Along with Bitcoin, the altcoin market is also playing a major catch-up with a strong 2.6% rally in the broader crypto markets. Avalanche, in particular, has emerged to be today’s star performer! The Avalanche (AVAX) price has shot up by 10% in the last 24 hours and is currently trading at $39.28 with a market cap of $14.43 billion. Interestingly, the AVAX trading volume has also shot up by 82% in the last 24 hours.

Avalanche (AVAX) Topple Dogecoin

Amid the current price rally, Avalanche (AVAX) has unseated Dogecoin for the ninth spot. The altcoin has registered a strong rally during the fourth quarter of 2023 making its place in the top ten crypto list.

The daily AVAX/USD chart suggests a potential breakout scenario. At press time, the bulls are already challenging the $39 resistance level, and a successful breakout could possibly propel AVAX to $43.85. Conversely, a rejection could lead to a pullback towards the next support zone at $33.85.

At present, the Relative Strength Index (RSI) sits at 54.42, indicating a resurgence in buying momentum. Further bolstering this outlook is the Awesome Oscillator (AO), which has been signaling increasing upward momentum for AVAX since rising from negative levels. Additionally, the Directional Movement Index (DMI) reinforces the bullish sentiment by showing greater buyer aggression compared to sellers in the market.

AVAX Price Eyes $50

The Average Directional Index (ADX) for AVAX currently stands at a relatively weak 13.49. However, a rise above 25, coupled with the positive Directional Movement Indicator (+DMI) leading the negative Directional Movement Indicator (-DMI), could signal AVAX’s potential trajectory toward $40.

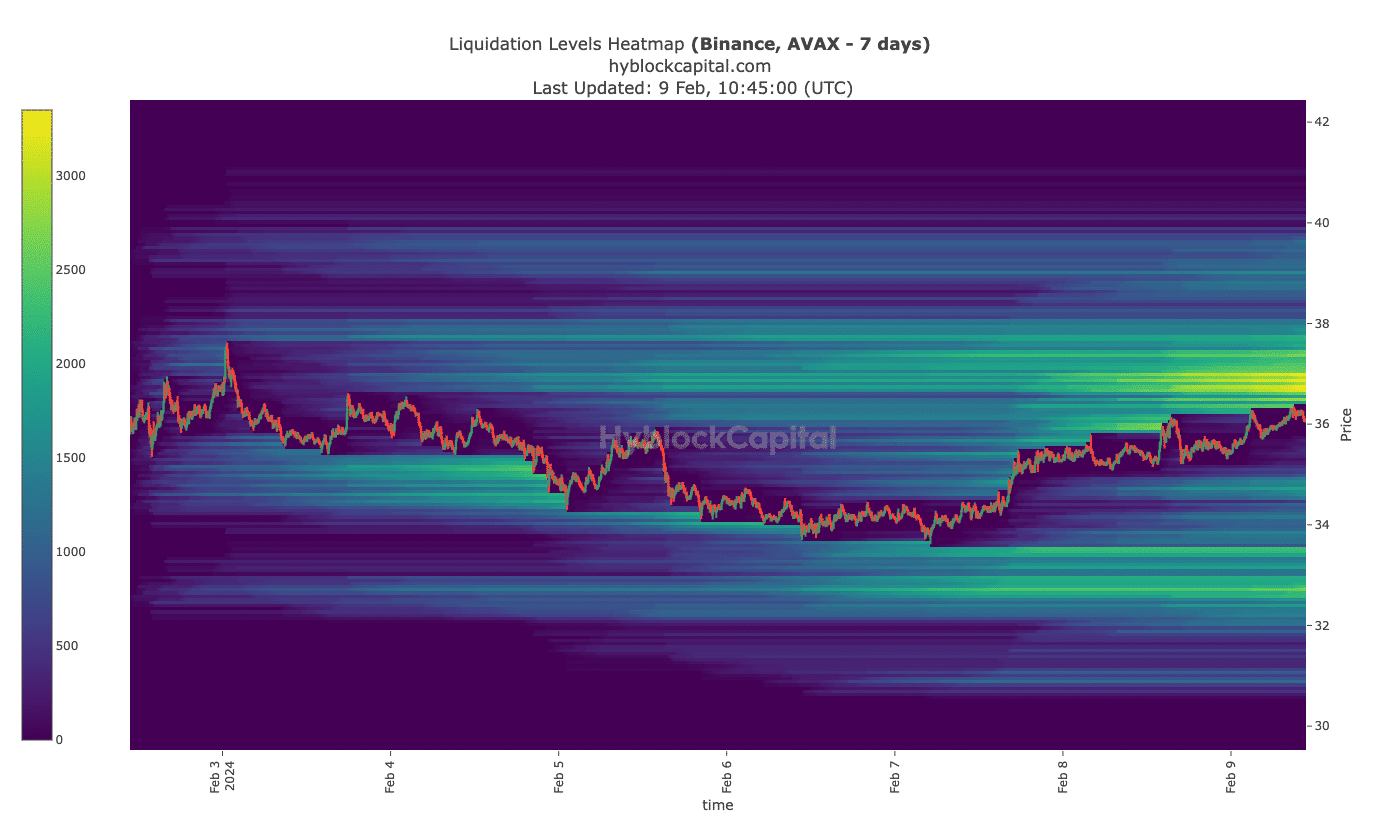

Despite this optimistic outlook, potential obstacles lie ahead as indicated by the Liquidation Heat Map, which forecasts significant liquidations around the $37 mark. Investors employing high leverage and maintaining low-margin balances are particularly susceptible to increased risk, especially if Avalanche (AVAX) surpasses the $38 threshold.

Market volatility remains a key factor to monitor, with fluctuations in volume potentially indicating forthcoming price movements. A decrease in volume may trigger a pullback, while an uptick could propel AVAX toward the $50 level.

Encouragingly, on-chain data reveals a positive Funding Rate for Avalanche (AVAX), suggesting that long positions are paying a funding fee to short positions. This bullish signal adds to the potential for sustained price appreciation in the AVAX market.

Read the full article here