The weekend has started with a correction on the cryptocurrency market, according to CoinMarketCap.

BTC/USD

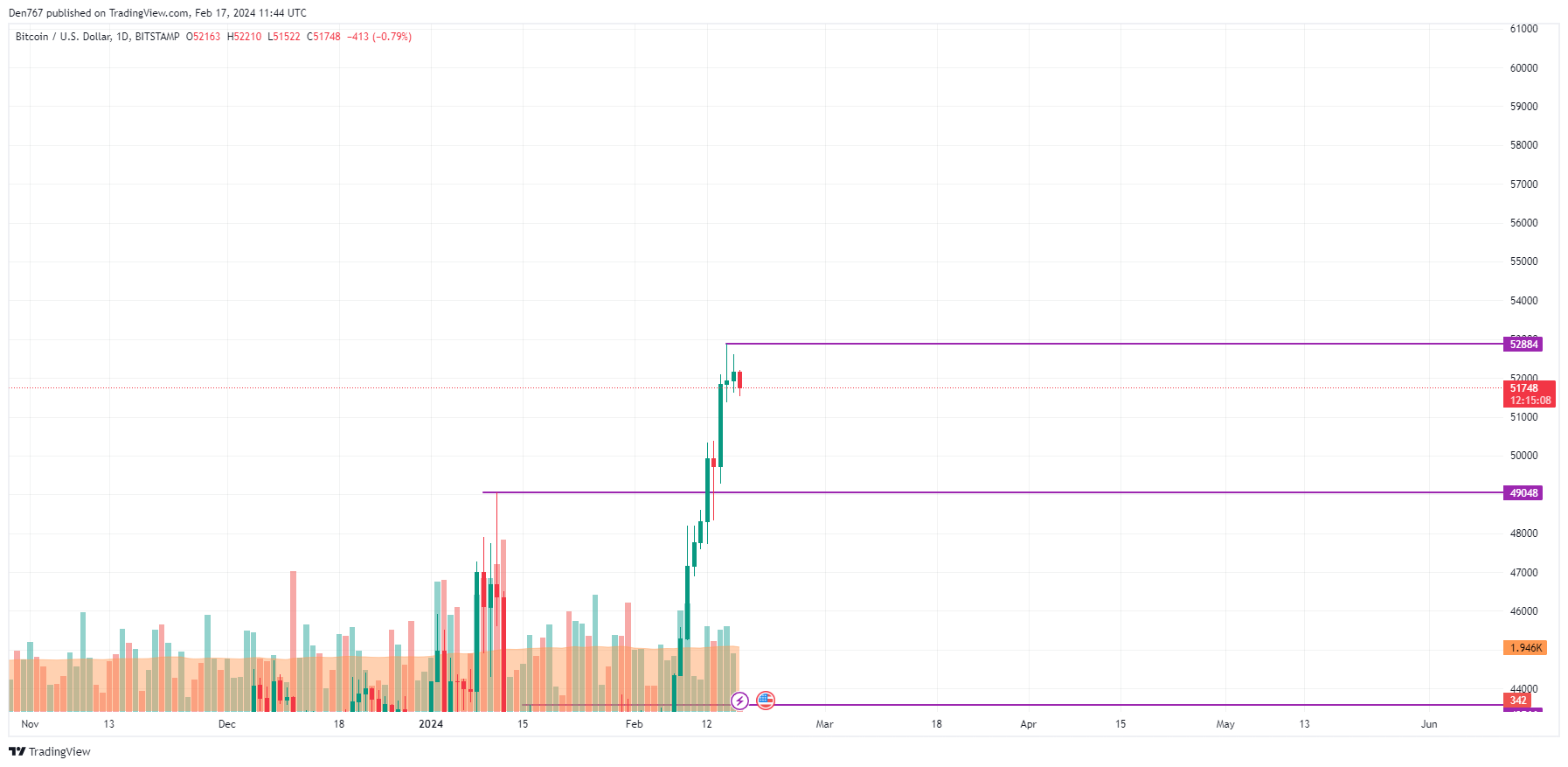

The price of Bitcoin (BTC) has fallen by 1.22% over the last 24 hours.

On the daily chart, the rate of BTC is accumulating energy after a sharp rise. This statement is confirmed by the declining volume, which means that neither bulls nor bears are ready for a further move. In this case, sideways trading between $51,000 and $52,500 is the more likely scenario for the next days.

Bitcoin is trading at $51,725 at press time.

ETH/USD

Ethereum (ETH) has followed the drop of BTC, going down by 1.68%.

From the technical point of view, Ethereum (ETH) is looking more bearish than BTC. The price is trading near the support level of $2,763. If a breakout happens, there is a chance to see a correction to the $2,700 area.

Ethereum is trading at $2,781 at press time.

XRP/USD

XRP has lost the most value on the list today, falling by 3.18%.

The rate of XRP is trading similarly to Ethereum (ETH). At the moment, one should pay attention to the daily closure in terms of yesterday’s low. If it happens below the $0.5526 mark, sellers may locally seize the initiative, which might lead to a decline to the $0.54-$0.5450 zone.

XRP is trading at $0.5536 at press time.

Read the full article here