Cryptocurrencies moderately rebounded this week but bulls are not in the clear yet. For instance, although Terra Classic (LUNC) climbed slightly above $0.0001 from support at $0.00009, it had corrected to $0.000095 during US business hours on Wednesday.

Further losses seem to hovering across the market amid expected doldrums before an anticipated pre-halving rally.

Halving is an event that triggers a special Bitcoin code every four years slashing miner rewards. The impact of this is a significant reduction in the supply of BTC.

Historically, BTC price has rallied exponentially following the halving backed by a spike in the demand for the coin. This has often positively impacted other crypto to buy tokens like LUNC.

1. Terra Classic (LUNC) Bottom

Terra Classic is fast approaching an area where it bottomed following the massive sell-off in 2022. This support at $0.000054 was successfully tested in October 2023, allowing bulls to take the reins and push for a sharp rebound to $0.00028 in December.

According to the Fibonacci levels, LUNC has already corrected more than the expected retracement to a ratio of 0.618 from the previous peak.

If this decline continues, Terra Classic might explore under the rising trendline on the daily chart — a move that could lead to another sweep of liquidity at $0.000054.

LUNC price chart | Tradingview

Although the chart might look dilapidated for buying the dip, trading near the bottom price implies that a rebound will take place sooner or later. Besides, the Relative Strength Index (RSI) although not oversold, is gradually closing in on 30. A dash into the oversold region would be the bullish signal investors would need to buy the dip.

More to read: 3 Best Crypto To Buy Today January 31: XRP, Solana (SOL), Shiba Inu (SHIB)

2. The Terra Classic Community

Despite the negative publicity Terra Classic and other ecosystem tokens like the TerraClassicUSD faced following the Terra Luna crash saga, the community never backed out of supporting the project.

The Terra Classic community was the main force behind the commendable rally in Q4. With such backing, LUNC has the potential to hit highs above $1 as it strives to regain its former glory.

3. Binance Token Burn Program

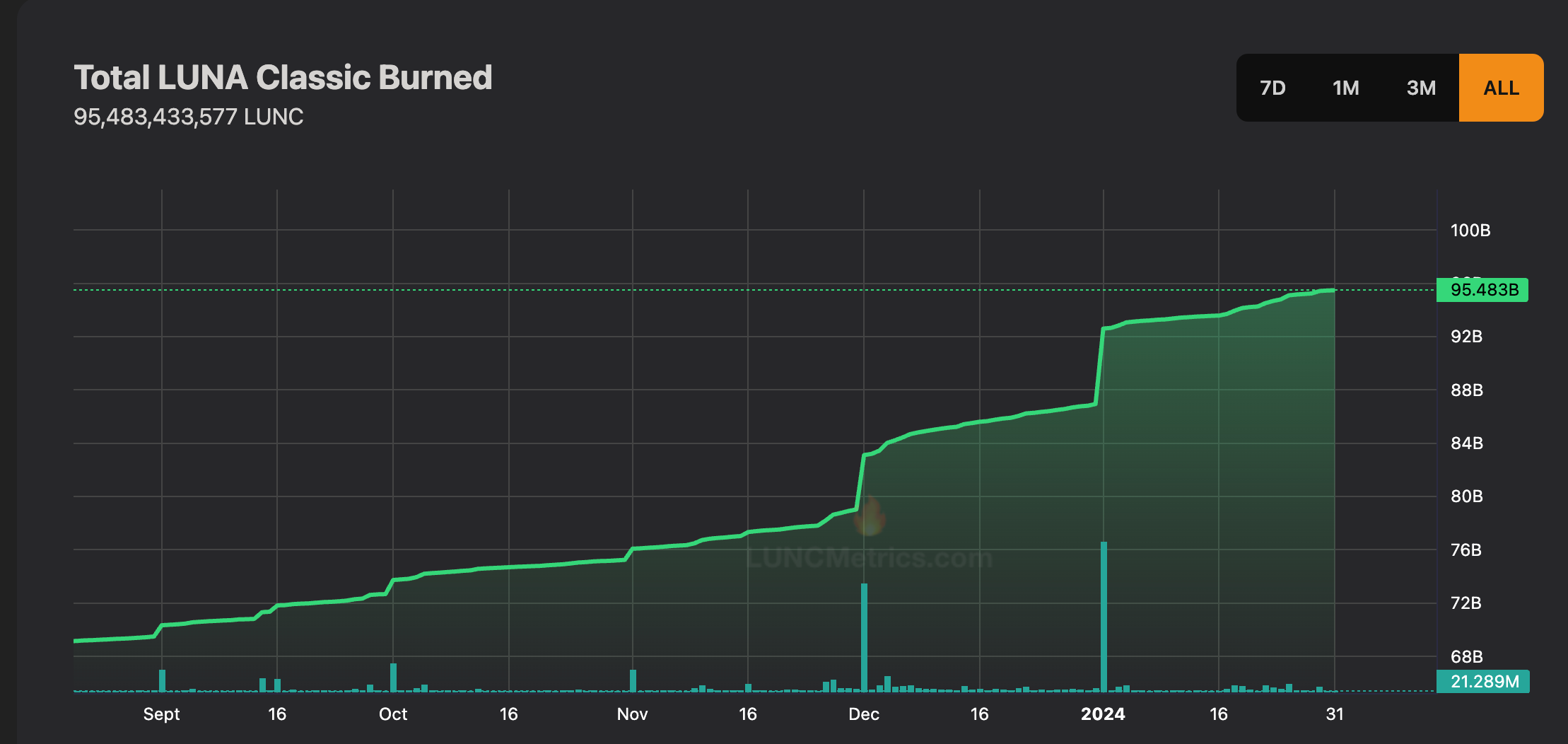

The Terra Classic community has commutatively burned 95 billion LUNC tokens since May 2022. Reducing the project supply has become a priority likely to boost its standing and performance in the market.

Binance, the largest cryptocurrency exchange by trading volume contributes immensely to the LUNC token burn program. So far, the exchange has removed from supply, 49.1 billion tokens, approximately 51.7% of the total burn, CoinGape reported.

Terra Classic burn rate chart

With the next burn round upcoming on February 1, the community anticipates a total of more than 100 billion LUNC to have been sent to a nonrecoverable wallet.

Bottom line, the Terra Classic project must purpose to increase network development and enhance LUNC’s utility to increase the burn rate as it seeks to significantly trim the supply currently at 6.81 trillion according to CoinMarketCap.

Related Articles

- Ethereum Price Prediction: Is $ETH Recovery Heading to $3000 in February?

- XRP Price Eyes Lift Off TO $2.2 In Feb As Bulls Navigate Market Volatility

- Shiba Inu Price Prediction: Is SHIB Ready To Reclaim $0.00001 Value In Feb?

Read the full article here