Uber Technologies, Inc. (UBER), the global leader in the ridesharing industry, faces a new threat as Tesla (TSLA) readies its robotaxi launch. The EV giant is eyeing market share in the booming ridesharing market. With that said, I believe that Uber is well-positioned to grow sustainably despite robotaxi competition. Uber itself has been embracing autonomous driving to offer competing services at a much larger scale compared to Tesla. However, I am ultimately neutral on Uber stock at the current price, and I believe the company’s current valuation accurately reflects the expected growth of the company.

Tesla Is a Long Way Behind Uber

I believe that stellar growth expectations for Uber are justified, and that Tesla has a lot of catching-up to do before posing a meaningful threat to Uber’s well-established business. Tesla, the largest EV maker in the United States, aims to commercialize robotaxis and enter the ridesharing industry. Revealing the company’s plans during the first-quarter earnings call last April, CEO Elon Musk claimed that Tesla will emerge similar to a combination of Airbnb, Inc. (ABNB) and Uber in the long run. Musk signaled that Tesla plans to allow Tesla owners to rent their vehicles to be used as robotaxis. However, during the highly anticipated robotaxi launch event last week, Tesla did not provide any information regarding the production details for robotaxis, leaving many to suspect that mass production is years away.

Tesla’s robotaxi launch event did not impress many Wall Street analysts either. Commenting on Tesla’s aspirations to threaten Uber, Jefferies analyst John Colantuoni said that the EV maker is yet to disclose verifiable evidence of progress toward Level 3 autonomous driving. That suggests the company is still a long way away from commercializing the technology. In addition, the Jefferies analyst noted that Tesla will struggle to build a meaningful fleet of autonomous vehicles to threaten Uber due to major challenges related to technological developments, asset ownership, fleet management, pricing, and routing. Uber, with expertise in all these areas, is well-positioned to bring autonomous taxis faster to market through strategic partnerships with other automakers and AV platforms.

Uber has already secured several high-profile partnerships in pursuit of AVs. These partnerships include a deal with Waymo to offer autonomous ridesharing in Austin and Atlanta by early 2025, a partnership with General Motors Company (GM) to launch autonomous taxis with the use of Cruise driverless rides, and an investment in Wayve to gain access to Embodied AI technology which is used in developing AVs. Furthermore, a new deal with BYD Company Limited (BYDDF) should expand Uber’s electric vehicle fleet by 100,000 units and offer autonomous rides. Aided by these strategic partnerships and investments, I believe that Uber is likely to offer autonomous ridesharing services at scale before Tesla even begins to enter the market.

Uber Will Likely Be a Big Winner in Autonomous Vehicle Growth

In addition to Uber’s head start in autonomous driving efforts, I am encouraged by the company’s unique positioning in the ridesharing market. That combination should help it emerge as a big winner in the expected growth of autonomous vehicles, despite the fact that I don’t see much share price upside.

Uber’s massive scale makes it the ideal platform for autonomous vehicle makers to partner with and offer driverless taxi services. During the Q2 earnings release, Uber demonstrated how its platform can efficiently match AV fleets with riders who are interested in driverless taxis, enabling automakers to utilize their AV fleets to achieve the best possible unit economics. Uber also highlighted how partnering with an established ridesharing platform should reduce the operating costs of an AV maker, by allowing the automaker to focus solely on advancing their AV technology. Meanwhile, Uber’s platform for monetization is already established.

Uber should benefit from improved operating efficiency as it embraces autonomous vehicles. By eliminating the need for human drivers in approved markets, Uber may offer rides at a substantially discounted price in the future, attracting more users to the platform. The company may also use AVs for food, grocery, and parcel delivery services, leading to a meaningful expansion in profit margins by eliminating the costs associated with drivers.

Uber Enjoys a Long Growth Runway

The favorable macroeconomic environment enjoyed by Uber is another reason behind my expectations for robust long-term earnings growth, despite my neutral stock rating. According to Fortune Business Insights, the global ridesharing market will likely grow at a stellar CAGR of 18.5% through 2032, reaching a value of $480 billion. The continued rise of smartphone usage in developing regions, environmental concerns, and urbanization that has led to overcrowded roads, are among the main growth drivers of this industry. Uber, as the largest player in this sector with a diversified product offering, is well-positioned to convert these positive industry trends into tangible financial results.

Uber’s strategic decision to offer localized ridesharing options such as motorbikes in Brazil and Southeast Asia should help the company solidify its market leadership in the long run.

In addition to expansion in the ridesharing market, Uber’s diversification into delivery services will also help the company grow. Uber Eats, the food delivery service, is now available in more than 45 countries, and the company is aggressively expanding its coverage by onboarding more restaurants.

Is Uber a Buy, According to Wall Street Analysts?

Wall Street analysts seem to agree that Uber will benefit from autonomous vehicle growth. Bank of America analyst Justin Post, after digesting Tesla’s robotaxi announcement last week, claimed that the rapid growth of AVs will increase the value of Uber’s network as AV companies try to monetize their technology. As noted earlier, Jefferies analyst John Colantuoni is also bullish on Uber despite the robotaxi threat.

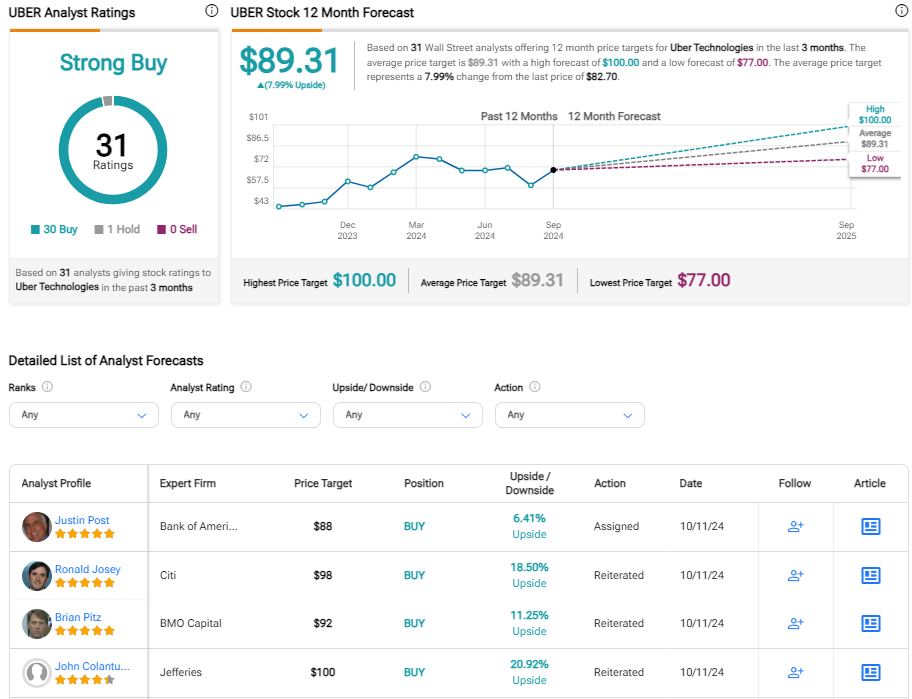

Based on Wall Street analysts who offer 30 Buy ratings and one Hold, TipRanks classifies UBER stock as a Strong Buy. Meanwhile, the average UBER price target of $89.31 points to potential upside of ~8% as compared to the current market price.

Although I have a positive outlook for Uber’s earnings growth, I believe the stock is fairly valued at a forward P/E of 38x. The limited upside potential implied by Wall Street analysts also suggests that Uber is appropriately valued already. Although there is the potential for a further expansion in earnings multiples, betting on such an outcome seems risky here.

Takeaway

Uber is a wonderful business, and offers defensible traits even in the wake of increased competition from EV giant Tesla. Although the EV maker has an ambitious plan to dominate the ridesharing industry, dethroning Uber will be easier said than done. Investors shouldn’t overlook the competitive advantages enjoyed by the Uber, and they don’t appear to be. While I believe that the company still has a long growth runway, UBER stock seems fairly valued at this point.

Disclosure.

Read the full article here