The Asian crypto exchange Bitrue has just completed the listing of two well-known cryptographic products managed and issued by Tether Operations Limited, namely Tether Gold (XAU₮) and Euro Tether (EUR₮).

The two cryptocurrencies offer investors a secure and cost-effective solution to have exposure respectively to the gold commodity and the fiat currency euro, while remaining within the boundaries of the Ethereum blockchain.

Both are backed on a 1:1 basis by assets that serve as collateral: in the case of Tether Gold, physical gold stored in a Swiss vault, while in the case of Euro Tether, the collateral is expressed in US Treasury bonds, cash reserves, and Bitcoin.

The listing on Bitrue increases their notoriety in the crypto world and helps meet the changing needs of the exchange’s customers.

Bitrue exchange: cryptocurrencies Tether Gold (XAU₮) and Euro Tether (EUR₮) launched

Bitrue, a cryptocurrency exchange based in Singapore, has just announced the listing of the coins Tether Gold (XAU₮) and Euro Tether (EUR₮), both controlled by the issuer Tether Operations Limited, which is the same company that manages USDT.

The two cryptocurrencies represent physical gold and the euro in the form of cryptographic currencies, more precisely stablecoins backed by a 1:1 equivalent with the respective asset.

For each Tether Gold (XAU₮) minted by Tether on the Ethereum blockchain, the company sets aside a physical gold bar, just as for each Euro Tether (EUR₮) the equivalent of 1 euro is set aside.

Bitrue was founded in 2018 and immediately achieved a prestigious position in the world of cryptocurrency exchanges, especially when it comes to trading XRP. The platform, committed to offering a diversified investment option, offers a wide range of services to its clients, including spot trading, futures, OTC, staking, auto-invest, and copy trading on over 700 available cryptocurrencies.

The listing of XAU₮ and EUR₮ further strengthens the presence of cryptographic products offered within the Bitrue infrastructure, in response to the growing demand from its customers, and at the same time contributes to the growth and dissemination of Tether technology.

Exchange users can now take advantage of two stablecoins backed by real-world assets, with all the benefits associated with the field of decentralized finance such as seamless operability, cost-effectiveness of operations, and increased privacy.

Tether, on the other hand, consolidates its position as a leader in the field of cryptographic stablecoins, with an extremely solid financial position consolidated by the latest quarterly data from the company, which revealed a net profit of 2.85 billion in Q4 2023.

In relation to the news of Tether Gold and Euro Tether, the Director of Partnerships and BD at Bitrue, Anchit Goel, stated that:

“As the main CEX, Bitrue is committed to providing our users with access to a wide range of digital assets and innovative features. The inclusion of EUR₮ and XAU₮ reaffirms this commitment. We are pleased to collaborate with Tether and offer these stablecoin options to our global users”

Some data about XAU₮ and EUR₮ coins

The listing of Tether Gold (XAU₮) and Euro Tether (EUR₮) on Bitrue contributes to accelerating the growth and adoption of these two cryptographic products, offering users of the exchange the possibility to use two stablecoins covered by real assets.

In particular, Tether Gold provides 1:1 ownership of a troy ounce of gold on a physical gold bar that meets the Good Delivery standard of the London Bullion Market Association (LBMA), with the collateral being held in a Swiss vault.

This technology allows for easy exposure to gold while avoiding the inconveniences associated with physical gold, such as high storage costs and limited accessibility.

XAU₮, which as a cryptocurrency can be fractionated up to six decimal places, has a circulating supply of 246,524 tokens with a market capitalization of 499 million dollars.

Until November 2021, the resource’s market capitalization was practically zero, then suddenly increased to about 200 million dollars thanks to a strategic investment by Tether, and later added another 450 million dollars in April 2022.

The more this currency spreads within decentralized business squares, the more likely its capitalization will grow as the minting of new tokens becomes necessary to meet market demand.

Euro Tether (EUR₮) is a stablecoin that reflects the value of the euro on a 1:1 basis, collateralized by US Treasury securities, cash reserves, short-term bonds, precious metals, Bitcoin, and secured loans.

The same reserves are also used to cover the issuance of all USDT tokens, the main stablecoin in the crypto market pegged to the US dollar.

EUR₮ provides individuals and organizations with a robust and decentralized method to exchange value based on a currency like the euro, thus meeting the needs of Tether’s customers in Europe.

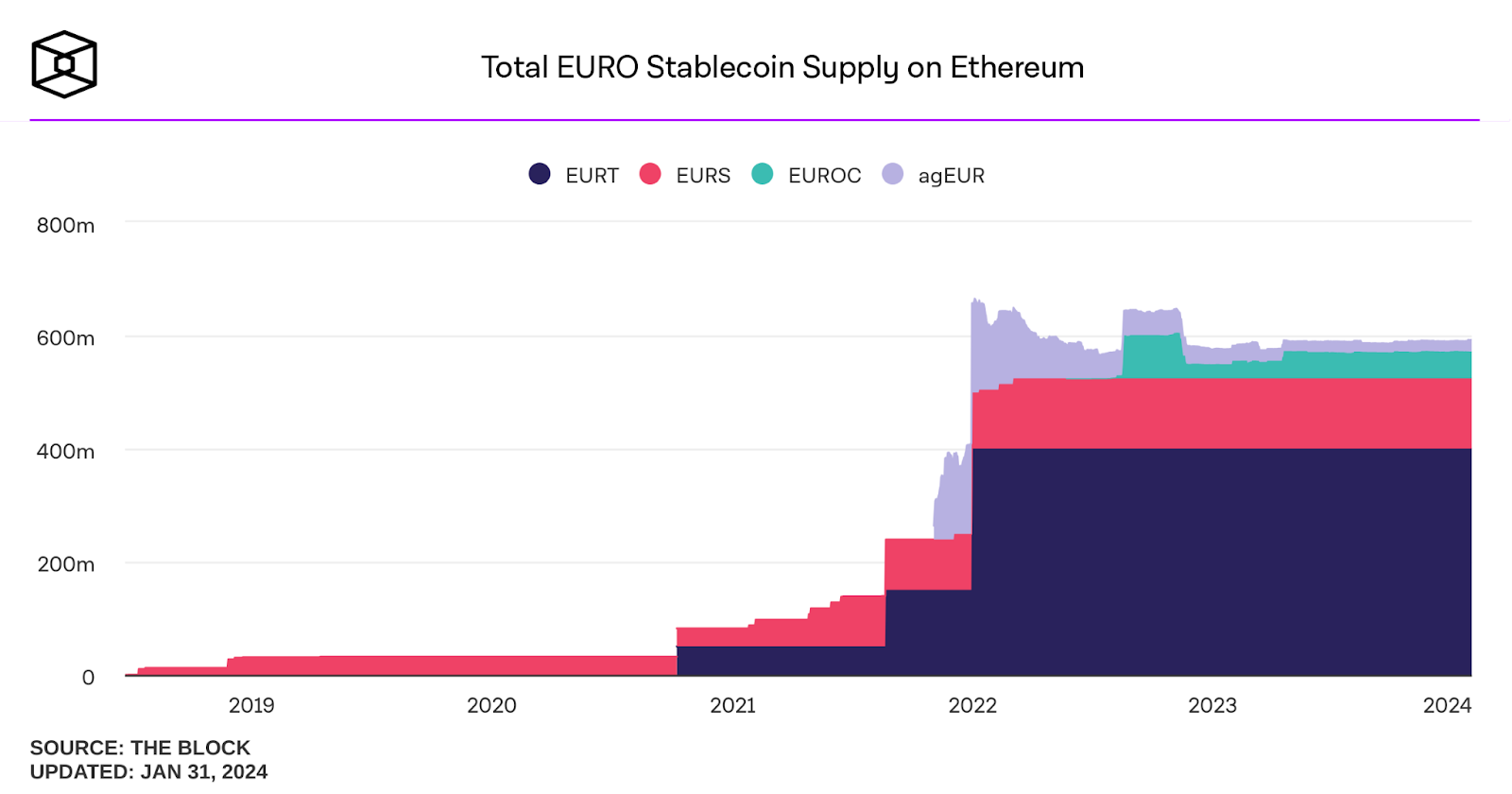

This represents the largest euro-peg stablecoin with a market share exceeding 60% and a market capitalization of 400 million euros.

Completing the offer are the resources EURS, EUROC, and agEUR, which together cover the remaining 192 million euros of capitalization.

Euro Tether (EUR₮) was born in October 2020 with an initial injection of 50 million euros from Tether, and then reinforced in August 2021 with an additional 100 million euros and in January 2022 with another 250 million euros.

In the last 2 years, the presence of this token on cryptocurrency exchanges has remained unchanged, while other stablecoins have started to spread, gaining a small market share without endangering the currency managed by Tether.

Read the full article here