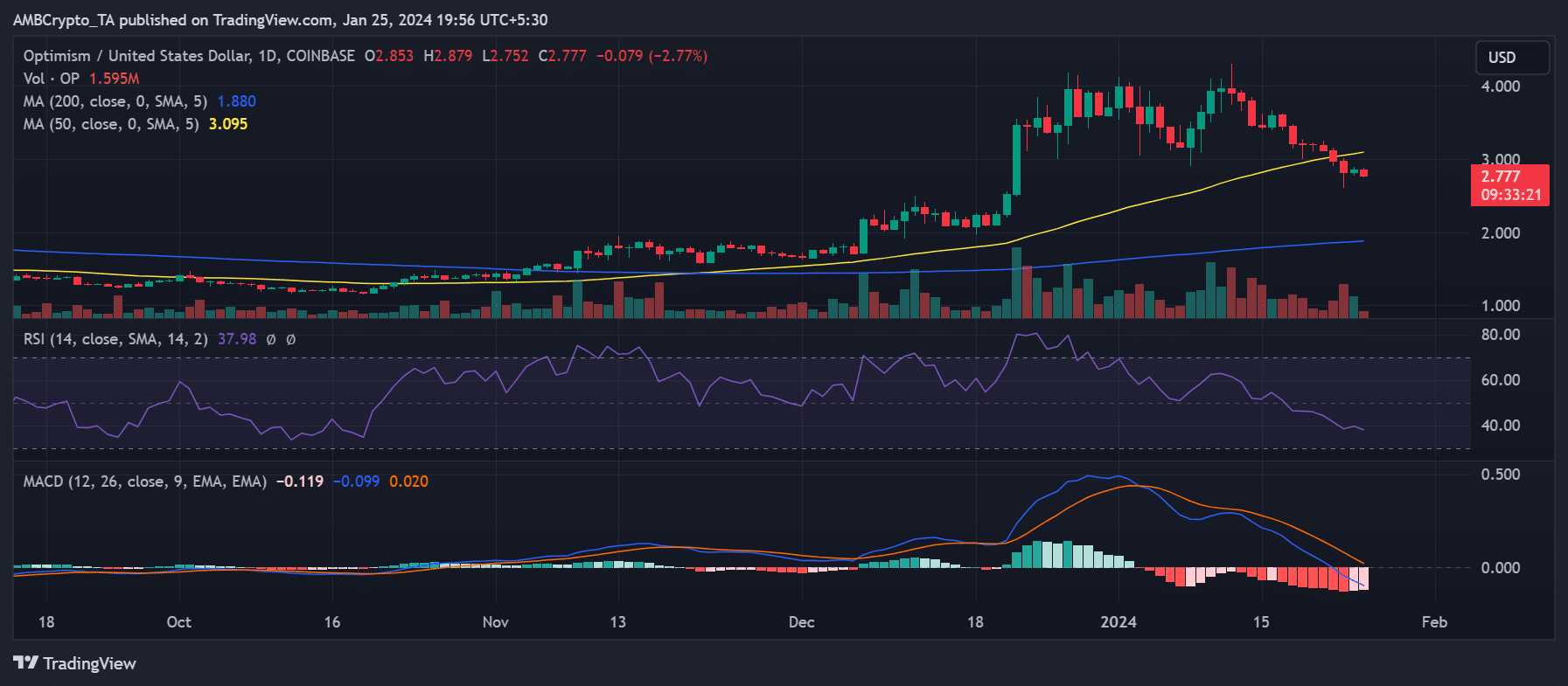

Source: Trading View by Ambcrypto

Optimism, on the other hand, has a more pronounced downtrend. Its valuation stands at around $2.7, down 2.7% and trading below its yellow trendline and the neutral line of its RSI, indicating a downtrend.

This data highlights the variability in the cryptocurrency market and Layer 2 solutions. Arbitrum and Optimism, while industry leaders, face market fluctuations and challenges. It is necessary for investors and market participants to maintain constant monitoring and adapt to changes, while the developers of these platforms continue to work on improving and stabilizing their systems.

Read the full article here