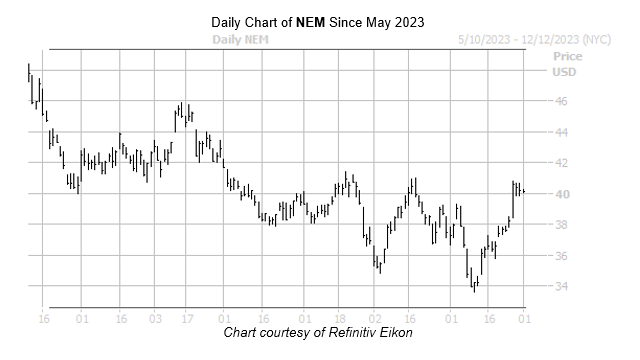

Precious metals producer Newmont Corporation (NYSE:NEM) is 0.4% higher at $40.37 this morning, looking to recover from two days of losses as gold miners felt the pressure of a rising dollar. The stock is down nearly 15% in 2023, and things looks bleak with a month to go before the start of the new year. However, history suggests that NEM could follow up its mid-November dip to annual lows below the $34 level to close out the year with a bang.

Per data from Schaeffer’s Senior Quantitative Analyst Rocky White, Newmont stock is one of the best-performing stocks on the S&P 500 Index (SPX) in the month of December over the last decade. The shares averaged a December return of 3.4% over the last 10 years, finishing the month with a positive return seven times. This makes the equity is the only precious metal stock to make the list, too.

It’s also worth noting Newmont stock’s Schaeffer’s Volatility Scorecard (SVS) ranks at a slightly elevated 77 out of 100. In other words, the equity tends to outperform options traders’ volatility expectations.

Read the full article here