Arbitrum price prediction: ARB, a Layer 2 scaling solution for Ethereum, has experienced a noteworthy uptick in its growth throughout 2023. Recently, its native token ARB has observed a bullish trend, surging by over 68% in the past month alone. This upward trajectory suggests a positive outlook for the future despite some recent bearish movements.

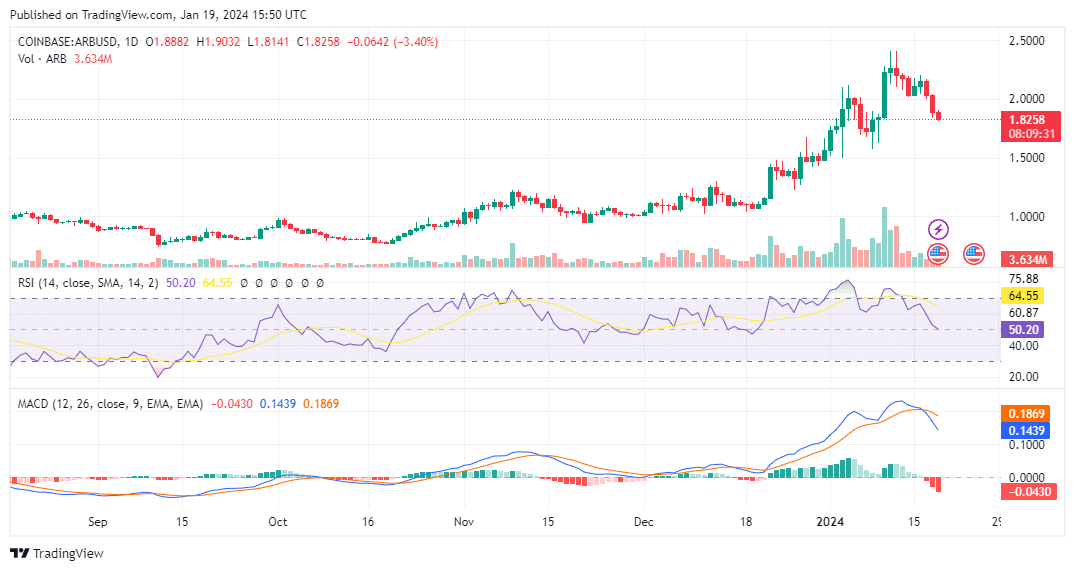

In the last 24 hours, there has been a slight downward trend in ARB’s performance. It is currently trading at $1.87, marking a 3% decline. This recent dip contributes to a weekly drop of more than 20%. The token has fluctuated within a price bracket of $1.80 to $2, showcasing its volatility.

Arbitrum price chart: Tradingview

This Ethereum-based platform has made significant strides in the crypto market. As of now, it holds the 38th position on CoinMarketCap. Its impressive market cap stands at $2.3 billion, a testament to its growing prominence. This is further bolstered by a substantial circulating supply, which exceeds 1.23 billion units.

Arbitrum Token Experiences Market Fluctuations Amidst Growth Surge

Arbitrum has been in the spotlight recently, garnering attention from notable cryptocurrency analysts. Crypto Tonny, a prominent figure in the field, has shared his optimistic forecast for this Ethereum Layer 2 solution. He anticipates a significant increase in ARB’s value soon. This comes after the token recently reached a high of $1.74, an encouraging sign for investors and enthusiasts alike.

According to Crypto Tonny, the key for ARB is to maintain its momentum above the $1.74 mark. This level is seen as crucial for sustaining the bullish trend. His analysis suggests that holding above this threshold could be a turning point for ARB, potentially leading to further gains. Investors are closely monitoring this situation, as the token’s performance at this juncture could set the tone for its short-term trajectory.

$ARB / $USD – Update

$1.74 is the level bulls need to hold this pic.twitter.com/MeTwJWipY4

— Crypto Tony (@CryptoTony__) January 18, 2024

If the bullish sentiment manages to sustain above the $1.74 threshold, the next hurdle for ARB could be at the $1.90 mark. Should the positive momentum persist, it’s conceivable for the token to confront a robust resistance at the $2.00 level. This scenario might pave the way for a significant bullish breakout in the near term.

Conversely, if the bearish forces gain the upper hand, pushing ARB below its current support, the next cushion might be found at $1.50. A further decline could potentially drive the price down to the $1.00 mark. Such movements could exert considerable bearish pressure on the token’s short-term market dynamics.

Key Technical Indicators for ARB Amidst Market Volatility

The daily technical analysis of ARB/USD reveals a diminishing momentum in the bearish zone, as indicated by the Moving Average Convergence Divergence (MACD) on the four-hour chart. Currently, both the MACD and its signal line are positioned below the zero level. This underlines the prevailing downward trend. Additionally, the 50 Exponential Moving Average (EMA), with its current slope at $1.61, offers a layer of support, potentially aiding buyers in a price pullback.

Arbitrum prie chart: Tradingview

The 24-hour Relative Strength Index (RSI) for ARB is currently hovering just near the midpoint of 50, indicating a neutral stance. This positioning of the RSI suggests a potential shift towards oversold conditions if the downward pressure continues. Conversely, a resurgence of bullish activity could propel the RSI beyond the 70 threshold, potentially leading it into overbought territory.

Related Articles

- Samson Mow Sees Ethereum As ‘Stupid Man’s’ Bitcoin & XRP A ‘Tricky One’

- Ethereum Accumulations Soar As ETH Price Slips Below $2,500

- Grayscale CEO Challenges Bitcoin ETF Rivals, Lauds 1.5% Fee Amid SEC Approvals

Read the full article here