Bitcoin’s performance after the BTC ETF approval last week was a bummer. Most speculators anticipated a price surge above $50,000 but all they got was a sharp dip below $42,000. Although the largest crypto had climbed to $42,563 during US business hours on Wednesday, market doldrums are still in full force. For some investors, turning to the best altcoins like Ethereum (ETH), Celestia (TIA), and SUI could fuel optimism, and bolster gains in Q1.

Ethereum Tops Best Altcoins To Buy As Duncan Upgrade Goes Live

Ethereum posted a commendable rally after the BTC ETF green light, rising to touch $2,700. It is believed investors turned to the largest smart contracts token amid expectations of an ETF in the next few months.

Albeit the impressive rally, Ethereum price retreated sliding below $2,500 to $2,465 before nurturing a brief uptick to $2,600 on Tuesday. Trading at $2,540 at the time of writing, Ether oscillates within the confines of a descending channel, sending signals of a potential bull flag breakout.

A bearish technical structure as established by the current neural Relative Strength Index (RSI) of 50, might compel sellers to increase activity aiming for a sweep through liquidity at $2,502. This region references confluence support created by the channel’s middle boundary and the 50 Exponential Moving Average (EMA) (in red).

A larger breakout is anticipated due to the formation of a bull flag pattern on the four-hour chart. However, ETH could remain suppressed by the overhead pressure until the price rises above the flag’s resistance.

Traders would be interested in entering long positions in ETH slightly above the breakout point. Such a move would be accompanied by a sharp increase in trading volume to back the highly probable move to $2,700.

The launch of the Ethereum Dencun upgrade on the Goerli testnet could keep ETH price buoyant. However, its impact might be overshadowed by the general market doldrums considering the upgrade failed to be completed within the expected time, Chinese crypto reporter Wu Blockchain said via X.

The Ethereum Dencun upgrade was launched on the Goerli testnet on Wednesday, but failed to be completed within the expected time. According to developer @parithosh_j, the validators came back online and the chain started finalizing again, a healthy number of blobs have submitted…

— Wu Blockchain (@WuBlockchain) January 17, 2024

On the bright side, QCP Capital outlined that Ethereum has the potential “to continue outperforming BTC over the medium-term as the narrative rotates to potential ETH Spot ETF approvals.”

QCP Capital expects ETH to continue outperforming BTC over the medium term as the narrative rotates to potential ETH Spot ETF approvals. Since the BTC spot ETF launch, BTC forwards have also fallen more than ETH forwards. BTC 1-month forward fell from a high of 32 % ann. to a low…

— Wu Blockchain (@WuBlockchain) January 17, 2024

Recommended: Ethereum Dencun Upgrade Unleashes ‘Proto-Danksharding’ On Goerli Testnet

Buying The Dip In Celestia (TIA), Here’s What You Should Know

The path of least resistance for Celestia is downward based on short-term price analysis, as seen on the four-hour chart. TIA’s uptrend lost momentum under $20, significantly increasing the risk for trend reversal.

Declines are bound to continue in the American session with TIA holding below the 20 EMA (blue) and struggling to hang onto support provided by the ascending trendline.

TIA price chart | Tradingview

The RSI’s neutral position below the midline at 47 is a sign that the bulls need a reality check. With the dip towards the oversold region, overhead pressure will push Celestia further down.

There’s a possibility of a bounce back from the 50 EMA (red) at $17.5 but the Fibonacci retracement level suggests that TIA could fall to the 0.618 ratio around $13.8 before considering another uptick.

If accepted above the rising trendline and the 20 EMA, an immediate rebound could ensue, building investor confidence to act as a springboard above $20.

Sui Price Back In The Green, How High Can It Go?

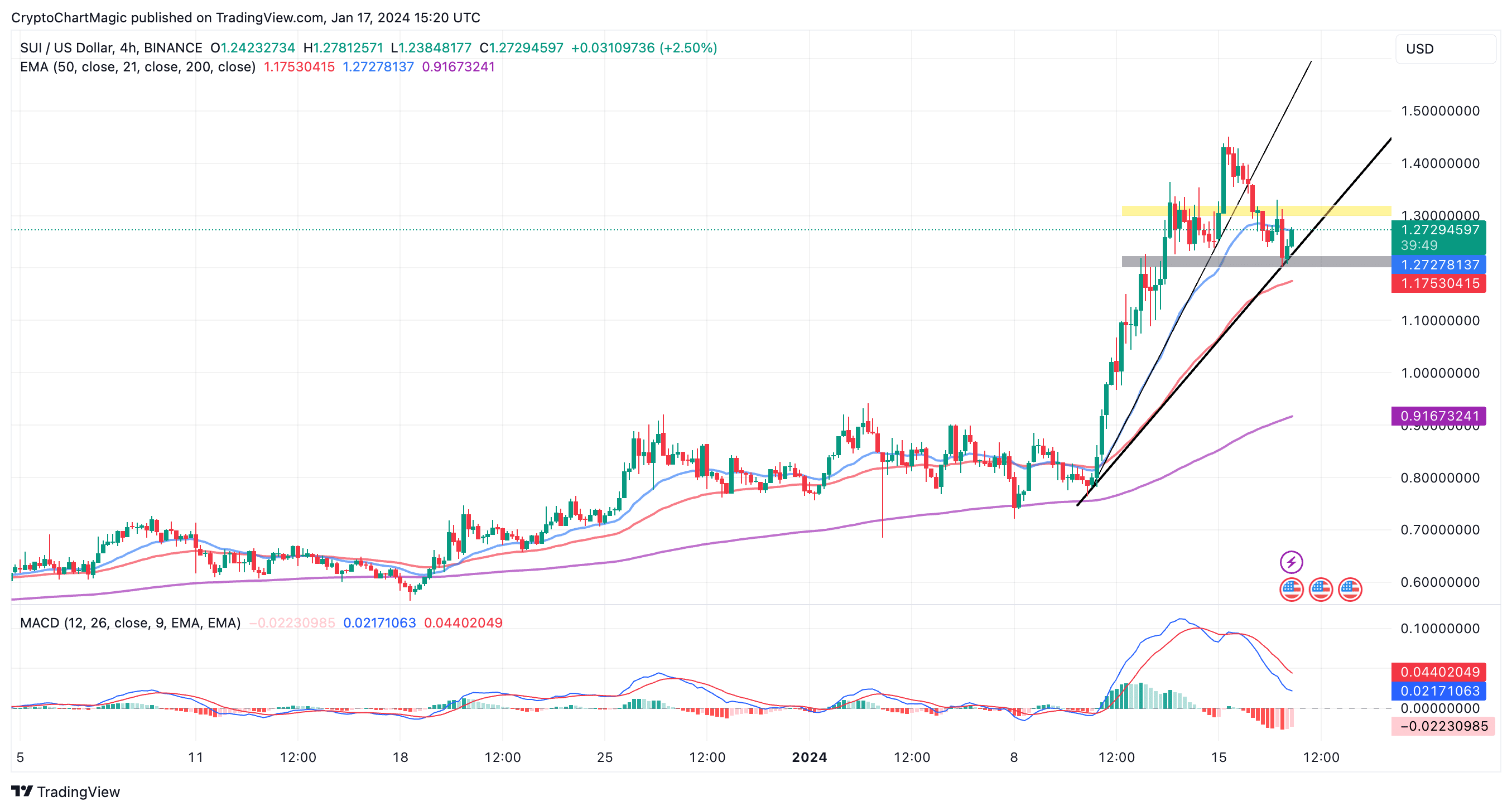

Sui price is seeing a modest 0.25% increase on Wednesday following a clear bounce back from higher support at $1.2. The token powering one of the trailblazing layer 1 blockchains, known for supporting the ownership of digital assets in a fast, private, and secure environment, is about to face intensifying resistance at the 20 EMA, $1.3 and $1.4.

Although in the neutral zone (below the midline), the RSI shows signs of regaining strength and supporting the building momentum behind SUI.

However, bulls must look beyond the sell signal from the Moving Average Convergence Divergence (MACD) indicator and refrain from closing long positions or shorting the token.

SUI price chart | Tradingview

A successful retest of the 20 EMA and the subsequent seller congestion at $1.3 would make Sui more attractive and increase investor risk appetite. Further movement above $1.4 could trigger FOMO and blast SUI to an all-time high of $1.72.

Related Articles

- Crypto Price Prediction For January 17: LINK, CHZ, RNDR

- Sei Network Price Prediction As Holders Buckle Up For Rocket Ride Breakout Past $1

- Chainlink Price Prediction for 2024: Will Current Recovery Cycle Surpass $30?

Read the full article here