The COVID-19 pandemic made the world realize the importance of investing in healthcare infrastructure and developing treatments for unmet medical needs. The increased focus on healthcare and the defensive nature of the sector during economic challenges bodes well for healthcare and pharma stocks. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place Eli Lilly (LLY), Novartis (NVS), and Intuitive Surgical (ISRG) against each other to find the healthcare stock with a Strong Buy rating, according to analysts.

Eli Lilly (NYSE:LLY)

Shares of pharma giant Eli Lilly have rallied over 54% so far this year, thanks to the robust demand for the company’s Type 2 diabetes Mounjaro and weight loss medication Zepbound. The company impressed investors with its upbeat Q2 results and upgraded its full-year guidance to reflect continued strength in these two treatments.

It is worth noting Zepbound, which gained the U.S. FDA’s (Food and Drug Administration) approval in November 2023, generated $1.24 billion in sales in the second quarter of 2024. Also, Mounjaro’s sales jumped more than 215% to $3.09 billion.

Meanwhile, concerns over the shortage of these popular drugs are easing, as Eli Lilly has been investing heavily to boost its production. Looking ahead, management is optimistic about the prospects of its glucagon-like peptide-1 (GLP-1) offerings like Mounjaro and Zepbound and medicines across cancer, neurological disorders, and autoimmune diseases.

Is LLY a Good Stock to Buy Now?

Last week, the U.S. FDA removed Eli Lilly’s Mounjaro and Zepbound (both based on tirzepatide) from its shortage list. Following the news, BMO Capital analyst Evan Seigerman reaffirmed a Buy rating on LLY stock with a price target of $1,101. The analyst noted that this announcement implies that compounded tirzepatide cannot be produced in “regularly or in inordinate amounts,” by firms selling cheaper versions known as compounded drugs.

Overall, he believes that this news is another positive indication for Eli Lilly and reinforces the company’s ability to grow its incretin portfolio by ensuring adequate supply for the current and future demand for tirzepatide products.

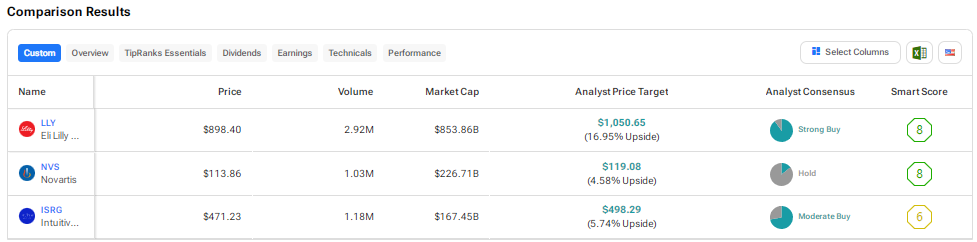

Eli Lilly stock scores a Strong Buy consensus rating based on 18 Buys versus two Hold recommendations. The average LLY stock price target of $1,050.65 implies about 17% upside potential from current levels.

See more LLY analyst ratings

Novartis (NYSE:NVS)

Novartis shares have risen about 13% so far this year, driven by strong operational performance and a solid product pipeline. The company announced better-than-expected results for the second quarter, with a 9.4% growth in net sales due to strength in the heart failure treatment Entresto, arthritis drug Cosentyx, and certain other drugs.

Moreover, the company raised its full-year FY24 profitability guidance. It expects core operating income growth in the mid-to-high teens, up from the previous outlook of low double-digit to mid-teens growth. With its focus on four core therapeutic areas – cardiovascular-renal-metabolic, immunology, neuroscience, and oncology, the company is confident about achieving its mid-term sales CAGR (compound annual growth rate) target of more than 5% at constant currency over the 2023-2028 period and deliver core operating income margin of over 40% by 2027.

Looking ahead, Novartis sees an over $20 billion market opportunity in its radioligand therapies (RLTs), which target cancerous cells.

Is Novartis a Good Stock to Buy?

Earlier this month, Bank of America analyst Graham Parry downgraded Novartis stock to Hold from Buy and lowered the price target to CHF110 from CHF 120 ($130 from $135) to reflect his cautious stance following the stock’s outperformance compared to the European pharma sector since early 2023.

NVS stock’s outperformance was driven by a series of positive Phase 3 catalysts, consecutive upbeat earnings, and guidance upgrades. However, the analyst moved to the sidelines due to a “quieter catalyst path” into the end of 2024 and the riskier Phase 3 readouts expected in 2025.

Overall, Wall Street has a Hold consensus rating on Novartis stock based on six Holds versus one Buy recommendation. The average NVS stock price target of $119.08 implies 4.6% upside from current levels.

See more NVS analyst ratings

Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical is the maker of the popular da Vinci surgical systems and is considered a pioneer in the robotic-assisted surgery space. ISRG shares have rallied about 40% so far this year, fueled by the company’s solid operational performance and continued demand for its products.

The company reported a 14% growth in its Q2 revenue to $2.01 billion, supported by a 14% rise in the da Vinci surgical system installed base to 9,203 systems and a 17% rise in da Vinci procedures. Moreover, the company’s EPS rose more than 25% to $1.78.

Intuitive is scheduled to announce its third-quarter results on October 17. Analysts expect the company’s EPS to increase by more than 12% to $1.64.

What Is the Price Target for ISRG Stock?

Earlier this month, Evercore analyst Vijay Kumar raised his price target for Intuitive Surgical stock to $475 from $410 but maintained a Hold rating on the stock. The analyst noted that utilization in the MedTech space remained positive in Q3 and the capex outlook into the next year continues to be healthy.

However, he remains on the sidelines following the recent run in stocks in the MedTech space.

Overall, Intuitive Surgical stock earns a Moderate Buy consensus rating based on 13 Buys and five Hold ratings on TipRanks. At $498.29, the average ISRG stock price target implies 5.7% upside potential from current levels.

See more ISRG analyst ratings

Conclusion

Among the three healthcare stocks discussed above, Wall Street is highly bullish on the prospects of Eli Lilly. Analysts see higher upside potential in LLY stock than shares of NVS and ISRG. They are confident about the huge growth potential of Eli Lilly’s diabetes and weight loss treatments, given the robust demand for these drugs worldwide.

Disclosure

Read the full article here