Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. By using this website, you agree to our terms and conditions. We may utilise affiliate links within our content, and receive commission.

Dunamu, the South Korean operator of the Upbit crypto exchange, has seen year-on-year profits fall by a staggering 82% in the third quarter of FY2023.

The South Korean media outlet Business Post reported that Dunamu published its financial report for the third quarter of 2023 on November 28. The report’s highlights included the following:

- Dunamu posted just under $149.5 million in sales in Q3

- The operator’s operating profits were $78.8 million

- The firm’s (consolidated) net profits were $22.8 million

- Compared to Q3 of FY2022, these numbers represent a 29% drop in sales, a 39.6% fall in operating profits, and a net profit decline of 81.6%.

What Has Caused Dunamu/Upbit’s Drop in Profits?

Dunamu claimed that its economic performance had declined due to a rise in interest rates.

It also blamed the economic recession and falling cryptoasset prices. A Dunamu spokesperson said:

“We will strive to revitalize the blockchain ecosystem and create an advanced investment environment. We will do our utmost to provide innovative services based on Dunamu’s unique technological capabilities.”

The numbers make grim reading for a company that was – until recently – being talked up as the first South Korean crypto firm to attain official “conglomerate-size” status.

At the height of the last crypto bull market, South Korean financial experts claimed that Dunamu was preparing to float on the New York Stock Exchange.

🇰🇷 South Korean Traders Drive Recent Crypto Surge as Exchanges’ Market Share Jumps to 13%

Traders in Asia, especially in South Korea, have emerged as key drivers behind the recent rally in the crypto market over the past two months.#CryptoNews #Koreahttps://t.co/4LTjDCiruy

— Cryptonews.com (@cryptonews) November 16, 2023

These rumors have cooled since the dawn of a prolonged crypto winter that has seen transaction volumes drop on Upbit.

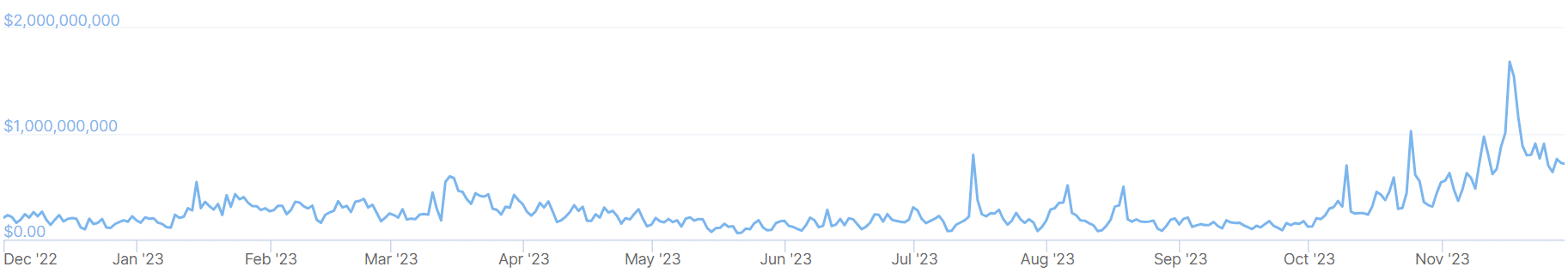

Trading volumes on the Upbit crypto exchange over the past 12 months. (Source: CoinGecko)

The exchange’s closest rival, Bithumb, has set its sights on a domestic IPO bid, despite a similar decline in profitability.

Trading volumes on the Bithumb crypto exchange over the past year. (Source: CoinGecko)

Upbit has cornered some 80% of the domestic market in recent years, thanks in no small part to its successful partnership with the neobank K Bank.

Read the full article here