(Bloomberg) — The multitrillion-dollar boom in risky assets that’s raged all year is engulfing more and more of Wall Street — and this time global policy makers are starting to lend their support.

Most Read from Bloomberg

Fueled by the latest “Goldilocks” economic data, once-unloved market pockets are rallying anew in the aftermath of the Federal Reserve’s dovish pivot. At the same time, the rest of the world is beginning to join the policy-easing party, from China to Europe.

Among the latest assets to jump higher this week: Once-berated emerging-market equities, companies acutely sensitive to the economic cycle, and speculative technology bets that win big during falling interest-rate regimes.

Thank the latest raft of benign data showing good times for Corporate America and a still-healthy consumer, even as the Fed is just starting to administer its monetary medicine.

As such, bears are getting crushed day in, day out. And life is getting harder for investors who failed to go all-in on equities, as dip-buying opportunities vanish.

One way of dissecting the risk-on bonanza up and down Wall Street is to look at the daily motion of markets. A Societe Generale SA index tracking cross-asset momentum has jumped to the highest in more than one year. With its 11 components — including copper versus gold, cyclical stocks versus defensive, cryptocurrencies, high-yield bonds and more — flashing hot, the gauge has reached these bulled-up levels only 5% or so of the time, going back to 2011.

“Investors have been hearing of recession risk, political uncertainty and poor seasonals in September — what you got was a jumbo Fed cut and China stimulus, sparking a big change in sentiment to the upside,” said Matt Miskin, co-chief investment strategist at John Hancock Investment Management. “You are closing out a full-blown risk-on quarter across US small caps, Chinese equities, and high yield.”

For people paid to predict the unknowable future, there are plenty of risks ahead — with stretched valuations chief among them — yet worrywarts were hard to find this week.

Animal spirits flared in nearly every asset class from gold to crypto, as optimism surged that the world’s largest economy is still expanding, even as its manufacturing sector continues to stagnate.

This week saw a mercifully mild increase in the Fed’s preferred gauge of inflation, strong gross domestic product data and a dip in jobless claims. And the relentless artificial-intelligence boom continues to prove relentless, with Micron Technology Inc. emerging as the latest winner.

All that helped the S&P 500 eke out a fresh gain this week, set for its best first three quarters since 1997 with its 20% advance in 2024.

“Aggressive policy easing, led by the Fed, when economic activity is still reasonably robust is keeping the hope of soft landing alive,” said Marija Veitmane, senior multi-asset strategist at State Street. “We also see a lot of other central bank joining the policy easing party, giving extra support to risk assets.”

A Goldman Sachs Group Inc. basket of most-shorted stocks is up 17% year-to-date, in the latest sign of pain for equity bears. And hedges of all stripes are underperforming against the backdrop of the so-called everything rally. The Cambria Tail Risk ETF (ticker TAIL), which protects against an extreme market crash, is headed for a fourth consecutive year of losses.

It’s not all good news. Momentum indicators suggest the euphoria will be hard to sustain in the near term, even if the big picture is bullish.

“There should be tactical caution,” said SocGen’s Manish Kabra. “But fundamentally, our view hasn’t changed. If the Fed follows the rate path guided by the bond market, we should see a strong cyclical improvement, increased profits for the weakest parts of the market.”

After an advance in the Treasury market in recent weeks, riskier fringes of the debt-investing landscape are rising. A Bloomberg index of US high-yield credit is poised for its best start in five years with year-to-date gains of about 8%.

The rest of the world is fueling the bullish spirits. Stimulus pledges by China’s Politburo — the largest since the pandemic — pushed Chinese equities to their best week since 2008, while Saudi Arabia looks ready to abandon its unofficial oil price target, possibly ushering in a new era of lower prices. Alongside the Fed, global central banks have expressed their intent to join the rate-cutting cycle to support economic growth.

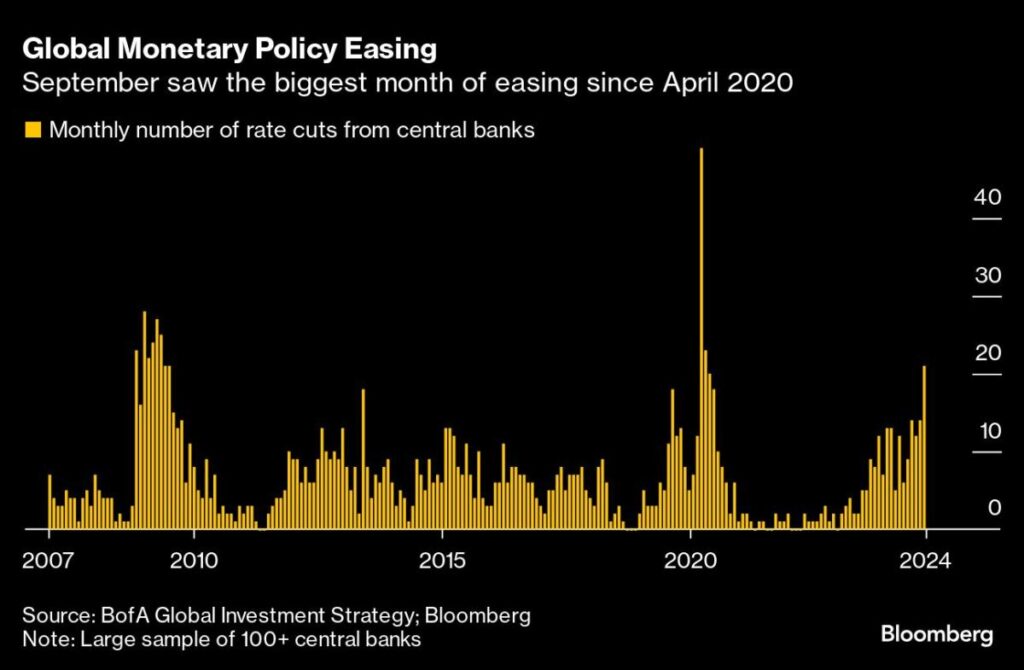

So far, September 2024 is shaping up to be the biggest month of global monetary policy easing since the pandemic crash, Bank of America Corp. data show. In the US, traders are pricing in 75 basis points of cumulative cuts by the end of 2024.

To Florian Ielpo of Lombard Odier Investment Managers, it’s starting to look risky out there. As such, his team is diversifying his equity bets and hedging in the volatility market.

“The term ‘cautiously optimistic’ has truly earned its relevance this month,” he said. “The Fed’s change of tone and China’s coordinated stimulus plan have significantly alleviated two of the financial markets’ biggest concern.”

For now, there’s nothing but cheer for markets. BlackRock Inc.’s momentum ETF hit a record high this week and is up nearly 30% for the year. A $25 billion semiconductor ETF meanwhile has risen 4% this week, eclipsing the gains of the S&P 500 and the tech-heavy Nasdaq 100.

“The market is telling you that things are different this time than previous rate cut cycles,” Jason Bloom, head of fixed income, alternatives, and ETF strategies at Invesco, said. “There’s been enough stress and enough jolts of volatility that I think we would’ve shaken that bubble loose if it was there. Things are different.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here