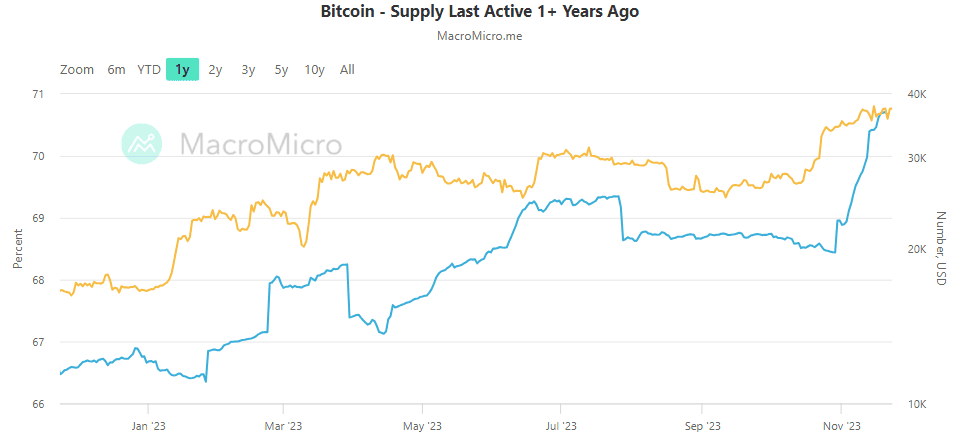

On Nov. 22, 2023, the share of the circulating supply of Bitcoin that was active more than a year ago exceeded 70%.

According to analytics firm Glassnode, the share of Bitcoin’s circulating supply that was active more than a year ago has reached 70.3%, a new milestone for the original cryptocurrency.

The data from MacroMicro follows the general trend, albeit with a different figure – indicating a 70.71% of circulating supply of Bitcoin active more than a year ago. Moreover, judging by the portal data, the ATH was set on November 20, 2023.

Starting in July 2023, the hodlers trend and the Bitcoin price curve have moved along the same trajectory. The overall picture resembles the beginning of Q3 2020.

However, despite the growth of hodlers, crypto parlance for someone who holds onto their crypto without executing short-term profits, there is no obvious outflow of BTC from crypto exchanges. Moreover, starting from the end of October 2023, the volume of reserves continues to grow, according to CryptoQuant.

Previously, a Glassnode report showed that although the volume of BTC supply in profit has hit levels last seen in 2021, it is still ‘far insufficient to motivate long-term holders.’ Analysts say that the cryptocurrency so far does not have enough momentum to motivate long-term holders to unload their bags.

Read the full article here