Crypto analyst Ali Martinez has provided some insights into why the Bitcoin, Ethereum, and Dogecoin prices are crashing. The crypto market has been on a decline these past few days after starting the year on a high.

Why The Bitcoin, Ethereum, And Dogecoin Prices Are Crashing

In an X post, Martinez revealed why the Bitcoin, Ethereum, and Dogecoin prices are crashing. He stated that capital inflows into the crypto market have declined over the past month, dropping from $134 billion to $58 billion. The crypto analyst added that this points to a significant reduction in investment activity.

Simply, there has been a lack of liquidity in the crypto market, which has caused the Bitcoin, Ethereum, and Dogecoin prices to crash. Bitcoin has led this downtrend, dropping to as low as $92,000 following its price recovery above $100,000 at the start of the year. Given their strong price correlation with the flagship crypto, Ethereum and Dogecoin have followed suit and suffered a similar downtrend.

The lack of inflows into the crypto market is likely due to the bearish sentiment among investors sparked by developments on the macro side. The recent strong US job data dampened hopes of an imminent Fed rate cut. Instead, traders now predict that there will only be one rate cut this year, likely in October.

This presents a bearish outlook for the Bitcoin, Ethereum, and Dogecoin prices because investors are less likely to invest in these risk assets in the absence of such quantitative easing policies.

Rate cuts usually lead to a surge in liquidity, which gives investors the confidence to invest in risk assets like cryptocurrencies. For context, there were three Fed rate cuts last year, which provided a huge boost for the crypto market as Bitcoin rallied above $100,000 for the first time in its history.

Other Onchain Metrics Also Highlight Bearish Sentiment

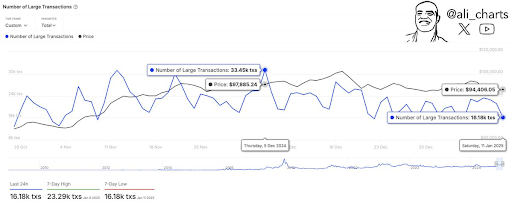

There are other on-chain metrics that highlight the bearish sentiment in the crypto market and explain why Bitcoin, Ethereum, and Dogecoin prices have crashed. In another X post, Martinez revealed that the number of large transactions on the BTC network has decreased by 51.64% over the past month, dropping from 33,450 to 16,180. The crypto analyst added that this could indicate a significant reduction in Whale activity.

A reduction in Whale activity is bearish for Bitcoin, considering how this category of investors puts the flagship crypto in price discovery when they accumulate. As such, BTC is bound to crash, with these Whales choosing to stay on the sidelines until the market conditions improve.

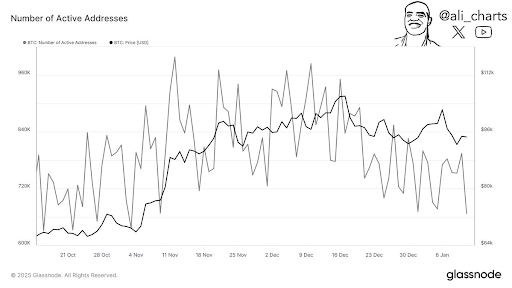

Meanwhile, Martinez revealed that Bitcoin’s network activity has fallen to its lowest level since November, with just 667,100 active addresses. This again highlights the current bearish sentiment among investors.

Featured image created with Dall.E, chart from Tradingview.com

Read the full article here