The cryptocurrency market is showing signs of recovery following the recent selloff triggered by US recession fears and the Bank of Japan’s (BOJ) interest rate hike. These events caused significant volatility across financial markets, including the crypto sector.

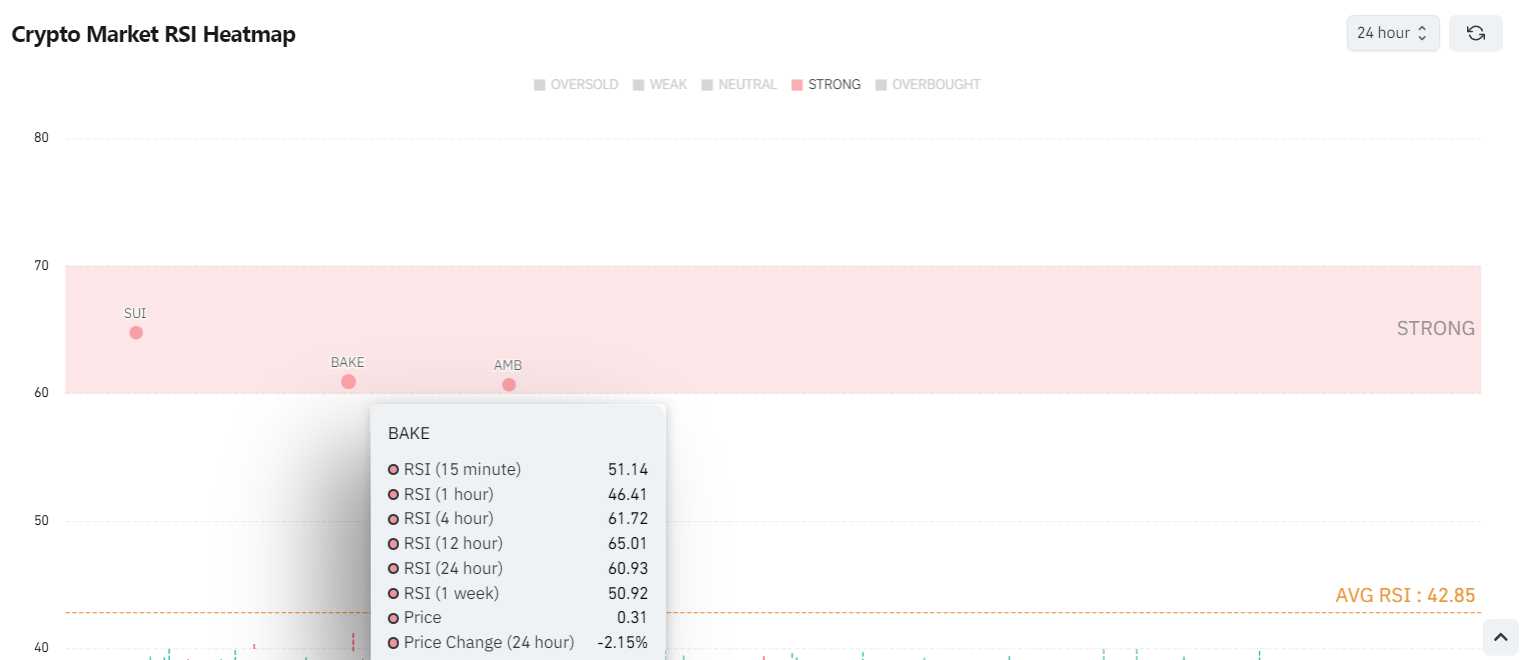

Amid this turbulence, Finbold analyzed the Relative Strength Index (RSI) heatmap from CoinGlass on August 10 to identify potential buy signals.

The overall market’s average weekly RSI of 41.72 and daily RSI of 42.85 reflect a largely neutral sentiment. While the market is not yet in a bullish phase, emerging opportunities for investors are evident.

Against this backdrop, two cryptocurrencies, Sui (SUI) and BakeryToken (BAKE), are showing promising signs of strength and momentum, making them key assets to watch as the market stabilizes and potentially moves higher.

Sui (SUI)

The SUI token is exhibiting strong upward momentum across various RSI intervals, underscoring its potential as a buy candidate. Starting with a 15-minute RSI of 51.89, SUI shows early signs of positive momentum.

This is reinforced by a one-hour RSI of 63.55, indicating that buying pressure is building over shorter time frames. The RSI continues to increase, reaching 76.95 at the four-hour interval, a level typically associated with strong bullish conditions.

The 12-hour RSI at 69.96 and the 24-hour RSI at 64.77 further confirm sustained buying interest in SUI.

Additionally, the one-week RSI stands at 43.68, reflecting resilience despite broader market fluctuations. Momentum indicators such as the Moving Average Convergence Divergence (MACD) and the Average Directional Index (ADX) also align with this bullish sentiment, showing a strong upward trend in price and momentum.

Furthermore, SUI has recorded a notable 6.29% price increase over the last 24 hours, highlighting its growing strength. The convergence of these technical and momentum indicators suggests that SUI is well-positioned for further gains, making it a compelling buy opportunity.

BakeryToken (BAKE)

On the other hand, BAKE presents a complex yet intriguing opportunity for investors. While the token has shown some short-term weakness, with a 15-minute RSI of 51.14 and a one-hour RSI of 46.41 indicating mild buying pressure, its longer-term indicators suggest the potential for a rebound.

The four-hour RSI improves to 61.72, signaling a build-up of momentum, and the 12-hour RSI further strengthens to 65.01, edging into bullish territory.

The 24-hour RSI at 60.93 supports this gradual recovery, suggesting that despite recent price declines, such as the 2.15% drop in the last 24 hours, BAKE is stabilizing.

Additional technical indicators like the MACD and ADX show mixed but potentially bullish signals, with the MACD nearing a crossover into positive territory and the ADX indicating moderate trend strength.

This divergence between short-term weakness and improving long-term momentum positions BAKE as a potential buy for investors looking to capitalize on a possible turnaround as market conditions stabilize.

In conclusion, SUI’s strong RSI and momentum indicators, coupled with its recent price surge, make it a clear buy candidate for investors seeking immediate gains. BAKE, while currently showing some short-term weakness, presents an opportunity for those willing to take a calculated risk on its potential recovery.

Despite the potential buy signals for these two cryptocurrencies, the market is volatile, and things can change quickly. Investors should remain vigilant and stay informed about market conditions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here