While those keen on boosting their passive income will consider various options, digging into the oil patch is a frequently used strategy. From niche operators to oil supermajors, there’s a wide range of choices to consider. With an enticing ultra-high 8.5% forward dividend yield, Vitesse Energy (NYSE: VTS) is surely an intriguing consideration for income-focused investors.

Unlike its brethren that operate throughout the energy value chain, Vitesse owns non-operating interests in oil and natural gas wells. In its 10-K, for example, Vitesse Energy states that its “business plan focuses on building a diversified, low-leverage, free cash flow generating business that can deliver meaningful dividends to our stockholders.”

Wasting no time, Vitesse rewards shareholders right after the spinoff

After being spun off from investment firm Jefferies Financial Group in January 2023, Vitesse Energy wasted no time rewarding shareholders. It returned $58 million in dividends for 2023 — the result of $0.50 per share quarterly distributions throughout 2023.

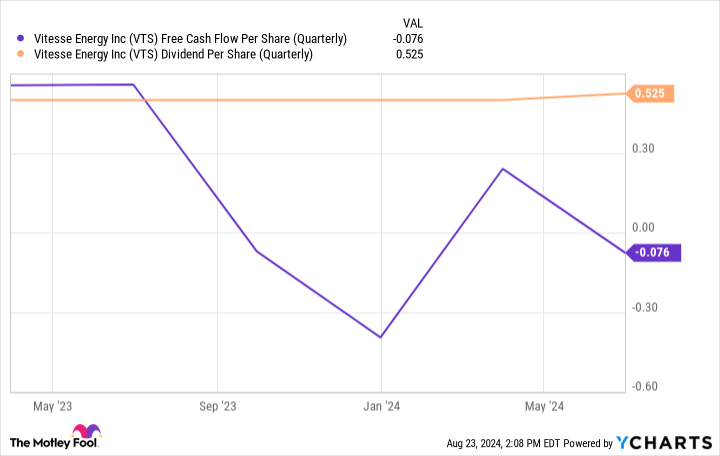

After declaring another dividend of $0.50 per share for the first quarter of 2024, Vitesse Energy boosted its distribution 5% and returned $0.525 per share to investors in the second and third quarters. Management hasn’t indicated plans for future dividend hikes, so if the payout remains steady, Vitesse Energy will return $2.10 per share in the form of dividends annualized.

In order to generate $1,000 in passive income in a year, therefore, investors would need to own 476.2 shares of Vitesse Energy.

A short history means a higher degree of risk

Vitesse may be focused on generating free cash flow and returning it to shareholders, but investors shouldn’t assume that this makes an investment less risky. With little time operating on its own after the spinoff, Vitesse hasn’t proven that it can achieve its purpose.

Over the past year, for example, it has failed to generate adequate free cash flow to source its dividend. Therefore, investors looking for a conservative approach to generating strong passive income from the oil patch may want to look elsewhere.

Should you invest $1,000 in Vitesse Energy right now?

Before you buy stock in Vitesse Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vitesse Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Jefferies Financial Group and Vitesse Energy. The Motley Fool has a disclosure policy.

Want $1,000 in Dividend Income? Here’s How Much You Have to Invest in Vitesse Energy Stock was originally published by The Motley Fool

Read the full article here