As Election Day nears, the potential impact on financial markets is a key concern for investors, especially given the stark policy differences between the two lead candidates Kamala Harris and Donald Trump.

For billionaire hedge fund manager John Paulson, the course of action is clear if Vice President and Democratic presidential nominee Kamala Harris secures a victory.

“If Harris was elected, I would pull my money from the market,” Paulson said in an interview with Fox Business.

Paulson said he is concerned about Harris’s potential tax on unrealized capital gains, which he said could have severe consequences for the economy.

“If they do implement a 25% tax on unrealized gains, that would cause mass selling of almost everything, stocks, bonds, homes, art. I think it would result in a crash in the markets and an immediate, pretty quick recession,” he said.

Safe haven in a potential crash

Paulson is no stranger to navigating turbulent markets. He famously made a $15 billion profit for his firm, Paulson & Co., during the 2007 financial crisis by betting against the U.S. housing market. His bold, contrarian approach enabled him to capitalize on one of the worst economic downturns in modern history.

So, if Paulson plans to withdraw his investments in the event of a Harris presidency, where does he plan to park his money?

“I’d go into cash and I’d go into gold, because I think the uncertainty regarding the plans they outlined would create a lot of uncertainty in the markets and likely lower markets,” he explained.

Paulson’s strategy reflects a defensive move in times of anticipated market instability. By holding cash, he preserves capital and maintains flexibility, ready to seize opportunities when the market stabilizes. Investing in gold, traditionally seen as a safe haven during economic or political turbulence, could protect his wealth against potential currency devaluation and inflation. This conservative allocation suggests that Paulson is preparing for significant volatility and prefers to wait for clearer economic signals before re-entering the market.

Gold has already caught the attention of many investors. The precious metal recently surged past the $2,600 per ounce mark, setting a new milestone.

For those who share Paulson’s concerns, note that these days, there are many ways to gain exposure to gold. You can own bullion, buy shares of gold mining companies or ETFs or even tap into potential tax advantages with a gold IRA.

Tax issues

While Paulson’s expressed concern about the tax treatment of unrealized capital gains has led him to plan a defensive strategy if Harris wins, not every billionaire investor shares his view.

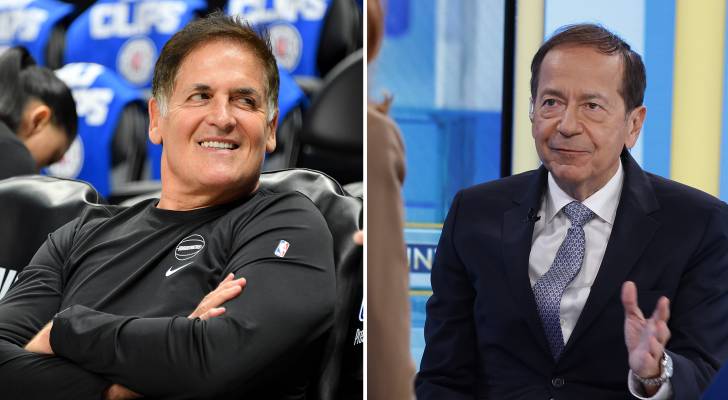

Shark Tank investor Mark Cuban offered a counter perspective. He said he doesn’t believe such a tax will be implemented.

“Every conversation I’ve had is that it’s not going to happen,” Cuban said during an interview with CNBC. He mentioned that he frequently communicates with Harris’s team and shared their explicit feedback: “Their verbatim words to me is, ‘That’s not where we want to go.’”

Paulson said he also has concerns about other tax policies that could be implemented under a Harris presidency.

“They want to raise the corporate tax rate from 21 to 28%,” he said. “They want to raise the capital gains rate from 20% to initially 39% now they flip-flopped back to 28%.”

An important element of Harris’s tax plan is the proposed increase in the corporate tax rate from the current 21% — a figure established under the 2017 Tax Cuts and Jobs Act spearheaded by the Trump administration — to 28%. This move is intended to generate additional revenue to fund her policy initiatives.

While Paulson is wary of a potential corporate tax hike, Cuban, who has endorsed Harris, doesn’t seem concerned.

Cuban wrote a post on X to compare the impact of Harris’s tax policy against Trump’s tariffs. Using a simplified mathematical example, he concluded that Harris’s approach would result in higher after-tax profits for companies.

Regarding capital gains, Harris advocates for a tax rate of 28% on long-term capital gains for individuals earning $1 million or more. This proposal is notably lower than the 39.6% rate proposed in President Biden’s fiscal 2025 budget, aiming to strike a balance that appeals to both policy goals and the concerns of investors.

Again, Cuban is not alarmed. “She’s trying to be very respectful of the president and everything he’s proposed,” he said in a CNBC interview. “When I talked to them, I thought it was fair.”

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Read the full article here