Wall Street doesn’t know what to make of Rivian (NASDAQ: RIVN) stock. Price targets range from $14 to $19 per share. With the stock price currently hovering around $13, there’s either minimal near-term upside or plenty of it. So which is it? One analyst recently reaffirmed his outperform rating for Rivian, reiterating confidence in his $19 price target with 42% in expected upside, the most bullish outlook on Wall Street.

Could there really by 42% upside to Rivian stock over the next 12 months? There’s reason to believe this analyst could be right.

Expect this from Rivian over the next 12 months

Predicting the short-term direction of a stock can be difficult. But predicting what will happen from a business standpoint is much more manageable. That’s especially true for a company like Rivian, for which the events of the next several years are predictable.

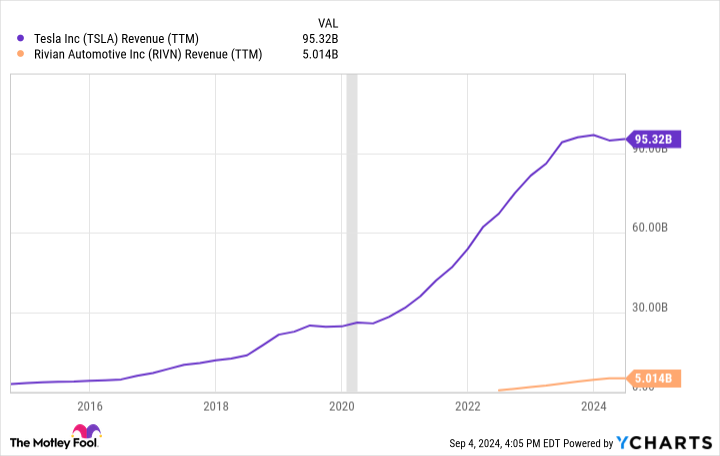

First, let’s recap Rivian’s current predicament. On paper, the company has done extraordinarily well recently. In a few short years, it went from almost zero revenue to more than $5 billion. It achieved this because of just two models: the R1T and R1S, both luxury vehicles aimed at the upper end of the market. In many ways, Rivian’s beginning mirrors that of Tesla, which first hit the market with high-priced models meant mostly to establish a reputation for quality and execution.

Rivian should also do what Tesla did next. After the success of its Model S and Model X variants, Tesla then leveraged its newfound reputation and access to capital to hit the mass market with its Model 3 and Model Y variants. This transition increased revenue from around Rivian’s current level to nearly $100 billion. Rivian expects to replicate this rise with its recently announced R2, R3, and R3X models, all of which are expected to debut under $50,000. These models should dramatically expand Rivian’s addressable market, with revenues rising rapidly in response.

Rivian’s new models won’t hit the road until the first half of 2026. So the year ahead will be fairly quiet, filled mostly with updates to manufacturing capacities and production timelines. But one event in the next 12 months could be a huge catalyst for the stock. It’s what has Wall Street’s most bullish analyst so optimistic.

This catalyst could add fuel to this EV stock

A major difference between Tesla and Rivian right now is their respective abilities to generate positive gross margins. Tesla is turning a profit for each vehicle it sells and has done so for years. As a smaller competitor, meanwhile, Rivian is still losing tens of thousands of dollars for every vehicle it sells. But management expects this to change fairly soon. Last month, Rivian executives confirmed that they expect to reach positive gross margins by the fourth quarter of 2024. Over the past year, Rivian has trimmed its gross loss per vehicle to just $6,000 from $33,000. Erasing the final deficit would lend credibility to management and their ability to prudently manage its finances as the company ramps up spending to support its new mass-market models.

Canaccord analyst George Gianarikas believes this flip to profitability will prove to the market that Rivian is not “one of the EV walking dead,” giving the company enough momentum to reach its R2, R3, and R3X sales launch. This boost, he argues, will help Rivian “push through, shake off operational cobwebs, and breathe life into its mass market lineup — the R2/R3; and achieve scale.”

If Rivian can achieve positive gross margins this year, its outlook for 2025 and beyond will improve considerably. And when its mass-market vehicles hit the road, the company’s current $13 billion valuation may end up looking like a steal. But investors will need to be patient to see this story through.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

This Wall Street Pro Thinks Rivian Stock Has 42% Upside was originally published by The Motley Fool

Read the full article here