In this piece, I am evaluating two data center stocks: Super Micro Computer (SMCI) and IBM (IBM). A closer look leads me to establish a bearish view for Super Micro Computer and a neutral view for IBM.

Super Micro Computer (Super Micro) manufactures servers for cloud computing, data centers, big data, artificial intelligence, 5G, and the Internet of Things. It also offers other computer products, including energy-efficient computing technology. Meanwhile, IBM is of course a legacy computing giant that now offers servers for data centers and a wide range of enterprise software, networking equipment, and other computing needs.

Super Micro stock is still higher by 55% YTD after plummeting 52% over the past three months. The shares are also up 78% over the past year. On the other hand, IBM stock has soared 25% over the last three months, bringing its year-to-date return to 35%. Shares of ‘Big Blue’ have surged 53% over the last year.

(SMCI = green, IBM = black line)

Despite such different three-month performances, the respective valuations for Supermicro and IBM aren’t that far apart. We compare their price-to-earnings (P/E) ratios to assess their valuations against each other and that of their industry.

For comparison, the information technology industry is trading at a P/E of 44.5x, versus its three-year average of 67.9x.

Super Micro Computer

With a trailing P/E of 21.8x, Super Micro Computer is trading at a sizable discount to its sector. However, such a discount seems warranted given recent developments at the company. A bearish view seems appropriate, at least until things blow over and we receive some transparency into the situation.

A negative report on SMCI from short seller Hindenburg Research raised all sorts of red flags. The firm makes a variety of allegations against the company, including that it has manipulated its financials. Hindenburg alleged accounting issues along with undisclosed transactions between related parties, sanctions violations, and problems with export control. Short sellers benefit when a stock price plummets, so may be motivated to issue reports on the companies they’re shorting for that reason. However, on the other hand, Hindenburg Research has a pretty good track record, and was correct about fraud at Nikola (NKLA) in 2020.

Additionally, Super Micro has already had documented accounting violations in the past, having settled a previous case with the Securities and Exchange Commission in 2020 for $17.5 million. As a result, investors might want to steer clear of SMCI until additional transparency is available, especially after the company decided to delay the release of its annual report.

What is the Price Target for SMCI stock?

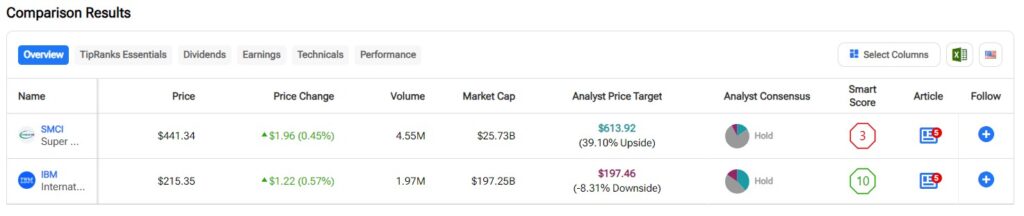

Super Micro Computer has a Hold consensus rating based on one Buy, 10 Holds, and one Sell rating assigned over the last three months. At $615.18, the average Super Micro Computer stock price target implies upside potential of 38.44%.

At a P/E of 23.7x, IBM is also trading at a deeply discounted valuation versus its sector, and also offers an attractive dividend yield. However, a review of the company’s valuation history reveals that the stock is trading at the top of its typical range going back to October 2019. Thus, a neutral view seems appropriate, as does monitoring for a buy-the-dip opportunity.

I’m cautious on IBM right now due to its valuation, even though there is much to like about this stock. Of course, IBM has been around for a long time, and it isn’t going anywhere anytime soon. It’s a stalwart, growing technology company, although it doesn’t post the level of revenue increases required to be considered a growth stock. Going back to October 2019, the company’s typical P/E range has been between about 17.5x and 25.1x. Therefore the stock does look a little pricey versus its historical range, suggesting that a buy-the-dip opportunity could surface before too long.

However, investors looking for technology exposure in their dividend portfolio may not find a better stock, as IBM’s dividend yield stands at around 3.1% with a healthy payout ratio of 65.4%, suggesting that the dividend is both appealing and pretty safe. Additionally, IBM has a 29-year history of raising its dividend annually, further sweetening the pot.

Finally, IBM’s long-term share-price appreciation demonstrates the stock’s appear as a buy-and-hold investment in a dividend portfolio. The shares are up 92% over the last three years, 101% over the last five, and 80.6% over the last 10. IBM has recently nudged into overbought territory with a Relative Strength Indicator of 73.8. Anything above 70 suggests a stock is overbought and that a correction to the downside could be near. I would simply wait for IBM stock to drop down to the lower end of its typical P/E range before potentially buying the shares.

What is the Price Target for IBM stock?

IBM has a Hold consensus rating based on five Buys, six Hold, and two Sell ratings assigned over the last three months. At $197.46, the average IBM stock price target implies downside potential of 8.69%.

Conclusion: Bearish on SMCI, Neutral on IBM

On one hand, Super Micro could present a buy-the-dip opportunity right now due to the short-seller’s report. However, there’s usually fire where there’s smoke, and the short seller who’s targeting the company has a good track record thus far. The delayed annual report also enforces the major lack of transparency and can represent a serious breach of trust with shareholders, so investors may want to steer clear of Super Micro Computer at this time.

On the other hand, there is much to like about IBM, although the price for its stock is pretty high, relatively speaking. Even if someone were to buy shares at the current price, the dividend and long-term appreciation potential still make this a buy-and-hold stock for the long term. However, I believe that we could see a pullback in IBM before too long, so I think it’s best to wait before pulling the trigger.

Disclosure

Read the full article here