Bitcoin’s price calmed over the past few days after the ETF-induced volatility during the previous business week but still slipped below $42,000 on Sunday evening.

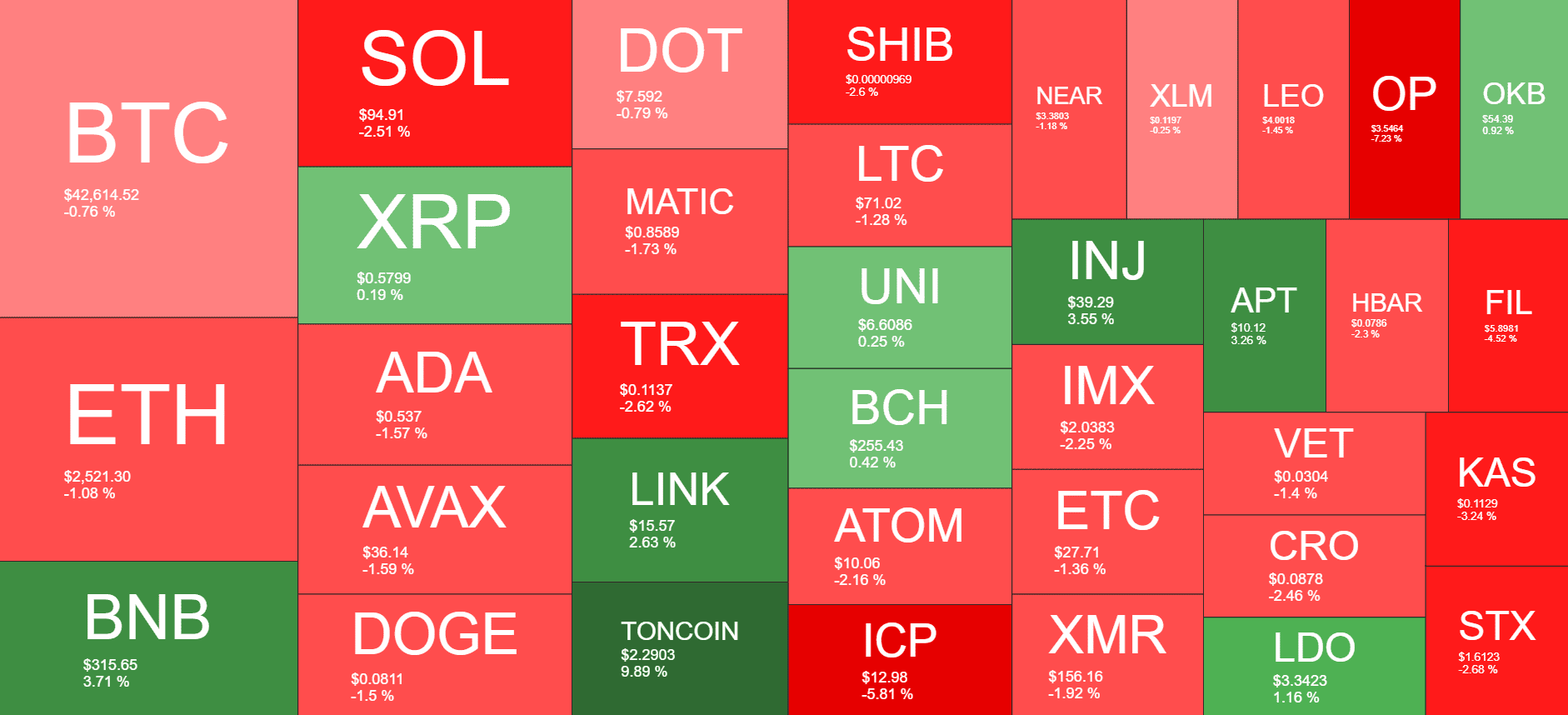

Most alternative coins have followed suit with minor losses, with SOL continuing to struggle below $100 and ETH declining further to just over $2,500.

BTC Slips Below $42K

The primary cryptocurrency faced massive volatility last week amid the developments on the ETF front. From a hack against the SEC to controversial statements from Gary Gensler and to finally approving and launching 11 such products on US markets, all eyes were on Bitcoin.

BTC saw its price skyrocket on Thursday – the day that the products went live – to over $49,000 for the first time in nearly two years. Hours later, though, the asset plummeted hard and lost over seven grand in just over a day, and you can check the possible reasons here.

After reaching the 2024 lows of under $41,600, BTC bounced off and calmed at around $43,000. It spent most of the weekend there aside from two brief price drops to under $42,000.

As of now, Bitcoin trades below $43,000, with its market cap struggling at $835 billion. Its dominance over the altcoins took a massive beating in the past week or so and is down under 50% on CMC.

TON Does Better

Most alternative coins have followed BTC on the way south with minor losses. Ethereum, Cardano, Avalanche, Dogecoin, and Polygon have all declined by around 1.5%. More losses come from the likes of SOL and TRX, with drops of 2.5% each. As a result, SOL struggles at $95, while TRX is down to $0.11.

In contrast, Binance Coin and Chainlink have gained around 4% overnight. Consequently, BNB trades above $315, while LINK is north of $15.

Toncoin has gained the most from the larger-cap alts. TON is up by 10% and sits at $2.3. INJ and APT are also in the green.

The total crypto market cap has seen about $10 billion gone since yesterday and is down to $1.680 trillion on CMC.

Read the full article here